FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

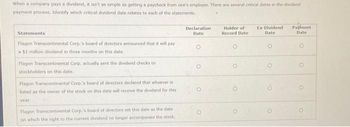

Transcribed Image Text:When a company pays a dividend, it isn't as simple as getting a paycheck from one's employer. There are several critical dates in the dividend

payment process. Identify which critical dividend date relates to each of the statements.

Statements

Flagon Transcontinental Corp.'s board of directors announced that it will pay

a $1 million dividend in three months on this date.

Flagon Transcontinental Corp, actually sent the dividend checks to

stockholders on this date.

Flagon Transcontinental Corp.'s board of directors declared that whoever is

listed as the owner of the stock on this date will receive the dividend for this

year.

Flagon Transcontinental Corp.'s board of directors set this date as the date

on which the right to the current dividend no longer accompanies the stock.

Declaration

Date

Holder of

Record Date

O

O

Ex-Dividend

Date

O

O

Payment

Date

O

O

O

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Whispering Mining Company declared, on April 20, a dividend of $466,000 payable on June 1. Of this amount, $128,000 is a return of capital. Prepare the April 20 and June 1 entries for Whispering. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Apr. 20 June 1 Debit Creditarrow_forwardToyota Motor Corporation (TYO: 7203; NYSE: TM) is one of the world’s largest vehicle manufacturers. The company’s most recent fiscal year ended on 31 March 2008. In early May 2008, you are valuing Toyota stock, which closed at ¥5,480 on the previous day. You have used a free cash flow to equity (FCFE) model to value the company stock and have obtained a value of ¥6,122 for the stock. For ease of communication, you want to express your valuation in terms of a forward P/E based on your forecasted fiscal year 2009 EPS of ¥580. Toyota’s fiscal year 2009 is from April 2008 through March 2009. What is Toyota’s justified P/E based on forecasted fundamentals? Based on a comparison of the current price of ¥5,480 with your estimated intrinsic value of ¥6,122, the stock appears to be slightly undervalued. Use your answer to question 1 to state this evaluation in terms of P/Es.arrow_forwardTom Yuppy, a wealthy investor, paid $49,920 for 1,280 shares of $10 par common stock issued to him by Leuig Corp. A month later, Leuig Corp. issued an additional 2,560 shares of stock to Yuppy for $39 per share. Required Show the effect of the two stock issues on Leuig's books in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. LEUIG CORP. Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Assets Stockholders' Equity Revenue Expense = Net Income Flow Event Common PIC in Cash Land Stock Excess 1- Common stock 2- Issue of additional sharesarrow_forward

- eBay Inc. developed a web-based marketplace at www.ebay.com, in which individuals can buy and sell a variety of items. eBay also acquired PayPal, an online payments system that allows businesses and individuals to send and receive online payments securely. In a recent annual report, eBay published the following dividend policy: We have never paid cash dividends on our stock and currently anticipate that we will continue to retain any future earnings for the foreseeable future.Given eBay’s dividend policy, why would investors be attracted to its stock?arrow_forwardEnterprise Storage Company has 450,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $8.75. It is six years in arrears in its dividend payments. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods.a. How much in total dollars is the company behind in its payments? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g., $1,234,000).) Dividend in arrears b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D1 $ 1.20 D2 1.30 D3 1.40 D4 1.50 The company anticipates earnings per share after four years will be $4.10 with a P/E ratio of 11.The common stock will be valued as the present value of future dividends plus the present value of the future stock price…arrow_forwardThe Cavendish Company recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. This action had no effect on the company's total assets or operating income. Which of the following effects would occur as a result of this action? 1. d. The company's basic earning power ratio increased. 2. c. The company's times interest earned ratio decreased. 3. a. The company's debt ratio increased. 4. e. The company's equity multiplier increased. 5. b. The company's current ratio increased.arrow_forward

- Baker Industries' net income is $24,000, its interest expense is $4,000, and its tax rate is 25%. Its notes payable equals $24,000, long-term debt equals $75,000, and common equity equals $240,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round intermediate calculations. Round your answers to two decimal places. ROE: ROIC: 10 Hide Feedback Partially Correctarrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $17.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 15% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 10%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 26% per year. Required: a. What is your estimate of DEQS's intrinsic value per share? b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? c. What do you expect to happen to price in the following year? d. What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 15% of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education