Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

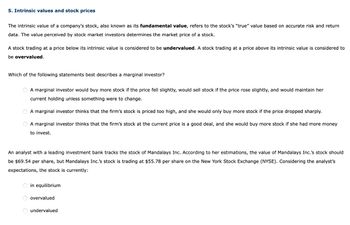

Transcribed Image Text:5. Intrinsic values and stock prices

The intrinsic value of a company's stock, also known as its fundamental value, refers to the stock's "true" value based on accurate risk and return

data. The value perceived by stock market investors determines the market price of a stock.

A stock trading at a price below its intrinsic value is considered to be undervalued. A stock trading at a price above its intrinsic value is considered to

be overvalued.

Which of the following statements best describes a marginal investor?

O A marginal investor would buy more stock if the price fell slightly, would sell stock if the price rose slightly, and would maintain her

current holding unless something were to change.

A marginal investor thinks that the firm's stock is priced too high, and she would only buy more stock if the price dropped sharply.

A marginal investor thinks that the firm's stock at the current price is a good deal, and she would buy more stock if she had more money

to invest.

An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.'s stock should

be $69.54 per share, but Mandalays Inc.'s stock is trading at $55.78 per share on the New York Stock Exchange (NYSE). Considering the analyst's

expectations, the stock is currently:

O in equilibrium

OO

overvalued

O undervalued

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In a few sentences, answer the following question as completely as you can. You are discussing stock valuation techniques with your broker. You mention that your Finance professor stated that “a stock that will never pay a dividend is valueless.” Your broker says this is not true because you can always sell the stock to someone else (thus, a capital gain is possible) a share of stock represents a share of ownership in something tangible (i.e., the issuing firm).Argue for or against your broker’s position.arrow_forwardWhich statement below is incorrect? Select one: A. Compared to interview, survey is more suitable to ask standardised questions. B. If a firm has more intangible assets, according to the trade-off theory, it is more likely to have a higher leverage. C. If a firm is more profitable, according to the pecking order theory, it should use less debt for financing. D. The CAPM model implies that a stock with a higher beta has a higher return on average.arrow_forwardIf the Modigliani and Miller hypothesis about dividends is correct, and if one found a group of companies which differed only with respect to dividend policy, which of the following statements would be most correct? Group of answer choices None of these statements is true. All of these statements are true. The total expected return, which in equilibrium is also equal to the required return, would be higher for those companies with lower payout ratios because of the greater risk associated with capital gains versus dividends. If the expected total return of each of the sample companies were divided into a dividend yield and a growth rate, and then a scatter diagram (or regression) analysis were undertaken, then the slope of the regression line (or b in the equation D1/P0 = a + b(g)) would be equal to +1.0. The residual dividend model should not be used, because it is inconsistent with the MM dividend hypothesis.arrow_forward

- Explain why the following statement is wrong: “The stock price is equal to the value of equity, divided by shares outstanding. Therefore, companies should avoid issuing equity because the number of shares outstanding goes up and thus the stock price would decrease."arrow_forwardYou are the CFO of a profitable firm that is financially constrained. The stock market is currently going through a boom phase (assume this is a bubble). From what you have learned in this course, you know that the rational decision would be to issue new shares and use this income to pursue positive NPV projects. Before you make this decision, what is the most important variable that you would examine Assume you have information on all these variables. Select one: O a. Market Q O b. Fundamental Q O c. Elasticity of price demand for common shares O d. Cash Savingsarrow_forwardKoffman Corporation is trying to raise capital. What method would be the least risky to raise capital if it has a less-than-favorable credit rating? A. Stock issuance, since a credit rating won’t negatively affect Koffman’s ability to sell stock. B. With low credit, Koffman doesn't have any options for raising capital. C. Bond issuance, since nobody wants to buy shares of a company with a less-than-perfect credit rating. D. Bond issuance, since additional debt can provide the company with more leverage.arrow_forward

- Which of the following statements is correct? A. The optimal dividend policy is the one that satisfies management, not shareholders. B. The use of debt financing has no effect on earnings per share (EPS) or stock price. C. Stock price is dependent on the projected EPS and the use of debt, but not on the timing of the earnings stream. D. The riskiness of projected EPS can impact the firm's value. E. Dlvidend policy is one aspect of the firm's financial policy that is determined solely by the shareholders. Reset Selectionarrow_forwardIf a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the investment cost is increased, the project's expected rate of return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock = r, D1 +8 Po(1-F) The difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. The firm's current common stock price, Po, is $25.00. If it needs to issue…arrow_forward4. What forms of market efficiency are violated if investors overreact to good news, resulting in stock price increases followed by stock price decreases: a. Semi-strong form efficiency b. Strong-form efficiency c. Both 1 and 2 d. Neither 1 nor 2arrow_forward

- You own Honeywell stock, and are worried that its price will fall. You are considering "insuring" yourself against this possibility. How can your provide such protection? (Choose the best answer below.) A. To protect against Honeywell's stock price dropping, you can buy a put with Honeywell as the underlying asset. B. To protect against Honeywell's stock price dropping, you can sell a call with Honeywell as the underlying asset. C. To protect against Honeywell's stock price dropping, you can buy a call with Honeywell as the underlying asset. D. To protect against Honeywell's stock price dropping, you can sell a put with Honeywell as the underlying asset.arrow_forwardWolseley manufacturing Co. invests in a group of risky projects, which increases the unsystematic risk of the firm, but does not change the systematic risk of the firm. All else the same, the expected risk premium on its common stock is most likely to: Select one: a. Increase, because the difference between the expected return on the firm's stock and the risk-free rate will widen. b. Increase or decrease, depending on the internal rate of return of the new projects. c. Decrease, because the difference between the expected return on the firm's stock and the risk-free rate will widen. d. Decrease, because the difference between the expected return on the firm's stock and the risk-free rate will narrow. e. Remain unchanged, because the level of systematic risk is unchanged.arrow_forwardSuppose a public company compensates its risk averse managers with stock awards rather than stock options, and the company's stock price has fallen precipitously. In this setting, using stock awards will induce more risk taking by management versus the use of stock options. Question options: a) True b) Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education