EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer financial accounting

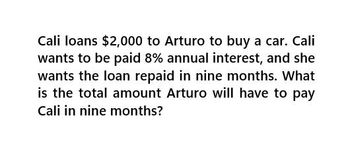

Transcribed Image Text:Cali loans $2,000 to Arturo to buy a car. Cali

wants to be paid 8% annual interest, and she

wants the loan repaid in nine months. What

is the total amount Arturo will have to pay

Cali in nine months?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Megan takes out a car loan for $13,000. She intends to make monthly payments for 5 years to pay off her loan. If the bank charges her an annual interest rate of 4.2% computed monthly on the loan balance, how much will her monthly payments be?arrow_forwardEvery two weeks, Betty makes a $210 payment toward a car loan whose annual rate is 4.8%. If she will be debt - free in 5 - years, how much interest will she pay on this loan?arrow_forwardSkylar bought a $270,000.00 house, paying 10% down, and financing the rest at 3% interest for 15 years. A. What is the monthly payment? Skylar has a payment of a month $________. B. How much interest will be paid over the life of the loan? Skylar will pay $_______ in interest over the life of the loan.arrow_forward

- Patty purchases a $240,000 house. She pays $40,000 down and takes out a 25 year mortgage with monthly payments, at an interest rate of 12% interest compounded monthly. How much money will Patty have to pay each month?arrow_forwardLuis is expected to settle a loan by paying $5,500. What amount should she pay if she decides to settle the loan seven months earlier? The interest rate is 3.25% compounded monthly.arrow_forwardRebecca Carlson purchases a car for $25,000 and finances her purchase by borrowing the money at 8% per year compounded monthly; she pays off the loan with equal monthly payments for 5 years. What will be the size of her monthly loan payment?arrow_forward

- Jane took out a loan from the bank today for X. She plans to repay this loan by making payments of $520.00 per month for a certain amount of time. If the interest rate on the loan is 1.12 percent per month, she makes her first $520.00 payment later today, and she makes her final monthly payment of $520.00 in 7 months, then what is X, the amount of the loan? O An amount less than $3,501.00 or an anmount greater than $4,238.00 O An amount equal to or greater than $3,501.00 but less than $3,739.00 O An amount equal to or greater than $3,739.00 but less than $3,980.00 O An amount equal to or greater than $3,980.00 but less than $4,081.00 O An amount equal to or greater than $4,081.00 but less than $4,238.00arrow_forwardPatty purchases a $190,000 house. She pays $50,000 down and takes out a 15-year mortgage with monthly payments, at an interest rate of 12% Interest. Find Patty's monthly payment. Patty will have to pay $ each month. (Round to the nearest cent as needed.)arrow_forwardMaria wants to attend Clarke University. She will need $90,000 eight years from today. Assume Maria's bank pays 6% interest compounded semiannually. What must Maria deposit today to have $90,000 in eight years? verify your answer.arrow_forward

- Jeanette took out a loan from the bank today for X. She plans to repay this loan by making payments of $100.00 per month for a certain amount of time. If the interest rate on the loan is 0.66 percent per month, she makes her first $100.00 payment later today, and she makes her final monthly payment of $100.00 in 12 months, then what is X, the amount of the loan? A O An amount less than $1,153.00 or an anmount greater than $1,324.00 O An amount equal to or greater than $1,153.00 but less than $1,199.00 O An amount equal to or greater than $1,199.00 but less than $1,245.00 O An amount equal to or greater than $1,245.00 but less than $1,275.00 O An amount equal to or greater than $1,275.00 but less than $1,324.00arrow_forwardEmma bought a $360,000.00 house, paying 10% down, and financing the rest at 2% interest for 20 years. A. What is the monthly payment? Emma has a payment of __?__a month. How much interest will be paid over the life of the loan? Emma will pay __?__ in interest over the life of the loan.arrow_forwardJenna bought a new car for $28,000. She paid a 20% down payment and financed the remaining balance for 36 months with an APR of 3.5%. Assuming she makes monthly payments, determine the total interest Jenna pays over the life of the loan. Round your answer to the nearest cent, if necessary.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning