FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:**Title: Understanding the Impact of Year-End Adjustments on Financial Statements**

---

The following exercise is designed to help you understand how year-end adjustments for estimated uncollectible accounts expenses affect financial statements using the allowance method.

**Question:**

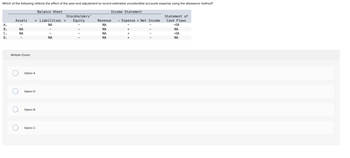

Which of the following reflects the effect of the year-end adjustment to record estimated uncollectible accounts expense using the allowance method?

**Table: Balance Sheet and Income Statement Analysis**

| Option | Balance Sheet | | Income Statement | | | Statement of Cash Flows |

|--------|------------------------------|-----------------------------|---------------------------|----|----|-------------------------|

| | Assets | = Liabilities + Stockholders’ Equity | Revenue − Expense = Net Income | | | |

| A. | \- | NA | \- | NA | \- | \-OA |

| B. | NA | \- | NA | + | \- | NA |

| C. | NA | \- | NA | + | \- | \-OA |

| D. | \- | NA | \- | + | \- | NA |

**Explanation:**

- **NA** indicates no effect.

- **+** indicates an increase.

- **-** indicates a decrease.

- **\*OA** denotes operating activities.

**Multiple Choice Options:**

- Option A

- Option B

- Option C

- Option D

Choose the correct option that accurately represents the accounting treatment of the adjustment. Consider how the allowance method impacts assets, liabilities, equity, revenue, expenses, net income, and cash flows.

This type of analysis is crucial for understanding the complexities involved in financial reporting and the implications of accounting standards on a company’s financial position and performance.

Expert Solution

arrow_forward

Step 1

Solution:

The journal entry to record year end adjustment for uncollectible account expense is:

1. Debit to Bad debt expense

2. Credit to allowance for doubtful accounts

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- - are cash and other assets expected to be converted to cash, sold, or consumed either in a year. O a. Equity O b. Non current liabilities Oc. Current assets O d. Current liabilities Oe. Non current assetsarrow_forward! Required information Problem 12-6A (Algo) Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. Net sales Cost of goods sold Gross profit Expenses: VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 2025 $3,495,000 2,477,000 1,018,000 Operating expenses Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income 952,000 27,000 16,500 7,700 1,003, 200 14,800 2024 $3,021,000 1,947,000 1,074,000 855,000 25,500 7,700 13,500 46,500 948, 200 125,800arrow_forwardCalculate the dividend payout ratio.arrow_forward

- Balance Sheet Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. Note: Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (L.e., .2345 should be entered as 23.45). Assats Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other FANNING COMPANY Vertical Analysis of Balance Sheeta Year 4 Total noncurrent liabilales Total abilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,600 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity…arrow_forwardState the effect the following situation would have on the amount of annual net income reported for 2019. No adjustment was made for the revenue earned previously recorded as unearned revenue for USD 6,000 as of 2019 December 31. Group of answer choices Net income is overstated, liabilities are understated Net income is understated, assets are overstated Net income is overstated, assets are overstated Net income is understated, liabilities are overstatedarrow_forwardIndicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Payment is made to trade creditors for previous purchasesarrow_forward

- Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Lishilitinn WALTON COMPANY Vertical Analysis of Balance Sheets Year 4 $ Amount 17,800 21,300 55,100 136,900 25,700 256,800 27,600 270,600 30,300 328,500 585,300 Percentage of Total % $ $ Amount Year 3 13,700 6,800 47,500 144,700 10,500 223,200 21,100 256,000 24,900 302,000 525,200 Percentage of Total %arrow_forwardPerform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth).arrow_forwardPrepare the statement of retained earnings with the information attached.arrow_forward

- Balance Sheet Prepare a horizontal analysis of the balance sheet for Year 4 and Year 3. Note: Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (1.e., .234 should be entered as 23.4). Assets Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Total long-term assets Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Terlam Notes payable Accounts payable Salaries payable Total current liabilites Noncurrent liabilities Bonds payable Other Total noncurrent liabilities Total abilities Stockholders' equity FRANKLIN COMPANY Horizontal Analysis of Balance Sheets Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,300 shares authorized and issued) EMAIA Common stock (no par; 50,000 shares authorized, 10,000 shares issued) Retained earnings Total stockholders' equity Total habilities & stockholders equity…arrow_forwardAssuming the current ratio equals 2, which of the following would cause the current ratio to increase? O Accrual for payroll. Declaration of cash dividend. O Payment for inventory purchased on account. O Inventory purchased on account.arrow_forwardWhat is the adjusting journal entry on December 31, 2019? Debit Unrealized Holding Gain/Loss (P&L), P200,000; Credit Retained Earnings, P200,000 Debit Financial Asset FVPL, P500,000; Credit Retained Earnings, P500,000 Debit Retained Earnings, P100,000; Credit Financial Asset FVPL, P100,000 Debit Retained Earnings, P300,000; Credit Unrealized Gain (P&L), P300,000 Debit Retained Earnings, P200,000; Credit Unrealized Holding Gain/Loss (P&L), P200,000 None of the choicesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education