Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

please post in general account subject

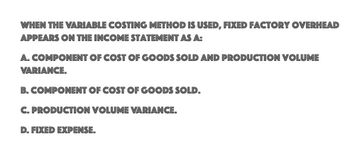

Transcribed Image Text:WHEN THE VARIABLE COSTING METHOD IS USED, FIXED FACTORY OVERHEAD

APPEARS ON THE INCOME STATEMENT AS A:

A. COMPONENT OF COST OF GOODS SOLD AND PRODUCTION VOLUME

VARIANCE.

B. COMPONENT OF COST OF GOODS SOLD.

C. PRODUCTION VOLUME VARIANCE.

D. FIXED EXPENSE.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For which cost concept used in applying (he cost-plus, approach to product pricing are fixed manufacturing costs, fixed selling and administrative expenses, and desired profit allowed for in determining the markup? A. Total cost B. Product cost C. Variable cost D. Standard costarrow_forwardIn what way do the cost of production summaries in Chapter 6, prepared using the weighted average cost method, differ from the cost of production summaries presented in Chapter 5? What is the reason for this difference?arrow_forwardIn the cost equation Y=a+bx, Y represents which of the following? A. fixed costs B. variable costs C. total costs D. units of productionarrow_forward

- Which is not a step in analyzing the cost driver for manufacturing overhead? A. Identify the cost B. identify non-value-added costs C. analyze the effect on manufacturing overhead D. identify the correlation between the potential driver and manufacturing overheadarrow_forwardAccumulating costs means that a. costs must be summed and entered on the income statement. b. each cost must be linked to some cost object. c. costs must be measured and tracked. d. costs must be allocated to units of production. e. costs have expired and must be transferred from the balance sheet to the income statement.arrow_forwardUsing the costs listed in the previous problem, classify the costs as either product costs or period costs.arrow_forward

- Under variable costing, all fixed manufacturing costs are treated as a a. product cost included in the cost of goods manufactured. b. product cost included in the cost of ending inventory. c. period expense deducted from manufacturing margin. d. period expense deducted from contribution margin.arrow_forwardNet income computed using absorption costing can be reconciled to the net income computed using variable costing by computing the difference between a. the gross profit under absorption costing and contribution margin under variable costing. b. the product costs per unit under the two costing methods. c. inventoried fixed factory overhead costs in the beginning and ending finished goods inventories. d. the selling prices under the two costing methods.arrow_forwardTRUE OR FALSE Production volume variance is adjusted to the cost of goods sold to get the cost of goods ed at actual under variable costing method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College