FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

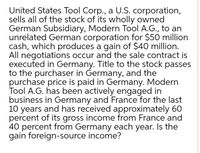

Transcribed Image Text:United States Tool Corp., a U.S. corporation,

sells all of the stock of its wholly owned

German Subsidiary, Modern Tool A.G., to an

unrelated German corporation for $50 million

cash, which produces a gain of $40 million.

All negotiations occur and the sale contract is

executed in Germany. Title to the stock passes

to the purchaser in Germany, and the

purchase price is paid in Germany. Modern

Tool A.G. has been actively engaged in

business in Germany and France for the last

10 years and has received approximately 60

percent of its gross income from France and

40 percent from Germany each year. Is the

gain foreign-source income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A US corporation has a UK subsidiary that is expected to generate the earnings of GBP2,000,000 at the end of operating quarter, March 31. The U.S. firm wishes to repatriate the GBP, perhaps to pay domestic shareholders a quarterly dividend. Let current spot rate be USD1.5385 = 1 GBP. The U.S. firm would like to hedge against unexpected depreciation in GBP, since such depreciation will results in fewer USD repatriation. The firm can do so by shorting the GBP forward contract by repatriating in April. Since GBP will be repatriated in April, the US Corporation used April GBP forward contract at USD1.5425 = 1 GBP. On maturity date the spot rate between USD and GBP is USD1.5175 = 1 GBP. Identify the position and determine gain or loss to US Corporation. Gain of USD 50,000 Loss of USD 50,000 Gain of GBP 50,000 Loss of GBP 50,000arrow_forwardPlease show all steps in Exceland please explain al steps. In1803, the U. S. doubled in sizewith the Louisiana Purchase.That well - known real estatemogul Napoleon Bonaparte soldus 827, 000 square miles(529, 280, 000 acres-there are640 acres in a square mile). Wepaid $15 million. Assume thatpart of the US is worth anaverage of $7, 500 per acre in2024. What is the annual rate ofreturn of this purchase for the U.S. ?arrow_forwardYou are working for an imports-exports company. In the current financial year, your company has a net income of $851,000 and plans to use a part of it as retained earnings for a new project which will cost $500,000 next year. The company’s stock is currently listed and actively traded on ASX. Required: Your company has an extra cash of A$216 000. The AUD/USA exchange rate in New York is 0.77923. The USD/AUD rate in Sydney is 1.29135. Is there any arbitrage profit possible? Set up an arbitrage scheme with the extra cash, disregarding bid-ask spread. What is the potential gain in AUD dollar?arrow_forward

- Royal Company (a U.S. based company) has foreign branch in Great Britain. The foreign branch generates £5,000,000 pretax income. October 15, branch sends £1,000,000 to Royal. Income tax rate in Great Britain is 15%. Taxes are paid to Great Britain’s government on December 31. Assume a tax rate of 21% in the U.S. Here are relevant exchange rates: US$ to £ 1/1 $1.2 10/15 $1.3 12/31 $1.4 Average $1.35 Determine the amount (in U.S. dollars) of U.S. taxable income, U.S. foreign tax credit, and U.S. tax liability related to the foreign branch.arrow_forwardOn January 1, 2024, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2024 financial statements stated in Swiss francs are given below. GRANT MANAGEMENT CONSULTANTS Comparative Balance Sheets January 1 and December 31, 2024 Direct exchange rates for Swiss franc are: Required: A. Translate the year-end balance sheet and income statement of foreign subsidiary using the current rate method of translation. B. Prepare a schedule to verify the translation adjustment. Cash and Receivables Net Property, Plant, and Equipment 40,000 37,000 60,000 92,000 30,000 32,000 20,000 20,000 10,000 40,000 60,000 92,000 Totals Accounts and Notes Payable Common Stock Retained Earnings Totals GRANT MANAGEMENT CONSULTANTS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2024 Jan. 1 Dec. 31 20,000 55,000 Revenues 75,000 Operating…arrow_forwardA U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexicanpeso, MP) and one in Japan (local currency, yen, ¥). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico:$80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) Currency Item US $ MP ¥ Spot exchange rates MP11.60/US$ ¥108.25/US$ Forecast percentage change −3.00% +1.50% Interest rates Nominal Euromarket 4.00% 6.20% 2.00% Domestic 3.75% 5.90% 2.15% Effective Euromarket Domestic Euromarket and the domestic market; then indicate where the funds should be invested and raised.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education