Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Need Help Please Solve This One Genera Accounting Question

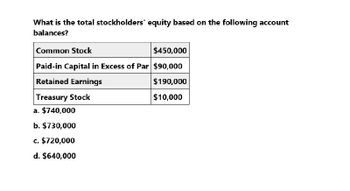

Transcribed Image Text:What is the total stockholders' equity based on the following account

balances?

Common Stock

$450,000

Paid-in Capital in Excess of Par $90,000

Retained Earnings

Treasury Stock

a. $740,000

b. $730,000

c. $720,000

d. $640,000

$190,000

$10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- If total assets are $20,000 and total liabilities are $12,000, the amount of stockholders’ equity is: A. $32,000. B. $(32,000). C. $(8000). D. $8,000.arrow_forwardWhat is the total stockholders' equity based on the following account balances? Common Stock $1110000 Paid-In Capital in Excess of Par 43000 Retained Earnings 173000 Treasury Stock 23000 O $976000. O $1174000. O $1303000. O $1151000.arrow_forwardWhat is Wayne Co.'s total stockholders' equity based on the following account balances? Common Stock Paid-In Capital in Excess of Par Retained Earnings Treasury Stock O $975,000. O $1,150,000. O $1,000,000. O $800,000. $950,000 50,000 175,000 25,000arrow_forward

- What is the total stockholders' equity based on the following account balances? Common Stock $450,000 Paid-in Capital in Excess of Par $90,000 Retained Earnings Treasury Stock a. $740,000 b. $730,000 c. $720,000 d. $640,000 $190,000 $10,000arrow_forwardWhat is the total stockholders' equity based on the following data? Common Stock $900,000 Excess of Issue Price Over Par—Common Stock 375,000 Retained Earnings (deficit) (50,000) a.$900,000 b.$1,225,000 c.$1,275,000 d.$1,325,000arrow_forwardWhat is the total stockholders equity based on the following account balances? Common stock $318,200 Paid in capital excess of par $58,300 Retained earnings $161,360 Treasury stock $21,200arrow_forward

- need helparrow_forwardWhat is the total stockholders' equity based on the following account balances? Common Stock $104,000 Paid-In Capital in Excess of Par 505,000 Retained Earmings 193,000 Treasury Stock 44,000 Oa. $802,000 OD $846,000 OC $758,000 Od. S609,000arrow_forwardA company reports the following: Net income Preferred dividends Average stockholders' equity $190,000 7,600 1,532,258 848,372 Average common stockholders' equity Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equity b. Return on Common Stockholders' Equity % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning