EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

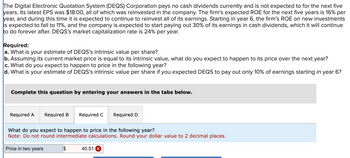

Transcribed Image Text:The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five

years. Its latest EPS was $18.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 16% per

year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments

is expected to fall to 11%, and the company is expected to start paying out 30% of its earnings in cash dividends, which it will continue

to do forever after. DEQS's market capitalization rate is 24% per year.

Required:

a. What is your estimate of DEQS's intrinsic value per share?

b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year?

c. What do you expect to happen to price in the following year?

d. What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 10% of earnings starting in year 6?

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C Required D

What do you expect to happen to price in the following year?

Note: Do not round intermediate calculations. Round your dollar value to 2 decimal places.

Price in two years

$

40.51 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 23 images

Knowledge Booster

Similar questions

- The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $17.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 15% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 10%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 26% per year. Required: a. What is your estimate of DEQS's intrinsic value per share? b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? c. What do you expect to happen to price in the following year? d. What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 15% of…arrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $13.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 17% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 12%, and the company is expected to start paying out 35% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 20% per year. Required: What is your estimate of DEQS's intrinsic value per share? Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? What do you expect to happen to price in the following year? What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 15% of earnings starting…arrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $11.00, all of which was reinvested in the company. The firm's expected ROE for the next five years is 15% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 14%, and the company is expected to start paying out 30% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 15% per year. a. What is your estimate of DEQS's intrinsic value per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Intrinsic value b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Round your dollar value to 2 decimal places.) Price will by % per year until year 6.arrow_forward

- The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $15.50, all of which was reinvested in the company. The firm’s expected ROE for the next five years is 19% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm’s ROE on new investments is expected to fall to 14%, and the company is expected to start paying out 35% of its earnings in cash dividends, which it will continue to do forever after. DEQS’s market capitalization rate is 22% per year. What is your estimate of DEQS’s intrinsic value per share if you expected DEQS to pay out only 15% of earnings starting in year 6?arrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $11.50, all of which was reinvested in the company. The firm’s expected ROE for the next five years is 20% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm’s ROE on new investments is expected to fall to 15%, and the company is expected to start paying out 35% of its earnings in cash dividends, which it will continue to do forever after. DEQS’s market capitalization rate is 19% per year. a. What is your estimate of DEQS’s intrinsic value per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Round your dollar value to 2 decimal places.) . c. What do you expect to happen to…arrow_forwardS The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $17.50, all of which was reinvested in the company. The firm's expected ROE for the next five years is 17% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 12%, and the company is expected to start paying out 45% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 24% per year. Required: a. What is your estimate of DEQS's intrinsic value per share? b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? c. What do you expect to happen to price in the following year? d. What is your estimate of DEQS's intrinsic value per share if you expected DEQS to pay out only 25% of…arrow_forward

- The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.20, all of which was reinvested in the company. The firm's expected ROE for the next four years is 19% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 18% per year. GG's market capitalization rate is 18% per year. a. What is your estimate of GG's intrinsic value per share? (Round your answer to 2 decimal places.) GG's intrinsic value b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? Price should at a rate of % over the next year.arrow_forwardThe Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.20, all of which was reinvested in the company. The firm's expected ROE for the next four years is 19% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 18% per year. GG's market capitalization rate is 18% per year. Required: a. What is your estimate of GG's intrinsic value per share? Note: Round your answer to 2 decimal places. b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? Complete this question by entering your answers in the tabs below. Required A Required B What is your estimate of GG's intrinsic value per share? Note: Round your answer to 2 decimal places. GG's intrinsic valuearrow_forwardThe Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $19.50, all of which was reinvested in the company. The firm’s expected ROE for the next five years is 15% per year, and during this time it is expected to continue to reinvest all of its earnings. DEQS’s Price Earnings Ratio is 5 and its market capitalization rate is 26% per year. At the beginning of Year 2, DEQS’s market price is $ 150 per share. Is this stock a better long purchase for your portfolio or a sale or a short ?? AND WHY ?arrow_forward

- Please answer D. The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $12.50, all of which was reinvested in the company. The firm’s expected ROE for the next five years is 21% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm’s ROE on new investments is expected to fall to 16%, and the company is expected to start paying out 45% of its earnings in cash dividends, which it will continue to do forever after. DEQS’s market capitalization rate is 20% per year. d. What is your estimate of DEQS’s intrinsic value per share if you expected DEQS to pay out only 25% of earnings starting in year 6? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardThe Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $5.50, all of which was reinvested in the company. The firm's expected ROE for the next four years is 21% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 20% per year. GG's market capitalization rate is 20% per year. a. What is your estimate of GG's intrinsic value per share? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. GG's intrinsic value $ Price should 73.32 x b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? increase X Answer is complete but not entirely correct. at a rate of 23 X % over the next year.arrow_forwardThe Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $5, all of which was reinvested in the company. The firm’s expected ROE for the next four years is 20% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm’s ROE on new investments is expected to fall to 15% per year. GG’s market capitalization rate is 15% per year.a. What is your estimate of GG’s intrinsic value per share?b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT