FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the balance of accounts payable at May 31st?

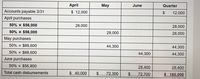

Transcribed Image Text:**Cash Disbursements Schedule**

This table outlines the cash disbursements for the months of April, May, and June, along with the quarterly total. Below is a breakdown of the disbursements:

1. **Accounts Payable as of March 31:**

- **Quarter Total:** $12,000

2. **April Purchases:**

- 50% of $56,000 = $28,000 to be paid in April

- 50% of $56,000 = $28,000 to be paid in May

3. **May Purchases:**

- 50% of $88,600 = $44,300 to be paid in May

- 50% of $88,600 = $44,300 to be paid in June

4. **June Purchases:**

- 50% of $56,800 = $28,400 to be paid in June

**Total Cash Disbursements:**

- **April:** $40,000

- **May:** $72,300

- **June:** $72,700

- **Quarter Total:** $185,000

This schedule provides a comprehensive view of when and how much cash will be disbursed for outstanding accounts payable and new purchases across the three-month period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At January 1, 2025, Pembina Imports Inc. reported this information on its balance sheet. Accounts receivable Less: Allowance for expected credit losses 1. During 2025, the company had the following summary transactions related to receivables and sales. Pembina uses the perpetual inventory system. Pembina expects a return rate of 3%. 2. 3. 4. $696,000 5. 44,800 Sales on account amounted to $2,800,000. The cost of the inventory sold was $2,100,000. Goods with a total sales price of $44,800 and a cost of $33,600 were restored to inventory. Collections of accounts receivable were $2,464,000. Write-offs of accounts receivable deemed uncollectible, $50,400. Recovery of credit losses previously written off as uncollectible, $16,800.arrow_forwardBramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Made Bramble credit card sales totaling $25,800. (There were no balances prior to January 15.) Made Visa credit card sales (service charge fee 2%) totaling $5,800. Collected $12,000 on Bramble credit card sales. Added finance charges of 1.5% to Bramble credit card account balances. Jan. 15 20 Feb. 10 15 Journalize the transactions for Bramble Stores. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date Jan 15 Jan. 20 Cash Debit Credit M Ç T 9 M Q Me Mu VI 65 Ac Q 59 Acearrow_forwardplease answerarrow_forward

- Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 10% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 June 12 June 13 Rashid's hard drive crashes and he sends it to DRS. After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,700. Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 10% educational discount and reducing the cost by $270 ( = $2,700 × 10%). DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today's date, offering a 2% discount for payment within 10 days. When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 30% of the data has…arrow_forwardAssume that the employees are paid from the company's regular bank account check numbers 981 and 982 prepare the entry to record and pay the payroll in general journal from September 30th if required round amounts to the nearest cent if an amount does not require an entry leave it blank. College accounting 13th editionarrow_forwardB. Record the entry for acceptance of promissory note in exchange of accounts receivable from McCormick Industries. C. Record the entry for interest accrued on promissory note received from McCormick Industries. D. Record the entry for interest received , from McCormick Industries , on the note's maturity date. E. Record the entry for payment received from McCormick Industries the principal on the note's maturity date.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education