Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

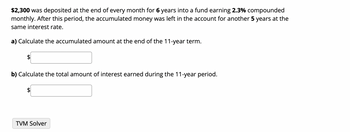

Transcribed Image Text:$2,300 was deposited at the end of every month for 6 years into a fund earning 2.3% compounded

monthly. After this period, the accumulated money was left in the account for another 5 years at the

same interest rate.

a) Calculate the accumulated amount at the end of the 11-year term.

b) Calculate the total amount of interest earned during the 11-year period.

TVM Solver

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- Determine the effective rate for $1 invested for 1 year at 7.8% compounded quarterly. The effective rate is %. (Round to three decimal places.)arrow_forwardIf $1125.00 accumulates to $1248.19 in two years, six months compounded semi-annually, what is the effective annual rate of interest? The effective annual rate of interest is %.arrow_forwardAt the start of this year, $10,000 was deposited into an account that earns an effective annual interest rate of 4% per year for 10 years. Another $1,000 will be deposited at the end of each year for years 1-10, also earning 4% per year. All interest earned remains in the account. How much money is in this account at the end of year 10?arrow_forward

- Four hundred dollars is deposited into an account that compounds interest quarterly. After 10 quarters the account balance is $441.85. Determine the nominal interest paid on the account.arrow_forwardUse the compound interest formula to compute the balance in the following account after the stated period of time, assuming interest is compounded annually. $9000 invested at an APR of 3.8% for 14 years.arrow_forwardCalculate the amount of money that will be in each of the following accounts at the end of the given deposit period: Account Holder Amount Deposited AnnualInterest Rate CompoundingPeriods Per Year (M) CompoundingPeriods (Years)Theodore Logan III $1,000 10% 1 10Vernell Coles $95,000 12% 12 1Tina Elliot $8,000 12% 6 2Wayne Robinson $120,000 8% 4 2Eunice Chung $30,000 10% 2 4Kelly Cravens $15,000 12% 3 3arrow_forward

- At the end of every year, $2000 is deposited into an account that earns interest of 10% /a, compounded annually. The value of the account after 10 years is: -$ 31,874.85 $ 114,549.99 - $ 114,549.99 $31,874.85arrow_forwardDetermine the interest earned after 8 years if $3000 is invested in each of the following accounts. A) an account earning 5.29% interest compounded daily B) an account earning 5.14% simple interestarrow_forwardComplete the following using compound future value. (Use the Table provided.) Time Principal Rate Compounded Amount Interest 6 months $15,000 6 % Semiannuallyarrow_forward

- Find the compound amount and the amount of interest earned by the following deposit. $3,000 at 4.77% compounded continuously for 9 years. What is the compound amount? (Round to the nearest cent.)arrow_forwardTRE Use the compound interest formula to compute the balance in the following account after the stated period of time, assuming interest is compounded annually. HO $15,000 invested at an APR of 4.4% for 15 years.arrow_forwardCompute the nominal annual rate of interest compounded quarterly at which $300.00 paid at the end of every three months for six years accumulates to $10.000.00 Came The nominal annual rate of interest is compounded quarterly (Round to two decimal places as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education