ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

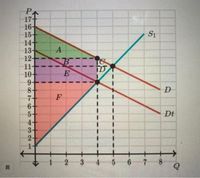

Transcribed Image Text:PA

17-

16-

15-

14-

13-

12-

S1

A

11

10+

9-

8+

7-

6-

5

4-

Dt

5 6 7 8

321

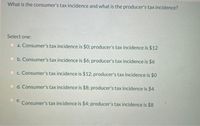

Transcribed Image Text:What is the consumer's tax incidence and what is the producer's tax incidence?

Select one:

O a. Consumer's tax incidence is $0; producer's tax incidence is $12

b. Consumer's tax incidence is $6; producer's tax incidence is $6

c. Consumer's tax incidence is $12; producer's tax incidence is $0

d. Consumer's tax incidence is $8; producer's tax incidence is $4

Consumer's tax incidence is $4; producer's tax incidence is $8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The table shows the market for chocolate bars. A tax of $0.30 per chocolate bar is imposed on sellers. What is the new price that buyers pay sellers for a chocolate bar? Price (dollars per chocolate bar) Quantity demanded Quantity sup (thousands per day) 55 45 35 22225 25 30 35 22334 2.00 2.10 2.20 2.30 40 2.40 15 45 Following the tax, buyers pay sellers $ per chocolate bar.arrow_forward6 . Consumer Surplus Ana buys an iPhone for $150 and gets a consumer surplus of $200. Her willingness to pay for an iPhone is $_________. If she had bought the iPhone on sale for $100, her consumer surplus would have been $_______. If the price of the iPhone had been $370, her consumer surplus would have been $_________.arrow_forwardWhich of the following will most likely lead to the smallest deadweight loss (all else equal)? Select one: A. A payroll tax of $10 B. A mandated benefit that costs $15 and employees value at $4 C. A payroll tax of $7 D. A subsidy of $13 E. A mandated benefit that costs $9 and employees value at $3 O O O Oarrow_forward

- A D A 3 Price (dollars per pizza) $406 30 20 0 Figure 4.4.3 50 P HE Reset Selection 100 Refer to Figure 4.4.3 above. When the price of pizza is $30, total expenditure and consumer surplus are, respectively: OA. $1500; $500. 4 OB. $1000; $1000. OC. $1500; $250. D. $1000; $500. D B DI Quantity of pizzas per week 22:01 2020/11/24arrow_forwardO Macmillan Learning Suppose that Michelle buys a cappuccino from Paul's Cafe and Bakery for $4.25. Michelle was willing to pay up to $7.25 for the cappuccino, and Paul's Cafe and Bakery was willing to accept $1.75 for the cappuccino. Based on this information, answer the following questions. Michelle's consumer surplus: $ Paul's Cafe and Bakery's producer surplus: $arrow_forwardmacro question 6arrow_forward

- When a tax is levied on a good, what happens to the market price and why? Select one: O a The market price rises because both quantity demanded and quantity cross out supplied falls. O b. The market price falls because quantity supplied falls. cross out O. The market price falls because quantity demanded falls. cross out O d. The market price rises because both quantity demanded and quantity cross out supplied rises.arrow_forward1. Suppose income-tax rates are lowered and as a result consumers experience an increase in income earned from working. Basic microeconomics predicts that, Demand for normal goods will fall. Demand for inferior goods will rise. Demand for normal goods will rise. Income changes do not change demand.arrow_forward6. Consumer Surplus Cho buys an iPhone for $240 and gets a consumer surplus of $160. Her willingness to pay for an iPhone is If she had bought the iPhone on sale for $180, her consumer surplus would have been If the price of the iPhone had been $420, her consumer surplus would have been Sarrow_forward

- 7. Consumer surplus for an individual and a market The following graph shows Shen's weekly demand for apple pie, represented by the blue line. Point A represents a point along his weekly demand. The market price of apple pie is $3.00 per slice, as shown by the horizontal black line. PRICE (Dollars per slice) PRICE (Dollars per slice) 7.50 0.75 6.00 4.50 3.75 7.50 3.00 6.75 2.25 6.00 1.50 5.25 Demand 0.75 4.50 0 3.75 3.00 2.25 1.50 0.75 0 From the previous graph, you can tell that Shen is willing to pay S for his 8th slice of apple pie each week. Since he has to pay only $3.00 per slice, the consumer surplus he gains from the 8th slice of apple pie is S 5.25 Demand Suppose the price of apple pie were to fall to $2.25 per slice. At this lower price, Shen would receive a consumer surplus of S slice of apple pie he buys. The following graph shows the weekly market demand for apple pie in a small economy. 0 Price Use the purple point (diamond symbol) to shade the area representing consumer…arrow_forward9. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes when the tax on sellers is set at $0 per pair. Suppose the government institutes a tax of $23.20 per pair, to be paid by the seller. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. Hint: To see the impact of the tax, first enter the value of the tax in the Tax on Sellers field. Adjust the value in the price field to move the green line to the after-tax equilibrium so that quantity demanded equals quantity supplied. Graph Input Tool Market for Shoes 200 180 I Price (Dollars per pair) $100 160 Quantity Demanded (Pairs of shoes) Quantity Supplied (Pairs of shoes) Supply 250.00 250.00 140 120 100 Supply Shifter 80 Demand Tax on Sellers (Dollars per pair) 60 0.00 40 20 50 100 150 200 250…arrow_forward6. Consumer Surplus Valerie buys an iPhone for $240 and gets a consumer surplus of $160. Her willingness to pay for an iPhone is $ If she had bought the iPhone on sale for $180, her consumer surplus would have been $ If the price of the iPhone had been $450, her consumer surplus would have been $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education