Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

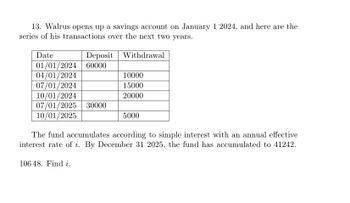

Transcribed Image Text:13. Walrus opens up a savings account on January 1 2024, and here are the

series of his transactions over the next two years.

Withdrawal

Deposit

Date

01/01/2024 60000

04/01/2024

07/01/2024

10/01/2024

07/01/2025 30000

10/01/2025

10000

15000

20000

106 48. Find i.

5000

The fund accumulates according to simple interest with an annual effective

interest rate of i. By December 31 2025, the fund has accumulated to 41242.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- 2. Andrew deposit $2 into a fund at time 0. Money in this fund accumulates at an effective annual interest rate of i during the first 5 years, and at an effective annual interest rate of 2i thereafter. This deposit accumulates to 6.18 at the end of 10 years and to 27.47 at the end of 20 years. What is the value of the deposit at the end of 7 years? Solution:arrow_forwardPascal has recently opened an RRSP. He plans to deposit $ 647 at the end of every month for 25 years. The account will compound interest semi-annually at the nominal rate of 6.7 %. How much money will Pascal have in his account immediately after his last deposit?a. $ 522341.09b.$ 492774.61c. $ 512485.60d.$ 532196.58e.$ 502630.10arrow_forwardAssignment - 11. Quiz: Savings Accounts ASSIGNMENTS COURSES SECTION 1 OF 1 QUESTION 2 OF 8 Attempt 1 of 1 1 4 7 8 <. Charlie invests $500 in a savings account with an annual interest rate of 12%. How much simple interest will he collect in 4 years? O 48 O 120 240 O 420 NEXT QUESTION O ASK FOR HELP TURN IT IN Type here to searcharrow_forward

- On the day you were born, your parents opened than the amount deposited in the previous year Immediately after your parents make the deposit on your 18th birthday, the amount of money in your savings account will be closest to which of the following? OA $80,839 OB $27,958 OC. $99,002 a college savings account with an initial deposit of $2.200 On every one of your birthdays since, your parents have made an additional deposit that is 3% larger The account eams 6.7% interest annually OD $30,000 OE $29,050 The deposit made on your 18th birthday will be the final deposit made into the account You plan on using the balance in the account to fund your college education You will be attending a 4-year institution and you will assume that tuition costs will remain constant over the next four years. If the first annual tution payment wit be made on your 19th birthday, what is the maximum annual tabon expense that the balance in your account can sustain if you plan on attending college for four…arrow_forwardwebwork / mat110e_oncampus_f/ finance.set.3/6 Finance.set.3: Problem 6 Previous Problem Problem List Next Problem Eugene began to save for his retirement at age 31, and for 15 years he put $ 425 per month into an ordinary annuity at an annual interest rate of 9% compounded monthly. After the 15 years, Eugene was unable to make the monthly contribution of $ 425, so he moved the money from the annuity into another account that earned 9% interest compounded monthly. He left the money in this account for 19 years until he was ready to retire. How much money did he have for retirement? Retirement amount = If Eugene had waited until he was 43 years old to start saving for retirement and then decided to put money into an ordinary annuity for 22 years earning 9% interest compounded monthly, what monthly payment would he have to make to accumulate the same amount for 2. retirement as you found in the first part of the question? Retirement amount = 3.arrow_forwardson.2arrow_forward

- Dineshbhaiarrow_forwardAndre Castello owns a savings account that is paying 2.5% interest compounded annually His current balance is $7.598.42. How much interest will he earn over 5 years if the rate remains constant? Select one: a. $998.49 b. $8596.91 c. $949.80 d. $882.52arrow_forwardQuestion 1 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest rate. a) What is the implied per annual simple interest rate for her purchasing (expressed as a percentage and rounded to three decimal places)? Select one: a. 0.076 b. 0.032 c. 0.031 d. 0.088 Question 2 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest rate. b) What is her selling price (rounded to four decimal places)? Select one: a. 98740.2903 b. 98634.0935 c. 98846.7161 d. 99317.7280 Question 3 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest…arrow_forward

- You decide to make monthly $2000 deposits into an account that pays 4% compounded monthly. If your first deposit was on January 1, 2019, then how much is in the account immediately after the deposit on January 1, 2025?arrow_forward0nly typed solutionarrow_forwardPascal has recently opened an RRSP. He plans to deposit $ 733 at the end of every month for 20 years. The account will compound interest semi-annually at the nominal rate of 6.4 %. How much money will Pascal have in his account immediately after his last deposit? a. $ 323528.06 b. $ 365727.37 c. $ 351660.93 d. $ 369243.98 e. $ 379793.81arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education