EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

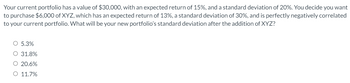

Transcribed Image Text:Your current portfolio has a value of $30,000, with an expected return of 15%, and a standard deviation of 20%. You decide you want

to purchase $6,000 of XYZ, which has an expected return of 13%, a standard deviation of 30%, and is perfectly negatively correlated

to your current portfolio. What will be your new portfolio's standard deviation after the addition of XYZ?

O 5.3%

O 31.8%

O 20.6%

O 11.7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you have $2,000 to invest. The market portfolio has an expected return of 10.5 percent and a standard deviation of 16 percent. The risk-free rate is 3.75 percent. How much should you invest in the risk-free asset if you wish to have a 15 percent return on the portfolio?arrow_forwardAssume that there is some risky portfolio Q, which has an expected return of 15%, and a standard deviation of 12%. The risk-free rate is 5%. There is also some asset P that is not part of Q. which has an expected return of 10%, and a standard deviation of 7%. You want to invest in some combination of the Q and the risk-free asset to achieve an expected return of 40% What is the standard deviation of your returns Select one O a 42% O b. 16% Oc 40% d 32%arrow_forwardSuppose that you have found the optimal risky combination using all risky assets available in the economy, and that this optimal risky portfolio has an expected return of 0.19 and standard deviation of 0.24. The T-bill rate is 0.05. What fraction of your money must be invested in the optimal risky portfolio in order to form a complete portfolio with an expected return of 0.09? Round your answer to 4 decimal places. For example, if your answer is 3.205 %, then please write down 0.0321..arrow_forward

- ) You estimate that the expected return of your portfolio is 30%. The standard deviation of the return is 25%. a. The returns of your portfolio are normally distributed. What is the probability of your portfolio suffering a loss greater than 20% (i.e., having a return that is less than -20%)? You may find the figure below helpful in answering the question (you can also use Excel). b. How would your answer to part a) change if the returns of your portfolio exhibited negative skewness (relative to the normal distribution). You do not need to do any calculations here - you just need to state whether it would be the same, higher or lower. Please explain your answer for full credit. 68.26% 95.44% 99.74% -30 -20 -10 +1g +20 +30 +40 Rate of return (%) E Focus MacBook Proarrow_forwardYou invest $100 in a risky asset with an expected return of 12% and a standard deviation of 15%, and a T-bill that pays 5%. [i]. If you desire to form a portfolio with an expected return of 9%, what percentages of your money must you invest in the T-bill? [ii]. If you desire to form a portfolio with a standard deviation of 9%, what percentages of your money must you invest in the T-bill?arrow_forwardSuppose that you currently have $100,000 invested in a portfolio with an expected return of 13% and a volatility of 8%. The efficient (tangent) portfolio has an expected return of 17% and a volatility of 10%. The risk-free rate of interest is 1%. Suppose that you want to keep the expected return equal to the current rate of 13%. Accordingly, the level of risk you can expect is: 1.00% 3.75% 4.75% 5.15% None of the abovearrow_forward

- You currently have $100,000 invested in a portfolio that has an expected return of 10% and a volatility of 10%. Suppose the risk-free rate is 5% , and there is another portfolio has an expected return of 24% and a volatility of 13%. a. What portfollo has a higherhigher expected return than your portfollo but with the same volatility? The portfolio should be composed of $ in the other portfolio, and $_____ in the risk-free investment (round to the nearest dollar). What is your expected return? % b. What portfolio has a lowerlower volatility than your portfollo but with the same expected return? You should invest $_____ in the other portfolio and $_______ in the risk-free investment, lowering your volitility to %.arrow_forwardSuppose the expected return on the tangent portfolio is 10% and its volatility is 40%.The risk-free rate is 2%.(a) What is the equation of the Capital Market Line (CML)?(b) What is the standard deviation of an efficient portfolio whose expected return of8%? How would you allocate $1,000 to achieve this positionarrow_forwardSuppose the assumption behind that the CAPM hold. The risk free rate is 2% and the expected return market is 9% .The standard deviation of the market portfolio is 15% .AAPL has a beta of 1.4 and standard deviation of 35% .Suppose that the standard deviation of your optimal portfolio is 18% . What is its expected return?arrow_forward

- Find the expected portfolio return and standard deviation if you were to invest 50% of your portfolio in Asset B, 50% in Asset C, with no allocation to Asset A. Compute your answers to the nearest tenth of a basis point. (See attached data file) We know that Asset A: B: C: expected return: 1.16 1.35 1.38 expected standard deviation: 2.88 1.58 2.19arrow_forwardYou invest 50% of your wealth in risky asset A and 50% in the risk-free asset. E(ra) is 10% and OA is 16%, while the risk- ree rate is 3%. The expected return on your portfolio is________ while the standard deviation is_________ Multiple Choice 6.50%,; 8.00% 7.90%; ,11.20% 5.80%; ,6.40% 7.20%; ,9.60%arrow_forwardYou will have a portfolio that is only comprised of two assets. You plan to allocate 47.1% into asset A, which has an expected return of 12.1%. The remainder of your portfolio will be allocated to asset B, which has an expected return of 5.9%. What is your expected return on this two-asset portfolio? State your answer as a percentage with two decimal places (i.e., 13.21, not 0.1321).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT