FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

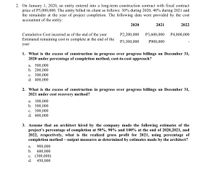

Transcribed Image Text:2. On January 1, 2020, an entity entered into a long-term construction contract with fixed contract

price of P5,000,000. The entity billed its client as follows: 30% during 2020, 40% during 2021 and

the remainder at the year of project completion. The following data were provided by the cost

accountant of the entity:

2020

2021

2022

Cumulative Cost incurred as of the end of the year

P2,200,000

P3,600,000

P4,800,000

Estimated remaining cost to complete at the end of the

P3,300,000

P900,000

year

1. What is the excess of construction in progress over progress billings on December 31,

2020 under percentage of completion method, cost-to-cost approach?

a. 500,000

b. 200,000

c. 300,000

d. 400,000

2. What is the excess of construction in progress over progress billings on December 31,

2021 under cost recovery method?

a. 100,000

b. 500,000

c. 300,000

d. 400,000

3. Assume that an architect hired by the company made the following estimates of the

project's percentage of completion at 50%, 90% and 100% at the end of 2020,2021, and

2022, respectively, what is the realized gross profit for 2021, using percentage of

completion method – output measures as determined by estimates made by the architect?

900,000

600,000

c. (300,000)

d.

а.

b.

450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q2. A 20 month, Rs 30 million project started on 1st June 2019. today is 1 st march 2020. According to the PMB, Rs 8 million worth of work should have been completed by today. A critical path activity 'X' was schedule to complete on 1st April; however, it has completed today. With the completion of activity 'X', Rs 10 million worth of work has been completed and Rs 12 million expended. Find the SV, CV%, EAC and VAC.arrow_forwardAsset End of year Amount Appropriate Required Return A 1 $5,000 18% 2 $5,000 3 $5,000 Cash Flow Using cell references to the given datea and the PV function, calculate the value of asset A.arrow_forwardConsider the return of investment as given in the following table: Year 2016 2017 2018 2019 2020 Amount (RM) 5000 5175 5394.94 5705.15 6047.46arrow_forward

- Cash Flow Asset End of year Amount Appropirate Requried Retrun A 1 $5,000 18% 2 $5,000 3 $5,000 Using cell references to the given datea and the PV function, calculate the value of asset A.arrow_forwardWhat's the forecasted capital expenditure based on the information below? -Net PP&E beginning of period = 4200-Net PP&E end of period = 6800-Depreciation expenses = 900 a. 5900b. 1700c. 3500d. 2600arrow_forwardSubject: acountingarrow_forward

- Cash Payback Period A project has estimated annual net cash flows of $49,500. It is estimated to cost $198,000. Determine the cash payback period. If required, round your answer to one decimal place. ? Yearsarrow_forwardPeriod A B D -3500 -3000 1500 1800 2100 -3000 -3600 3000 1800 1800 1800 2 2000 1=13% 5500 1000 Which among the four projects has an annual equivalent worth of around P570k?arrow_forwardManjiarrow_forward

- The following table tracks the main components of working capital over the life of a four-year project. 2021 2022 2023 2024 2025 Accounts receivable 0 174,000 249,000 214,000 0 Inventory 87,000 142,000 142,000 107,000 0 Accounts payable 31,000 56,000 62,000 41,000 0 Calculate net working capital and the cash inflows and outflows due to investment in working capital.arrow_forwardA8arrow_forwardCash Flow Asset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 By using cell references to the given datea and the function PV, Calculate the value of asset D.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education