Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5. What is the amount of non-competitive bids accepted?

Question 20

6. What is the amount of non-competitive bids tendered?

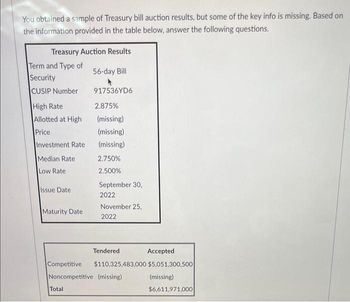

Transcribed Image Text:You obtained a sample of Treasury bill auction results, but some of the key info is missing. Based on

the information provided in the table below, answer the following questions.

Treasury Auction Results

56-day Bill

Term and Type of

Security

CUSIP Number

High Rate

Allotted at High

Price

Investment Rate

Median Rate

Low Rate

Issue Date

Maturity Date

917536YD6

2.875%

(missing)

(missing)

(missing)

2.750%

2.500%

Total

September 30,

2022

November 25,

2022

Tendered

Accepted

Competitive $110,325,483,000 $5,051,300,500

Noncompetitive (missing)

(missing)

$6,611,971,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What would be the alloted at high for this problem?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What would be the alloted at high for this problem?

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- act. The detalls of the contract are given below Date of contract 1 September 2015 Close out date (maturity 4 September 2015 date) Contract price Size of contract R975 per ounce 10 futures contract, each contract represents 100 troy ounces The initial margin Maintenance margin R12,000 per contract RI1,200 per contract Over the four trading days, the gold prices were as follows Date Spot price 1* September 2015 2nd September 2015 R964 R960 3rd September 2015 R970 4th September 2015 R980 Required 1. Explain whether Chill Ltd is buying or selling futures as a hedge. 2. Demonstrate the concept of marking to market using the 10 gold futures. Do that for the buyer and the seller. Clearly show the balance in the margin account at the end of each of the four trading days. 3. Under what circumstances is (a) a short hedge and (b) a long hedge appropriate?arrow_forwardOn December 1, 2015, the U.S. Treasury issued a $1,000, 10-year inflation indexed notes with a coupon rate of 2% (paid semi-annually on Dec 1 and June 1). On the date of issue, the consumer price index (CPI) was 231, but had increased to 259 on December 1, 2020. What was the amount of the coupon payment made on December 1, 2020? Select one: a. $10.46 b. $11.21 c. $20.00 d. $22.42 e. None of the above.arrow_forwardOn April 1, $10,000.00 364-day treasury bills were auctioned off to yield 1.91%. (a) What is the price of each $10,000.00 T-bill on April 1? (b) What is the yield rate on July 19 if the market price is $9,813.45? (c) Calculate the market value of each $10,000.00 T-bill on September 24 if the rate of return on that date is 2.75%. (d) What is the rate of return realized if a $10,000.00 T-bill purchased on April 1 is sold on December 16 at a market rate of 2.796%1 (a) The price is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10, 2020 is $4.23. You believe GME is overvalued and decide to short-sell GME. You have $156,912 worth of Treasury Bills in your brokerage account that can be used as collateral. Your broker requires an initial margin of 50% and a maintenance margin of 43%. You must also set aside 100% of the cash proceeds as collateral. You decide to short as many shares as you can with the collateral you have. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points.arrow_forwardUse the following information to answer. Coupon Payments are annual unless otherwise indicated! Years Face Coupon Market Security Rating Maturity Value Rate Price Treasury 1 $ 1,000 0.00% $ 965.00 Treasury 3 $ 1,000 1.90% $ 939.06 Treasury 5 $ 1,000 4.30% $ 932.42 Treasury 10 $ 1,000 6.80% $ 1,007.12 Treasury 15 $ 1,000 6.60% $ 908.25 Corp A A 5 $ 1,000 8.10% $ 990.00 Corp B BB 10 $ 1,000 7.90% $ 859.88 Corp C AA 15 $ 1,000 7.00% $ 660.00 What is the default risk premium for a BB debt security (round to two places)arrow_forwardRequired Information On January 1, 2024, Avalanche Corporation borrowed $102,000 from First Bank by issuing a two-year, 8% fixed-rate note with annual interest payments. The principal of the note is due on December 31, 2025. • Avalanche wanted to hedge against declines in general interest rates, so it also entered into a two-year SOFR-based interest rate swap agreement on January 1, 2024, and designates it as a fair value hedge. Because the swap is entered at market rates, the fair value of the swap is zero at inception. • The agreement called for the company to receive fixed interest at the current SOFR swap rate of 5% and pay floating interest tied to SOFR. This arrangement results in an effective variable rate on the note of SOFR + 3%. • The contract specifies that the floating rate resets each year on June 30 and December 31 for the net settlement that is due the following period. In other words, the net cash settlement is calculated using beginning-of-period rates. The SOFR rates…arrow_forward

- Please do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forward8. On January 28, 2011 a T-bill was issued with a face value of $170000 and a maturity date of July 22, 2011. If it was purchased for $164862.17 on the date it was issued, what yield is the investor realizing?arrow_forwardOn April 1, $10,000.00 364-day treasury bills were auctioned off to yield 3.24%. (a) What is the price of each $10,000.00 T-bill on April 1? (b) What is the yield rate on July 10 if the market price is $9,682.27? (c) Calculate the market value of each $10,000.00 T-bill on October 20 if the rate of return on that date is 4.104 %. (d) What is the rate of return realized if a $10,000.00 T-bill purchased on April 1 is sold on December 5 at a market rate of 4.232 %? (a) The price is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The yield rate is %. (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) (c) The market value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (d) The rate of return realized is. (Round the final answer to two decimal places as needed. Round all…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education