FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Problem 8.4A What total amount was recorded for purchases returns and allowances in the month of September? What percentage of total purchases does this represent? See attached information.

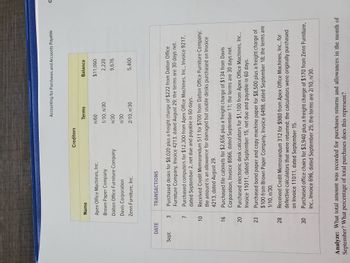

Transcribed Image Text:DATE

Sept.

3

7

10

16

20

23

Apex Office Machines, Inc.

Brown Paper Company

Dalton Office Furniture Company

Davis Corporation

Zenn Furniture, Inc.

28

30

Name

TRANSACTIONS

Creditors

Accounting for Purchases and Accounts Payable

Terms

n/60

1/10, n/30

n/30

n/30

2/10, n/30

Balance

$11,060

2,220

9,676

5,400

Purchased desks for $8,020 plus a freight charge of $222 from Dalton Office

Furniture Company, Invoice 4213, dated August 29; the terms are 30 days net.

Purchased computers for $12,300 from Apex Office Machines, Inc., Invoice 9217,

dated September 2, net due and payable in 60 days.

Received Credit Memorandum 511 for $700 from Dalton Office Furniture Company;

the amount is an allowance for damaged but usable desks purchased on Invoice

4213, dated August 29.

Purchased file cabinets for $2,656 plus a freight charge of $134 from Davis

Corporation, Invoice 8066, dated September 11; the terms are 30 days net.

Purchased electronic desk calculators for $1,100 from Apex Office Machines, Inc.,

Invoice 11011, dated September 15, net due and payable in 60 days.

Purchased bond paper and copy machine paper for $8,500 plus a freight charge of

$100 from Brown Paper Company, Invoice 6498, dated September 18; the terms are

1/10, n/30.

Received Credit Memorandum 312 for $980 from Apex Office Machines, Inc., for

defective calculators that were returned; the calculators were originally purchased

on Invoice 11011, dated September 15.

Purchased office chairs for $3,940 plus a freight charge of $170 from Zenn Furniture,

Inc., Invoice 696, dated September 25; the terms are 2/10, n/30.

Analyze: What total amount was recorded for purchases returns and allowances in the month of

September? What percentage of total purchases does this represent?

C

Transcribed Image Text:Lawn and Gardens Supply

Warren Industrial Products

n/30

2/10, n/30

Analyze: What total freight charges were posted to the general ledger for the month of July?

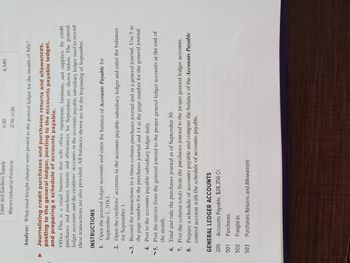

Journalizing credit purchases and purchases returns and allowances,

posting to the general ledger, posting to the accounts payable ledger,

and preparing a schedule of accounts payable.

6,540

Office Plus is a retail business that sells office equipment, furniture, and supplies. Its credit

purchases and purchases returns and allowances for September are shown below. The general

ledger accounts and the creditors' accounts in the accounts payable subsidiary ledger used to record

these transactions are also provided. All balances shown are for the beginning of September.

INSTRUCTIONS

1. Open the general ledger accounts and enter the balance of Accounts Payable for

September 1, 20X1.

4.

5.

2.

Open the creditors' accounts in the accounts payable subsidiary ledger and enter the balances

for September 1.

-3.

Record the transactions in a three-column purchases journal and in a general journal. Use 5 as

the page number for the purchases journal and 14 as the page number for the general journal.

Post to the accounts payable subsidiary ledger daily.

Post the entries from the general journal to the proper general ledger accounts at the end of

the month.

GENERAL LEDGER ACCOUNTS

205 Accounts Payable, $28,356 Cr.

501

Purchases

502

Freight In

503 Purchases Returns and Allowances

6.

Total and rule the purchases journal as of September 30.

7. Post the column totals from the purchases journal to the proper general ledger accounts.

8.

Prepare a schedule of accounts payable and compare the balance of the Accounts Payable

control account with the schedule of accounts payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What does it mean "listed at" example Merchandise purchased on May 4, "listed at" $520, is returned for credit.arrow_forwardCash receipt journalarrow_forwardUnit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* Units completed and transferred out Units in process, July 31, 80% complete* * With respect to conversion costs. 11,000 88,000 15,100arrow_forward

- LIFO Perpetual Inventory The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Number Date Transaction Per Unit Total of Units Apr. 3 Inventory 36 $225 $8,100 8 Purchase 72 270 19,440 11 Sale 48 00 750 36,000 30 Sale 30 750 22,500 May 8 Purchase 60 60 300 18,000 10 Sale 36 750 27,000 19 Sale 18 750 13,500 28 Purchase 60 330 19,800 June 5 Sale 36 790 28,440 16 Sale 48 790 37,920 21 Purchase 108 360 38,880 28 Sale 54 790 42,660 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.arrow_forward35 Which inventory issue must be disclosed in the notes to financial statements? Price changes for customers Suppliers' net assets Average costs of inventory Transactions with related parties BOOKMARKarrow_forwardUsing the accounts and amounts below, calculate Net Sales: Account Amount Sales Revenue $142,055 Purchase Discounts 1,886 Sales Discounts Sales Returns and Allowances 2,881 2,515 Cost of Goods Sold 40,889arrow_forward

- Ch. 12-16 1 The cost of goods sold reflects the selling price of the merchandise sold over a period of time. True or False True Falsearrow_forwardMatch the.last day the discount may be taken to each letter Invoice Date Date Merchandise was Last Date Received Terms for Cash Discount a. September 28 October 4 8/10 EOM b. July 28 August 2 8/10 ROG C. January 22 January 27 2/10 EOM d. March 21 March 27 2/10 ROG е. May 30 June 6 1/15, n/30 f. September 14 September 17 3/10,n/30arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education