Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

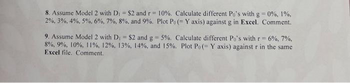

Transcribed Image Text:8. Assume Model 2 with D₁ = $2 and r= 10%. Calculate different Po's with g = 0%, 1%,

2%, 3%, 4%, 5%, 6%, 7%, 8%, and 9%. Plot Po (= Y axis) against g in Excel. Comment.

6%, 7%,

9. Assume Model 2 with D₁ = $2 and g = 5%. Calculate different Po's with r =

8%, 9%, 10%, 11%, 12%, 13%, 14%, and 15%. Plot Po(= Y axis) against r in the same

Excel file. Comment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Let X be a random variable such that E[X] = μ, V[X] =σ², max[X] = My min(X) = m with 0 Not egual to m < M and consider its normalization: E[Y] =μ M-m Determine whether the following statements are true or false. Perform the corresponding calculations. E[Y] μ V[Y] = M-m 2 σ M-marrow_forwardConsider the generalised linear regression model: y = Xẞ + e, with E[e] = 0 and E[ee] = 022. Let the model be estimated using both OLS and GLS, and let the OLS estimator of ẞ be denoted as BOLS and its GLS estimator as BGLS. Which of the following statements are incorrect about the OLS and GLS estimators? (a) BOLS is BLUE (b) BGLS is BLUE (c) The variance of BOLS cannot be less than that of BGLS (d) BGLS is more efficient that BOLSarrow_forwardNo chatgpt used i will give 5 upvotes typing please i need both answersarrow_forward

- I need typing clear urjent no chatgpt use i will give 5 upvotesarrow_forwardFind the optimal solution for the following problem. Note: Round your answers to 3 decimal places. Maximize C = 13x + 9y subject to and 6x + 11y ≤ 18 16x + 21y ≤ 41 x ≥ 0, y ≥ 0. a. What is the optimal value of x? X b. What is the optimal value of y? c. What is the maximum value of the objective function?arrow_forwardOn the Apple tab, the slope and beta are the same value. True Falsearrow_forward

- Find the numerical value of factor (F/A,19%,20) using: a) the interpolation. b) the formula.arrow_forwardb. Convert the Data available into a Table and choose a Design of your choice.c. Obtain the Mean, Median, Standard Deviation, Variance, Quartiles (Q1, Q2, Q3, Q4), IQRfor the entire data (1895-1998), using ONLY Excel Functions (not using the Analysis ToolPak Add-In)d. Use the Statistical measurements generated from the Analysis Toolpak (Add-In) andcompare the values obtained in (c). Comment on your findings.arrow_forwardThe correlation of two variables will be Group of answer choices a. Between -1 and +1, inclusive b. Between 0 and +2, inclusive c. Between 0 and +1, inclusive d. Between minus infinity and plus infinityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education