Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

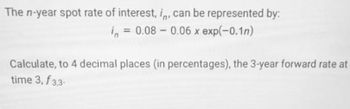

Transcribed Image Text:The n-year spot rate of interest, in, can be represented by:

= 0.08 0.06 x exp(-0.1n)

-

Calculate, to 4 decimal places (in percentages), the 3-year forward rate at

time 3, f 3,3-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Answer and working out are not correct, can you try again

Solution

by Bartleby Expert

Follow-up Question

Can you try again, using only formulas, no tables

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Answer and working out are not correct, can you try again

Solution

by Bartleby Expert

Follow-up Question

Can you try again, using only formulas, no tables

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the nominal annual rate of interest compounded quarterly that is equivalent to 4.8% compounded semi-annually. The nominal annually compounded rate of interest is %. (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardThe n-year spot rate of interest per annum, in, is given by: b in = a(1.1)" +- n for n = 1, 2 and 3 and where a and b are constants. With time measured in years from the present, the implied one-year forward rates applicable at time 0 and at time 1 are 7.3% and 6.8%, respectively. Showing all of your workout, calculate to 5 decimal places the following: (i) the values of a and b; (ii) the implied two-year forward rate applicable at time 1; (iii) the price per £1 nominal at time t = 0 of a bond which pays annual coupons of 7% in arrears and is redeemed at 95% after 3 years.arrow_forwardHh3.arrow_forward

- Given an Annual Percentage Rate (APR) of 0.072 with quarterly compounding, the equivalent interest rate for effective annual rate is ____%. Instruction: Round to three decimal places.arrow_forwardComplete the following using compound future value. (Use the Table 12.1 provided.) Note: Round your answers to the nearest cent. Time: 12 years Principal: $17,300 Rate: 3% Compounded: Annually Amount: Interest: Future value interest factor of $1 per period at i% for n periods, FVIF(i,n). Period 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 1 1.0050 1.0100 1.0150 1.0200 1.0250 1.0300 1.0350 1.0400 1.0450 1.0500 1.0550 1.0600 1.0650 1.0700 1.0750 1.0800 1.0850 1.0900 1.0950 1.1000 2 1.0100 1.0201 1.0302 1.0404 1.0506 1.0609 1.0712 1.0816 1.0920 1.1025 1.1130 1.1236 1.1342 1.1449 1.1556 1.1664 1.1772 1.1881 1.1990 1.2100 3 1.0151 1.0303 1.0457 1.0612 1.0769 1.0927 1.1087 1.1249 1.1412 1.1576 1.1742 1.1910 1.2079 1.2250 1.2423 1.25.97 1.2773 1.2950 1.3129 1.3310 4 1.0202 1.0406 1.0614 1.0824 1.1038 1.1255 1.1475 1.1699 1.1925 1.2155 1.2388 1.2625 1.2865 1.3108 1.3355 1.3605 1.3859 1.4116 1.4377 1.4641 5 1.0253…arrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Nominal Interest Compound Compound Principal Period (years) Rate (%) Compounded Amount Interest $8,000 4 12 annually Ex Enter a number.arrow_forward

- answer please lol!arrow_forwardSolve for the unknown interest rate in each of the following (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.):arrow_forwardAttempt History Current Attempt in Progress Wildhorse Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Cost Old Equipment Accumulated depreciation Remaining life Current salvage value Salvage value in 8 years Annual cash operating costs $80,240 $40,300 8 years $9,920 $0 $35,100 Cost New Equipment Estimated useful life Salvage value in 8 years Annual cash operating costs $38,000 8 years $4,800 $29,900 Depreciation is $10,030 per year for the old equipment. The straight-line depreciation method would be used for the new equipment over an eight-year period with salvage value of $4,800.arrow_forward

- Pls show complete steps and both parts or skip itarrow_forwardAssume an effective compound interest rate i= 3% per annum. Compute the following equivalent rates. In each case, enter your answer as a percentage. a) The nominal interest rate payable semi-annually Number % Enter an answer correct to 4 decimal places. b) The effective interest rate payable quarterly Number Enter an answer correct to 2 decimal places. c) The effective rate of discount per annum Number Enter an answer correct to 2 decimal places. d) The nominal rate of discount payable monthly Number % Enter an answer correct to 4 decimal places.arrow_forwardThe nominal interest rate compounded quarterly, ¿(4) is 6%. Let ¿ be the annual effective interest rate, d be the annual effective discount rate, d(12) be the nominal discount rate compounded monthly and be the annual constant force of interest. Calculate i + 2d + 3d(¹2) + 46. A 59.14% B 59.34% C 59.54% D 59.74% E 59.94%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education