Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

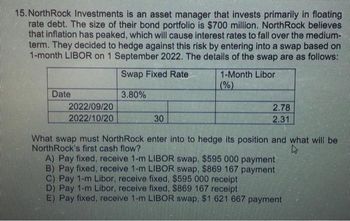

Transcribed Image Text:15. NorthRock Investments is an asset manager that invests primarily in floating

rate debt. The size of their bond portfolio is $700 million. NorthRock believes

that inflation has peaked, which will cause interest rates to fall over the medium-

term. They decided to hedge against this risk by entering into a swap based on

1-month LIBOR on 1 September 2022. The details of the swap are as follows:

Swap Fixed Rate

3.80%

Date

2022/09/20

2022/10/20

30

1-Month Libor

(%)

2.78

2.31

What swap must NorthRock enter into to hedge its position and what will be

NorthRock's first cash flow?

4

A) Pay fixed, receive 1-m LIBOR swap. $595 000 payment

B) Pay fixed, receive 1-m LIBOR swap. $869 167 payment

C) Pay 1-m Libor, receive fixed, $595 000 receipt

D) Pay 1-m Libor, receive fixed., $869 167 receipt

E) Pay fixed, receive 1-m LIBOR swap. $1 621 667 payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the effect on interest of an interest rate swap?arrow_forwardWhat types of risks are interest rate andexchange rate swaps designed to mitigate?Why might one company prefer fixed-rate payments while another company prefers floating-ratepayments, or payments in one currency versusanother?arrow_forwarda. What is meant by coupon stripping in theTreasury market?b. What is created as a result of coupon strippingin the Treasury market?arrow_forward

- Which type of trader is said to be paid to take on risk? O Speculator O Hedger O Arbitrageurarrow_forwardHow can the company use currency futures contracts to hedge against exchange rate risk?arrow_forwardExplain with examples how to measure exchange rate risk for long positions and short positions Notes : Use your own numbers in making calculations!arrow_forward

- How might thetreasurer of a multinational firm use the interest rate parity concept (a) when deciding howto invest the firm’s surplus cash and (b) whendeciding where to borrow funds on a short-termbasis?arrow_forwardHedgers should buy calls if they are hedging an expected outflow of foreign currency. True or False ? Explain.arrow_forwardA(n). OOO futures hedge is most likely to result in ongoing payments over the life of the foreign exchange instrument. options money market forwardarrow_forward

- What is the difference in cash flow between short-selling an asset and entering a short futures position?arrow_forwardHow can a company offset risk using interest rate swaps?arrow_forward11.) Define Futures Contracts, and Options. How are these products commonly used as portfolio diversification mechanisms?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education