FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

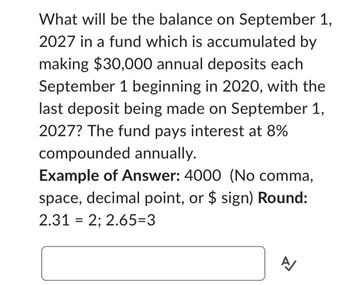

Transcribed Image Text:What will be the balance on September 1,

2027 in a fund which is accumulated by

making $30,000 annual deposits each

September 1 beginning in 2020, with the

last deposit being made on September 1,

2027? The fund pays interest at 8%

compounded annually.

Example of Answer: 4000 (No comma,

space, decimal point, or $ sign) Round:

2.31 = 2; 2.65=3

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello sir please find the answer belowarrow_forwardA sum of 50,000 deposited in a fund which will earn 12% compound semiannualy for the first 5 years and 8% interest compounded quarterly for the next 7 years. How much will be the amount after 12 years.arrow_forwardCreate a complete sinking fund schedule and calculate the total payments and interest earned needed for a fund of $9,000 one year from now. The fund will receive deposits made at the end of every three months and earns 5% compounded quarterly. Payment Number 1 2 3 4 Total Payment Amout at End ($) (PMT) Number Number Number Number Total PMT = Number Interest Earned or Accrued ($) (INT) Number Number Number Number Total INT Number Principal Balance Accumulated at End of Payment Interval ($) (BAL) Number Number Number Numberarrow_forward

- A college savings fund is opened with a $12,000 deposit. The account earns 6.55% annual interest compounded continuously. What will the value of the account be in 18 years? $26,704.29 $38,704.29 $27,013.46 $39,013.46 . By formula only please correct ansarrow_forwardK Find the amount of each payment into a sinking fund if $14,000 must be accumulated Payments are made at the end of each quarter for 3 years, with interest of 6% compounded quarterly Round to the nearest cent Click here to view part 1 of the Sinking Fund table. Click here to view part 2 of the Sinking Fund table. OA. $829.92 OB. $4,597 32 OC. $1,180.06 OD. $1,073.52arrow_forward$2,950 was deposited at the end of every six months for 8 years into a fund earning 4.5% compounded semi-annually. After this period, the accumulated money was left in the account for another 7 years at the same interest rate. a) Calculate the accumulated amount at the end of the 15-year term. $ b) Calculate the total amount of interest earned during the 15-year period.arrow_forward

- sarrow_forwardFind the interest rate needed for the sinking fund to reach the required amount. Assume that the compounding period is the same as the payment period. $14,129 to be accumulated in 3 years; quarterly payments of $1075. The interest rate needed is approximately %. (Type an integer or decimal rounded to two decimal places as needed.)arrow_forwardSix annual deposits in the amounts of $12,000,$10,000, $8,000, $6,000, $4,000, and $2,000, in thatorder, are made into a fund that pays interest at a rateof 7% compounded annually. Determine the amountin the fund immediately after the sixth deposit.arrow_forward

- Q1) On April 12th, 2013, Joseph invested $15,000 in a fund that was growing at 6% compounded quarterly. a. Calculate the accumulated amount of the fund on November 10th, 2013. b. On November 10th, 2013, the interest rate on the fund changed to 3% compounded monthly. Calculate the accumulated amount of the fund on October 27th, 2014.arrow_forward$4,250 was deposited at the end of every six months for 5 years into a fund earning 2.2% compounded semi-annually. After this period, the accumulated money was left in the account for another 4 years at the same interest rate. a) Calculate the accumulated amount at the end of the 9-year term. $ b) Calculate the total amount of interest earned during the 9-year period.arrow_forward2,500 is deposited into Fund X, which earns an annual effective rate of zero. At the end of each year, 10% of the balance is withdrawn from the fund. The annual withdrawals are deposited into Fund Y, which earns an annual effective rate of 10%. Determine the accumulated value of Fund Y at the end of year 10. a) 2,806 b) 2,252arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education