Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

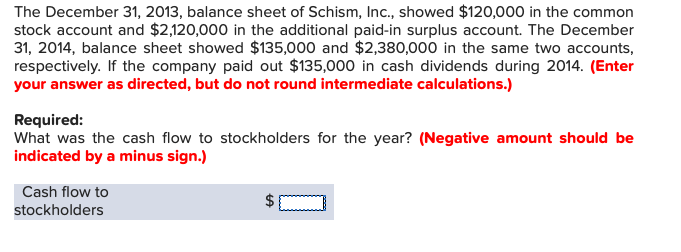

Transcribed Image Text:The December 31, 2013, balance sheet of Schism, Inc., showed $120,0 00 in the common

stock account and $2,120,000 in the additional paid-in surplus account. The December

31, 2014, balance sheet showed $135,000 and $2,380,000 in the same two accounts

respectively. If the company paid out $135,000 in cash dividends during 2014. (Enter

your answer as directed, but do not round intermediate calculations.)

Required:

What was the cash flow to stockholders for the year? (Negative amount should be

indicated by a minus sign.)

Cash flow to

stockholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- REQUIRED: What is the net income for the period?arrow_forwardMadrid Company has provided the following data (ignore income taxes): 2014 revenues were $80,500. 2014 net income was $34,500. Dividends declared and paid during 2014 totaled $6,300. Total assets at December 31, 2014 were $223,000. Total stockholders' equity at December 31, 2014 was $130,000. Retained earnings at December 31, 2014 were $85,000. Which of the following is not correct?arrow_forwardWhispering Mining Company declared, on April 20, a dividend of $466,000 payable on June 1. Of this amount, $128,000 is a return of capital. Prepare the April 20 and June 1 entries for Whispering. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Apr. 20 June 1 Debit Creditarrow_forward

- Super Grocers, Inc. provided the following financial information for the quarter ending September 30, 2016. Find the net cash flow from operating activites. Depreciation and amortization: $133,414 Net Income: $341,463 Increase in receivables: $112,709 Increase in inventory: $81,336 Increase in accounts payables: $62,411 Decrease in marketable securities: $31,225 Issued new common stock: $3,500 O $343,243 ○ $374,468 O $308,458 O $312,018arrow_forwardThe 2017 balance sheet of Kerber's Tennis Shop , Incorporated, showed $2.4 million long-term debt, $760,000 in the common stock account, and $5.95 million in the additional paid-in surplus account. The 2018 balance sheet showed $3.95 million $985,000, and $8.05 million in the same three accounts , respectively . The 2018 income statement showed an interest expense of $ 310,000 . The company paid out $590,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $690,000 , and the firm reduced its net working capital Investment by $185,000 , what was the firm's 2018 operating cash flow , or OCF ? Typed solutionarrow_forwardKiley Corporation had these transactions during 2022. Analyze the transactions and indicate whether each transaction is an operating activity, investing activity, financing activity, or noncash investing and financing activity. (a) Purchased a machine for $30,000, giving a long-term note in exchange. (b) Issued $50,000 par value common stock for cash. C (d) Declared and paid a cash dividend of $13,000 (e) Issued $200,000 par value common stock upon conversion of bonds having a face value of $200,000. (0) Sold a long term investment with a cost of $15.000 for $15,000 cash Collected $16.000 from sale of goods. Paid $18,000 to suppliers.arrow_forward

- No explanation of answers requiredarrow_forwardStarbucks reports net income for 2015 of $2,956.4 million. Its stockholders' equity is $6,527 million and $7,073 million for 2014 and 2015, respectively. a. Compute its return on equity for 2015.Round answer to one decimal place (ex: 0.2345 = 23.5%)Answer% b. Starbucks repurchased over $1.4 billion of its common stock in 2015. Did this repurchase increase or decrease Starbucks’ ROE? ROE usually decreases since the repurchase of shares reduces the denominator (avg. stockholders' equity). ROE usually increases since the repurchase of shares reduces the denominator (avg. stockholders' equity). ROE usually increases since the repurchase of shares increases the denominator (avg. stockholders' equity). ROE usually decreases since the repurchase of shares increases the denominator (avg. stockholders' equity). c. If Starbucks had not repurchased common stock in 2015, what would ROE have been? Note: Round answer to one decimal place (example: 20.6%). Answer%arrow_forwardIn 2018, Jake's Jamming Music, Inc. announced an ROA of 8.46 percent, ROE of 13.50 percent, and profit margin of 8.5 percent. The firm had total assets of $8.5 million at year-end 2018. Calculate the 2018 value of net income available to common stockholders for Jake’s Jamming Music, Inc. (Enter your answer in dollars. Round your answer to the nearest whole dollar.) Calculate the 2018 value of common stockholders’ equity for Jake’s Jamming Music, Inc. (Enter your answer in dollars not in millions and round to the nearest whole dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education