Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

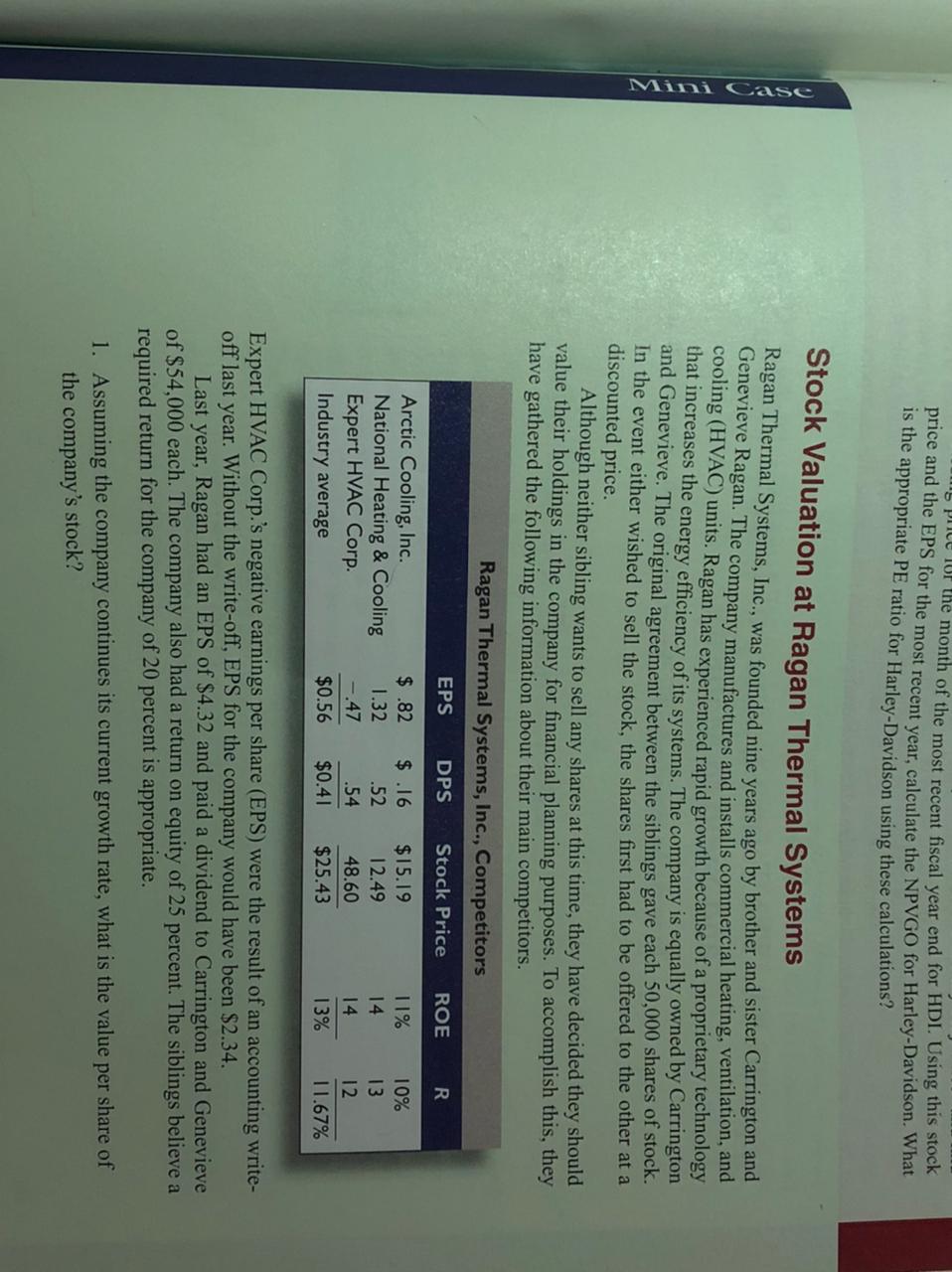

Carrington and Genevieve agree that they would like to try to increase the value of the company stock. Like many small business owners, they want to retain control of the company and do not want to sell stock to outside investors. They also feel that the company's debt is at a manageable level and do not want to borrow more money. What steps can they take to increase the price of the stock? Are there any conditions under which this strategy would not increase the stock price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not one of the things that manager can do to reduce the capital ratio (increase the equity multiplier) if he or she finds that the bank has a capital surplus?O Buying back some of the bank's stock.O Paying out higher dividends to stockholders.O Selling more CDs and use the funds to invest in loans or securities.O Selling some mortgage-backed securities and use the proceeds to reduce liabilities.arrow_forwardGive typing answer with explanation and conclusion Which of the following represent undiversifiable risks? I. The Federal Reserve raises interest rates. II. A product is recalled because of safety problems. III. The economy slips into a recession. IV. The CEO 's divorce settlement forces him to sell off half of his stock holdings.arrow_forwardWhich of the following is true? 1. Shareholder activism requires the investors to exercise their voting rights. 2. Agency problem arises if the management does not hold the majority share in the firm (i.e., more than 50%). 3. Stock options and performance plans are examples of external market forces. 4. Agency costs are borne by all the stakeholders, including the shareholders.arrow_forward

- In developing a compensatory share option plan, a company's objective is to motivate executives and employees to manage the company in a way that increases stock price. to decrease employee turnover. to enhance compensation packages without having to expend cash. to do all of these options.arrow_forwardA retiree believes that investing in a non-dividend paying growth firm, which requires the periodic sale of stock for income, will eventually lead to a loss of all shares. Explain the flaw in this logic.arrow_forward1. How is hiring the “next generation” of Chinese elites different from practices here in North America. Is it the same as Clinton’s daughter securing a job at a hedge fund company? 2. What are some of the moral principles involves here and what are some of the consequences of this practice? How does any company stay competitive if others choose to conduct unethical business practices?arrow_forward

- Why is the study of financial management important? Offer examples of how poor financial management can ruin a company. Provide specific real-life examples to back up your assertions.arrow_forwardWhich of the following statements is false? Group of answer choices a.If management does not consider the needs of the bondholders of a firm, they could end up destroying shareholder value b.If management chooses to ignore the needs of bondholders when structuring a firm, the firm can be expected to have to pay a higher interest rate on its debt c.In a perfect capital market, if a firmʹs current capital structure is not optimal, one can expect that firm to be a takeover target d.Management should focus only on the needs of a firmʹs shareholders since they are the true owners of the firm and, as such, they elect the firmʹs directorsarrow_forwardAccording to Modigliani and Miller, a firm's dividend policy is irrelevant: if the financial markets are inefficient if the financial markets are perfect if the financial markets are efficient if all investors are rational because dividends are discretionaryarrow_forward

- Tesla Inc. is thinking about acquiring Lithium Power Corp. Tesla's VP thinks that it is going to add value to the firm because Lithium Power has a relatively low P/E ratio and is earnings accretive. As Tesla's shareholder, do you agree with what the VP says? Explain.arrow_forwardWhich of the following makes this a true statement? In this slightly more realistic world with corporate taxes, managers can: Multiple Choice maximize the firm's value by taking on as much equity as possible. maximize the firm's value by taking on as much debt as possible. minimize the firm's value by taking on as much debt as possible. maximize the firm's value by financing only with debt.arrow_forwardWhich of the following statements is most often the case? a0Socially responsible investing gives poorer returns than non-socially responsible investing. b)Investors are more short-term focused and so socially responsible investing should not be a factor in their investment portfolio. c)Socially responsible businesses tend to post higher profits than those not focused on social responsibility. d)Companies that are not socially responsible will have better profits, but have a moral obligation to society.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education