FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

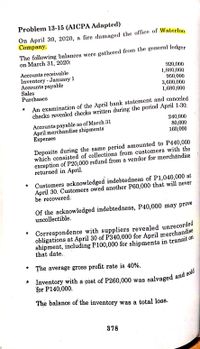

Transcribed Image Text:Problem 13-15 (AICPA Adapted)

On April 30, 2020, a fire damaged the office of Waterloo

Company.

The following balances were gathered from the general ledger

on March 31, 2020:

Accounts receivable

Inventory - January 1

Accounts payable

Sales

Purchases

920,000

1,880,000

950,000

3,600,000

1,680,000

An examination of the April bank statement and canceled

checks revealed checks written during the period April 1-30;

240,000

80,000

160,000

Accounts payable as of March 31

April merchandise shipments

Еxрenses

Deposits during the same period amounted to P440,000

which consisted of collections from customers with the

exception of P20,000 refund from a vendor for merchandise

returned in April.

Customers acknowledged indebtedness of P1,040,000 at

April 30. Customers owed another P60,000 that will never

be recovered.

Of the acknowledged indebtedness, P40,000 may prove

uncollectible.

Correspondence with suppliers revealed unrecorded

obligations at April 30 of P340,000 for April merchandise

shipment, including P100,000 for shipments in transit on

that date.

* The average gross profit rate is 40%.

* Inventory with a cost of P260,000 was

for P140,000.

salvaged and sold

The balance of the inventory was a total loss.

378

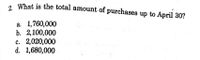

Transcribed Image Text:, What is the total amount of purchases up to April 30?

a. 1,760,000

b. 2,100,000

c. 2,020,000

d. 1,680,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5. PE.07-08B H Show Me How eBook Inventory Turnover and Days' Sales in Inventory Financial statement data for years ending December 31 for Tango Company follows: 20Y7 20Y6 Cost of merchandise sold $3,864,000 $4,001,500 Inventories: Beginning of year 770,000 740,000 End of year ৪40,000 770,000 a. Determine the inventory turnover for 20Y7 and 20Y6. Round to one decimal place. Inventory Turnover 20Y7 20Y6 b. Determine the days' sales in inventory for 20Y7 and 20Y6. Assume 365 days a year. Round interim calculations and final answers to one decimal place. Days' Sales in Inventory 20Y7 days 20Y6 days c. Does the change in inventory turnover and the days' sales in inventory from 20Y6 to 20Y7 indicate a favorable or an unfavorable trend?arrow_forwardWhat does it mean "listed at" example Merchandise purchased on May 4, "listed at" $520, is returned for credit.arrow_forwardwhat is the Credit for partial payment knowing that information?arrow_forward

- 5. Gingerbread, Corp. presents the following information for inventory purchases and sales throughout the month of December. The company uses LIFO Perpetual Method for inventory. DATE TRANSACTIONS UNITS UNIT COST December 1 Beginning inventory 1,000 $1.00 December 5 Sale 500 December 20 Purchase 1,000 $1.10 December 31 Sale 500 Cost of goods sold for the month of December is ?arrow_forwardLIFO Perpetual Inventory The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Number Date Transaction Per Unit Total of Units Apr. 3 Inventory 36 $225 $8,100 8 Purchase 72 270 19,440 11 Sale 48 00 750 36,000 30 Sale 30 750 22,500 May 8 Purchase 60 60 300 18,000 10 Sale 36 750 27,000 19 Sale 18 750 13,500 28 Purchase 60 330 19,800 June 5 Sale 36 790 28,440 16 Sale 48 790 37,920 21 Purchase 108 360 38,880 28 Sale 54 790 42,660 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.arrow_forwardquestion 5 A record of transactions for the month of January was as follows: Purchases Sales Jan 1 (balance) 500 @ $5.00 Jan 3 200 @ $7.00 10 1,300 @ $5.60 18 1,000 @ 8.50 25 800 @ $6.00 Assuming that perpetual inventory records are kept in dollars, determine the ending inventory and cost of goods sold for FIFO, LIFO and moving average.arrow_forward

- ▶Inc. is a retailer. Its accountants are preparing the company's 2nd quarter master budget. The company has the following balance sheet as of March 31. Inc. Balance Sheet March 31 Assets Cash $ 83,000 Accounts receivable Inventory 126,000 69,750 220,000 Plant and equipment, net of depreciation Total assets $ 498,750 Liabilities and Stockholders' Equity Accounts payable Common stock $ 81,000 348,000 69,750 Retained earnings Total liabilities and stockholders' equity $ 498,750 accountants have made the following estimates: 1. Sales for April, May, June, and July will be $310,000, $330,000, $320,000, and $340,000, respectively. 2. All sales are on credit. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at March 31 will be collected in April. 3. Each month's ending inventory must equal 30% of next month's cost of goods sold. The cost of goods sold is 75% of sales. The company pays for 40% of its…arrow_forwardTransactions for the month of June were: Purchases Sales June 1 (balance) 3180 @ $3.30 June 2 2350 @ $5.40 3 8820 @ 3.20 6 6380 @ 5.40 7 4900 @ 3.40 9 3920 @ 5.40 15 7180 @ 3.50 10 1540 @ 8.00 22 1960 @ 3.60 18 5610 @ 8.00 25 760 @ 8.00 Assuming that periodic inventory records are kept in units only, the ending inventory on a LIFO basis isarrow_forwardWhat is the balance of accounts payable at May 31st?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education