FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

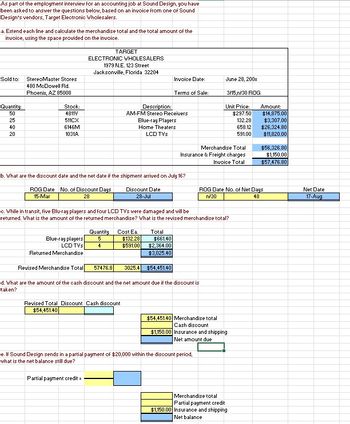

Transcribed Image Text:As part of the employment interview for an accounting job at Sound Design, you have

been asked to answer the questions below, based on an invoice from one of Sound

Design's vendors, Target Electronic Wholesalers.

a. Extend each line and calculate the merchandise total and the total amount of the

invoice, using the space provided on the invoice.

Sold to:

Quantity:

50

25

40

20

StereoMaster Stores

480 McDowell Rd.

Phoenix, AZ 85008

Stock:

4811V

511CX

6146M

1031A

ROG Date No. of Discount Days

15-Mar

28

ELECTRONIC WHOLESALERS

1979 N.E. 123 Street

Jacksonville, Florida 32204

Blue-ray players

LCD TVs

Returned Merchandise

TARGET

b. What are the discount date and the net date if the shipment arrived on July 16?

Discount Date

28-Jul

Revised Merchandise Total 57476.8

Quantity Cost Ea

5

4

Partial payment credit =

Description:

AM-FM Stereo Receivers

Revised Total Discount Cash discount

$54,451.40

Invoice Date:

Blue-ray Players

Home Theaters

LCD TVs

Terms of Sale:

c. While in transit, five Blu-ray players and four LCD TVs were damaged and will be

returned. What is the amount of the returned merchandise? What is the revised merchandise total?

$132.28

$591.00

Total

$661.40

$2,364.00

$3,025.40

$54,451.40

d. What are the amount of the cash discount and the net amount due if the discount is

taken?

3025.4

June 28, 200x

3/15,n/30 ROG

Merchandise Total

Insurance & Freight charges

Invoice Total

Unit Price:

$297.50

e. If Sound Design sends in a partial payment of $20,000 within the discount period,

what is the net balance still due?

$54,451.40 Merchandise total

Cash discount

$1,150.00 Insurance and shipping

Net amount due

132.28

658.12

591.00

ROG Date No. of Net Days

n/30

48

Merchandise total

Partial payment credit

$1,150.00 Insurance and shipping

Net balance

Amount:

$14,875.00

$3,307.00

$26,324.80

$11,820.00

$56,326.80

$1,150.00

$57,476.80

Net Date

17-Aug

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format ? and fast answering please and explain proper steps by Step.arrow_forward(Trade credit discounts) Determine the effective annualized cost of forgoing the trade credit discount on the following terms: a. 2/6, net 30 b. 2/7, net 45 c. 1/8, net 25 d. 5/9, net 80 e. 5/7, net 70 f. 3/7, net 60arrow_forwardEarly payment discounts offered by vendors are __________________ if payment is made within the discount period. Select one: A. automatically calculated by QBO B. displayed in the pay bills window C. displayed on the bill form D. None of the above are correctarrow_forward

- PARRISH Pg. 173 PURCHASE DISCOUNTS INVENTORY NET METHOD Please explain the following transactions for periodic and perpetcual Discounts using the Net Method. Receipt of Invoice Periodic Dr. Purchases 980 Cr. Accounts Payable 980 Perpetual Dr. Inventory 980 Cr. Accounts Payable 980 Payment within discount period Periodic Dr. Accounts Payable 980 Cr. Cash 980 Perpetual Dr. Inventory 980 Cr. Cash 980 Payment after discount period Periodic Dr. Accounts Payable 980 Dr. Interest Expense 20 Cr. Cash 1000 Perpetual Dr. Accounts Payable 980 Cr. Interest Expense 20 Cr. Cash 1000arrow_forwardA computer lists for $ 600. 1. Find the trade discount if a discount rate of $ 10 is offered. 2. Find the net price. 3. Find the net price rate. 4. Use the net price rate to recalculate the net price.arrow_forwardMatch the.last day the discount may be taken to each letter Invoice Date Date Merchandise was Last Date Received Terms for Cash Discount a. September 28 October 4 8/10 EOM b. July 28 August 2 8/10 ROG C. January 22 January 27 2/10 EOM d. March 21 March 27 2/10 ROG е. May 30 June 6 1/15, n/30 f. September 14 September 17 3/10,n/30arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education