FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

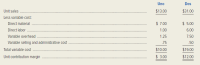

Duo Company manufactures two products, Uno and Dos. Contribution margin data follow. Duo company’s production process uses highly skilled labor, which is in short supply. The same employees work on both products and earn the same wage rate.

Required: Which of Duo Company’s products is more profitable? Explain.

Transcribed Image Text:Uno

Dos

Unit sales

$13.00

$31.00

Less varlable cost:

Direct material

$ 7.00

$ 5.00

Direct labor

1.00

6.00

Variable overhead

1.25

7.50

Variable selling and administrative cost

.75

.50

Total variable cost

$10.00

$19.00

Unit contribution margin

$ 3.00

$12.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manjiarrow_forwardPlease provide this Question solution with explanation and Proper solutionarrow_forwardHelpful Division of X Company makes two products, Small and Large. The company has always used Conventional Costing (for financial reporting purposes), but this period wants to try using Activity-Based Costing to make better decisions. Information related to the current period is as follows: REQUIRED: (#1) Since the company has three activities, what are the three overhead application rates the company would use for activity-based costing? (ROUND EACH RATE TO THE NEAREST CENT and be sure to label the rates appropriately.) (#2) Using activity-based costing, what was the cost to manufacture one Small unit? (#3) Using activity-based costing, what was the cost to manufacture one Large unit? (#4) Based on what you learned about activity-based costing this week, how might Helpful Division managers use the new cost information from its activity-based costing system to better manage its operations? Helpful Resource: https://www.youtube.com/watch?v=PU3U_aMbKwsarrow_forward

- Please choose a company which produces more than one product. Take at least two of these products and discuss the different costs between these two products which may make one more profitable than the other.arrow_forwardChocolate Bars, Inc. (CBI), manufactures creamy deluxe chocolate candy bars. The firm has developed three distinct products: Almond Dream, Krispy Krackle, and Creamy Crunch. CBI is profitable, but management is quite concerned about the profitability of each product and the product costing methods currently employed. In particular, management questions whether the overhead allocation base of direct labor-hours accurately reflects the costs incurred during the production process of each product. In reviewing cost reports with the marketing manager, Steve Hoffman, who is the cost accountant, notices that Creamy Crunch appears exceptionally profitable and that Almond Dream appears to be produced at a loss. This surprises both him and the manager, and after much discussion, they are convinced that the cost accounting system is at fault and that Almond Dream is performing very well at the current market price. Steve decides to hire Jean Sharpe, a management consultant, to study the…arrow_forwardRelyaTech Corporation manufactures a number of products at its highly automated factory. The products are very popular, with demand far exceeding the factory's capacity. To maximize profit, management should rank products based on their selling price gross margin contribution margin per unit of the constrained resource contribution marginarrow_forward

- The JAG Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. JAG Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. The following are data from the most recent periods: Cost Hours $25,000 5,025 25,100 4,000 34,000 7,515 60,370 15,500 38,000 9.500 Required: (a) Using the high-low method, estimate the cost function. Round to two decimal places. Show work to receive partial credit!! (b) Calculate the estimated total costs at an operating level of 6,000 hours. Show work to receive partial credit!!!arrow_forwardHansabenarrow_forwardChocolate Bars, Inc. (CBI), manufactures creamy deluxe chocolate candy bars. The firm has developed three distinct products: Almond Dream, Krispy Krackle, and Creamy Crunch. CBI is profitable, but management is quite concerned about the profitability of each product and the product costing methods currently employed. In particular, management questions whether the overhead allocation base of direct labor-hours accurately reflects the costs incurred during the production process of each product. Skipped In reviewing cost reports with the marketing manager, Steve Hoffman, who is the cost accountant, notices that Creamy Crunch appears exceptionally profitable and that Almond Dream appears to be produced at a loss. This surprises both him and the manager, and after much discussion, they are convinced that the cost accounting system is at fault and that Almond Dream is performing very well at the current market price. Steve decides to hire Jean Sharpe, a management consultant, to study the…arrow_forward

- Smokey Jack's BBQ makes only one product-BBQ sauce. However, they have several different flavors of BBQ sauces. How would Smokey Jack's cost accounting differ if they used a process cost system compared to a job-order cost system? O Under a process cost system, product-related costs would be allocated to products based on each batch or flavor of BBQ sauce that was made. Under a job-order cost system, product-related costs would be allocated to products based on how many units of BBQ sauce were made in a one-month period, regardless of flavor. O Under a process cost system, product-related costs would be traced from raw materials to finished product for each individual unit. Under a job-order cost system, product-related costs would be allocated to products based on how many units of BBQ sauce were made in a one-month period, regardless of flavor. O Under a process cost system, product-related costs would be allocated to products based on how many units of BBQ sauce were made in a…arrow_forwardAqua Company produces two products–Alpha and Beta. Alpha has a high market share and is produced in bulk. Production of Beta is based on customer orders and is custom designed. Also, 55% of Beta's cost is shared between design and setup costs, while Alpha's major portions of costs are direct costs. Alpha is using a single cost pool to allocate indirect costs. Which of the following statements is true of Aqua? Question 6 options: Aqua will overcost Alpha's indirect costs as it is using a single cost pool to allocate indirect costs Aqua will overcost Beta's indirect costs because beta has high indirect costs Aqua will undercost Alpha's indirect costs because alpha has high direct costs. Aqua will overcost Beta's direct costs as it is using a single cost pool to allocate indirect costsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education