FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Instructions

What is the

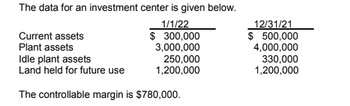

Transcribed Image Text:The data for an investment center is given below.

1/1/22

$ 300,000

3,000,000

Current assets

Plant assets

Idle plant assets

Land held for future use

The controllable margin is $780,000.

250,000

1,200,000

12/31/21

$ 500,000

4,000,000

330,000

1,200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the two mutually exclusive investment projects given in the table below for which MARR = 9%. On the basis of the IRR criterion, which project would be selected under an infinite planning horizon with project repeatability likely? ●● Screen Shot 2017-04-20 at 3.22.38 PM ✓ Click the icon to view the cash flows for the investment projects. The rate of return on the incremental investment is %. (Round to one decimal place.) View Zoom Share n 0 1 2 3 IRR Highlight Rotate Markup. Net Cash Flow Project A - $5,000 3,000 4,000 4,000 49.39% Project B - $10,500 9,500 9,500 50.57% Q Search Searcharrow_forwardPatricia Gomez owns a company called Ceram-Lite which manufactures ceramic kitchenware. Over the past 10 years, Ceram-Lite has enjoyed steady growth. However, recently, there has been increased competition in kitchenware as a result of successful TV shows like Celebrity Chef. Gomez, Ceram-Lite's CEO, believes an aggressive strategy will be needed to meet the company's goals. You have been provided with the following information for the current year (2022) for Ceram- Lite's flagship Dutch Oven dish, which Gomez has indicated will be the focus product for the upcoming holiday season: Variable Costs (per dutch oven) Direct Materials Direct Manufacturing Labour Variable Overhead (manufacturing, marketing, distribution, and customer service) Total Variable cost per dutch oven Fixed Costs Selling Price Expected Sales Income tax rate Manufacturing Marketing, distribution, and customer service Total Fixed Costs 50,000 units 555 $ $ $ 18 30 28 76 $ 18,000 $ 155,760 $ 173,760 $ 88 $4,399,500 38%arrow_forwardQuestion 6 Which one of the following methods predicts the amount by which the value of a firm will change if a project is accepted? O Payback O Profitability index O Net present value O Internal rate of return O Discounted paybackarrow_forward

- All answers are correct except: At what amount will Fuzzy Monkey report its investment in the December 31, 2024 balance sheet?arrow_forwardUsing the findings, provide a brief summary about the financial status of each of the companies and provide a recommendation for the investment choice.arrow_forwardHow to calculate annual sustainable growth rate for the years 2009 through 2013.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education