FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

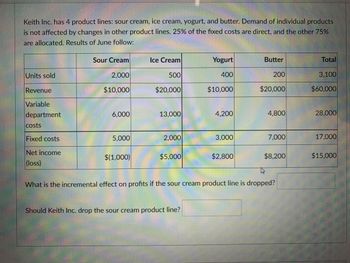

Transcribed Image Text:### Product Line Profitability Analysis for Keith Inc.

Keith Inc. manages four product lines: sour cream, ice cream, yogurt, and butter. Each product line has its own market demand that is independent of the others. The fixed costs of operating these product lines are partially direct (25%) and the majority are allocated (75%).

#### June Financial Results:

| | Sour Cream | Ice Cream | Yogurt | Butter | Total |

|----------------|------------|-----------|--------|--------|---------|

| Units Sold | 2,000 | 500 | 400 | 200 | 3,100 |

| Revenue | $10,000 | $20,000 | $10,000| $20,000| $60,000 |

| Variable Costs | $6,000 | $13,000 | $4,200 | $4,800 | $28,000 |

| Fixed Costs | $5,000 | $2,000 | $3,000 | $7,000 | $17,000 |

| Net Income (Loss) | ($1,000)| $5,000 | $2,800 | $8,200 | $15,000 |

#### Analysis Questions:

1. **Incremental Effect on Profits**:

- Determine how dropping the sour cream product line impacts overall profitability.

2. **Decision on Sour Cream Product Line**:

- Evaluate whether Keith Inc. should discontinue the sour cream product line based on its profitability and potential impact on total company performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 4. There is a monopolist in a market for a particular type of consumer goods. It is costly to create new types of products (brands) in this market, but consumers have different taste and thus some will prefer the new brand. Will the monopolist create too few brands or too many? Explain.arrow_forward“Since break even analysis focuses on making Zero profit, it is of no value in determining the units a company must sell to earn a targeted profit”, Do you agree or disagree with this statement? Why or why not?arrow_forwardCorning’s market value was below its book value because it was facing pricing pressure in the market, which reduced its ROIC. What are some ways to tell if pricing pressure is temporary – and if a company should wait it out – or permanent, and the company should consider shutting down?arrow_forward

- A company's break-even point will not be changed by: a change in the selling price per unit. a change in the income tax rate. a change in the variable cost per unit. a change in total fixed costs.arrow_forward1. Signs of job burnout include: A. Listening to workplace gossip B. Being a perfectionist a work C. Continual complaining D. Coming to work early 2. A ________ is one or more people assigned to reaching a goal. A. Team B. Department C. Group D. Company 3. An event that would affect employees in the "safety" level of Maslow's hierarchy includes: A. A cancelled vacation B. Recent layoffs C. A cancelled company picnic D. A salary freezearrow_forwardPlease don't give image formatarrow_forward

- What are some advantages of invetsting in industy competitors? ie., You own stock in Walgreens and you also choose to invest in a competitor such as CVS How would investing in an industry's competitor help ensure a satisfactory return even if the original company's value depreciates?arrow_forwardSince break-even analysis focuses on making zero profit, it is of no value in determining the units a firm must sell to earn a targeted profit. Do you agree or disagree with this statement? why?arrow_forwardPart 1: Use the Value per Products Description bar chart.1. Which product has the highest profit value?2. What is the profit value for the product with the highest profit value?3. Do any of the products have a negative profit value (the company is losing money on them)?4. If there are products with a negative profit value, which products are those?5. Do you think the company should keep selling the “Shirt Girls (pink)” product? Why or whynot?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education