Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

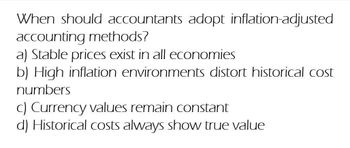

When should accountants adopt inflation-adjusted accounting methods?

Transcribed Image Text:When should accountants adopt inflation-adjusted

accounting methods?

a) Stable prices exist in all economies

b) High inflation environments distort historical cost

numbers

c) Currency values remain constant

d) Historical costs always show true value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During a period of inflation, an account balance remains constant. With respect to this account, a purchasing power gain will be recognized if the account is a: a. Monetary liability b. Monetary asset c. Nonmonetary liability d. Nonmonetary assetarrow_forwardWhich of the following basic accounting assumptions is threatened by the existence of severe inflation in the economy? Monetary unit assumption. Periodicity assumption. Going-concern assumption. Economic entity assumption.arrow_forwardDuring a period of inflation, an account balance remains constant. With respect to this account, a purchasing power loss will be recognized if the account is a: a. Monetary asset b. Monetary liability c. Nonmonetary asset d. Nonmonetary liabilityarrow_forward

- Why are the net present value and the internal rate of return models superior to the payback period and the accounting rate of return models?arrow_forwardInflation is a general rise in market prices that affects all goods equally. OA. True OB. Falsearrow_forwardWhy is it true, in general, that a failure to adjust expected cash flows forexpected inflation biases the calculated NPV downward?arrow_forward

- Which of the following is consistent with a steeply upwardly sloping yield curve?a. Monetary policy is expansive and fiscal policy is expansive.b. Monetary policy is expansive while fiscal policy is restrictive.c. Monetary policy is restrictive and fiscal policy is restrictive.arrow_forwardThe _______ models the relationship between inflation rate, nominal return, and real return. Multiple Choice Interest Rate Parity. Put-Call Parity. Fisher Effect. Law of One Price. Purchasing Power Parity.arrow_forwardPls help ASAParrow_forward

- The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation of a future value. The process for converting present values into future values is called four time-value-of-money variables. Which of the following is not one of these variables? O The present value (PV) of the amount invested O The inflation rate indicating the change in average prices O The duration of the investment (N) O The interest rate (I) that could be earned by invested funds This process requires knowledge of the values of three of All other things being equal, the numerical difference between a present and a future value corresponds to the amount of interest earned during the deposit or investment period. Each line on the following graph corresponds to an interest rate: 0%, 8%, or 16%. Identify the interest rate that corresponds with each line.arrow_forwardLogan is conducting an economic evaluation under inflation using the then-current approach. If the inflation rate is j and the real time value of money rate is d, which of the following is the interest rate he should use for discounting the cash flows? a. j b. d c. j + d d. j + d + dj.arrow_forwardWhich of the following statements correctly describe how the present value of a future expected cash flow may vary with different factors? Group of answer choices A. More than one of the other options are correct. B. As the expected loss of purchasing power due to inflation increases, then, holding all else constant, the present value of a future expected cash flow will decrease. C. As the period of time we have to wait until we receive a future expected cash flow decreases, then, holding all else constant, the present value of the cash flow will decrease. D. As the risk associated with a future expected cash flow increases, then, holding all else constant, the present value of the cash flow will increase.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning