Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

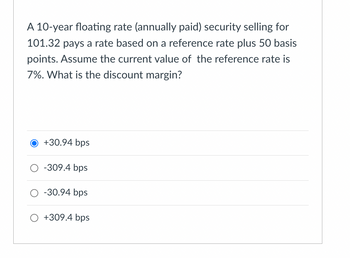

Transcribed Image Text:A 10-year floating rate (annually paid) security selling for

101.32 pays a rate based on a reference rate plus 50 basis

points. Assume the current value of the reference rate is

7%. What is the discount margin?

O +30.94 bps

O -309.4 bps

O -30.94 bps

O +309.4 bps

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- __________ is the interest rate that makes NPV equal to zero when it is used as the discount rate.arrow_forwardSuppose the demand functions for two products are q1 = f(p1, p2) and q2 = g(p1, p2) wherep1, p2, q1, and q2 are the prices (in dollars) and quantities for products 1 and 2. Consider thefour partial derivatives∂q1/∂p1,∂q1/∂p2,∂q2/∂p1and ∂q2/∂p2,State the sign of each of these partial derivatives if:(a) the products are complementary goods(b) the products are substitute goods.arrow_forwardHow do you find the maximum profit and loss percentage using these graphs? Long put Payoff Profe Kluss X short put Past/101/ pay off Xarrow_forward

- #7 For context NPV is net present value, IRR is internal rate of return, and ARR is accounting rate of return 3 c Known Amt. ? ? Known Amt. ? Known Amounts What is this chart? What is this chart? What is this chart? What is this chart? ? Known Amounts Describe Compound Interest. What do we mean when we say "discounting"? What are the reasons for using the PVA table? How do NPV and IRR differ from Payback Period and ARR?arrow_forwardFind the APR using the formula APR= 2nr/n+1 when n= 38 and r= 8%arrow_forwardcoefficient variation=.55 positive coeficient of correlation =.20 expected value=$1200 What does standard deviation equal?arrow_forward

- Why will the fixed-charge-coverage ratio always be equal to or less than times interest earned?arrow_forwardC) the internal rate of return is between what two whole discount rates (e.g, between 10%, and 11%, between 11% and 12% between 12% and 13% between 13%and 14% etc)? Can you help me solve this question with the table provided in excel?arrow_forwardHow were you able to find a D/V of 9.7% and D/V of 20%?arrow_forward

- 11-8 The reward-to-risk ratio is also sometimes called the Select one: a. Sharpe ratio. b. risk premium. c. coefficient of variation. d. Treynor index. e. Gordon ratio.arrow_forwardThere is one period. Assume a representative agent with utility function U(ct) = αc_t − βc^2_tassume the following: α = 100, β = 1, and δ = 0.97. Consumption at t = 0 is C0 = 24. At t = 1 one of two states θ1 and θ2 eventuate with probability π1 = 0.5, and π2 = 0.5,respectively. There are two complex securities s^1 and s^2.s^1 has a payoff of 23 in θ1 and 27 in θ2.s^2 has a payoff of 20 in θ1 and 32 in θ2.What is the stochastic discount factor mt+1? hint: Recall mt+1 =δU′(ct+1)/U′(ct)arrow_forwardWhat is the reason P/E Ratio become lower and higher?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education