Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hello tutor provide answer these general accounting question

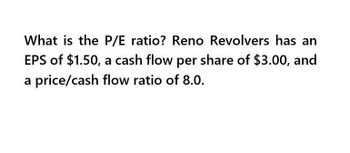

Transcribed Image Text:What is the P/E ratio? Reno Revolvers has an

EPS of $1.50, a cash flow per share of $3.00, and

a price/cash flow ratio of 8.0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reno Revolvere has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow ratio of 8.0. What is its P/E ratio?arrow_forwardHummel Inc. has $30,000 in current assets and $15,000 in current liabilities. What is Hummels current ratio? a. 3 c. 1 b. 2 d. 0.5arrow_forwardWhat would be the net income for Floress Catering? a. 45,500 b. 16,800 c. 19,800 d. 10,800arrow_forward

- Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of goods sold 660.0 Gross profit 135.0 Selling expenses 73.5 EBITDA 61.5 Depreciation expenses 12.0 Earnings before interest and taxes (EBIT) 49.5 Interest expenses 4.5 Earnings before taxes (EBT) 45.0 Taxes (40%) 18.0 Net income 27.0 a. Calculate the ratios you think would be useful in this analysis. b. Construct a DuPont equation, and compare the companys ratios to the industry average ratios. c. Do the balance-sheet accounts or the income statement figures seem to be primarily responsible for the low profits? d. Which specific accounts seem to be most out of line relative to other firms in the industry? e. If the firm had a pronounced seasonal sales pattern or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you correct for such potential problems?arrow_forwardSmoltz Company reported the following information for the current year: cost of goods sold, $252,500; increase in inventory, $21,700; and increase in accounts payable, $12,200. What is the amount of cash paid to suppliers that Smoltz would report on its statement of cash flows under the direct method? a. $218,600 c. $262,000 b. $243,000 d. $286,400arrow_forwardJarem Company showed 189,000 in prepaid rent on December 31, 20X1. On December 31, 20X2, the balance in the prepaid rent account was 226,800. Rent expense for 20X2 was 472,500. Required: 1. What amount of cash was paid for rent in 20X2? 2. CONCEPTUAL CONNECTION What adjustment in prepaid expenses is needed if the indirect method is used to prepare Jarems statement of cash flows?arrow_forward

- Define each of the following terms: Liquidity ratios: current ratio; quick, or acid test, ratio Asset management ratios: inventory turnover ratio; days sales outstanding (DSO); fixed assets turnover ratio; total assets turnover ratio Financial leverage ratios: debt ratio; times-interest-earned (TIE) ratio; EBITDA coverage ratio Profitability ratios: profit margin on sales; basic earning power (BEP) ratio; return on total assets (ROA); return on common equity (ROE) Market value ratios: price/earnings (P/E) ratio; price/cash flow ratio; market/book (M/B) ratio; book value per share Trend analysis; comparative ratio analysis; benchmarking DuPont equation; window dressing; seasonal effects on ratiosarrow_forwardRatio Analysis Consider the following information taken from Chicago Water Slides (CWSs) financial statements: Also, CWSs operating cash flows were $25,658 and $29,748 in 2019 and 2018, respectively. Note: Round all answers to two decimal places. Required: 1. Calculate the current ratios for 2019 and 2018. 2. Calculate the quick ratios for 2019 and 2018. 3. Calculate the cash ratios for 2019 and 2018. 4. Calculate the operating cash flow ratios for 2019 and 2018. 5. CONCEPTUAL CONNECTION Provide some reasons why CWSs liquidity may be considered to be improving and some reasons why it may be worsening.arrow_forwardWhat is the entry to record the cash received on a sale of 500, credit terms 1/15, n/30, if the payment is received within the discount period? a. Accounts Receivable 500 DR; Cash 500 CR b. Cash 500 DR; Accounts Receivable 500 CR c. Cash 495 DR, Sales Discount 5 DR; Accounts Receivable 500 CR d. Accounts Receivable 500 DR; Cash 495 CR, Sales Discount 5 CR e. Cash 500 DR; Sales Discount 5 CR, Accounts Receivable 495 CRarrow_forward

- If beginning cash equaled $10,000 and ending cash equals $19,000, which is true? A. Operating cash flow 9,000; Investing cash flow (3,500); Financing cash flow (2,500) B. Operating cash flow 4,500; Investing cash flow 9,000; Financing cash flow (4,500) C. Operating cash flow 2,000; Investing cash flow (13,000); Financing cash flow 2,000 D. none of the abovearrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forwardThe average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning