ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

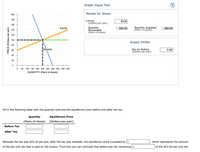

Transcribed Image Text:Graph Input Tool

Market for Shoes

200

180

I Price

(Dollars per pair)

$100

160

Quantity

Demanded

(Pairs of shoes)

Quantity Supplied

(Pairs of shoes)

Supply

250.00

250.00

140

120

100

Supply Shifter

80

bemand

Tax on Sellers

(Dollars per pair)

60

0.00

40

20

50

100 150 200 250 300 350 400 450 500

QUANTITY (Pairs of shoes)

Fill in the following table with the quantity sold and the equilibrium price before and after the tax.

Quantity

Equilibrium Price

(Pairs of shoes)

(Dollars per pair)

Before Tax

After Tax

Although the tax was $23.20 per pair, after the tax was imposed, the equilibrium price increased by $

which represents the amount

of the per-unit tax that is paid by the buyers. From this you can conclude that sellers pay the remaining $

of the $23.20-per-unit tax.

PRICE (Dollars per pair)

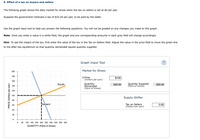

Transcribed Image Text:9. Effect of a tax on buyers and sellers

The following graph shows the daily market for shoes when the tax on sellers is set at $0 per pair.

Suppose the government institutes a tax of $23.20 per pair, to be paid by the seller.

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

Hint: To see the impact of the tax, first enter the value of the tax in the Tax on Sellers field. Adjust the value in the price field to move the green line

to the after-tax equilibrium so that quantity demanded equals quantity supplied.

Graph Input Tool

Market for Shoes

200

180

I Price

(Dollars per pair)

$100

160

Quantity

Demanded

(Pairs of shoes)

Quantity Supplied

(Pairs of shoes)

Supply

250.00

250.00

140

120

100

Supply Shifter

80

Demand

Tax on Sellers

(Dollars per pair)

60

0.00

40

20

50

100 150 200 250 300 350 400 450 500

QUANTITY (Pairs of shoes)

PRICE (Dollars per pair)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4-5 Draw the price effect and the quantity effect for a price change from $60 to $70. Which effect is larger? Does total revenue increase or decrease? No calculation is necessary.arrow_forwardPrice Supply $4 M 3 2 Demand 40 50 60 Quantity If the price starts out at $4, what will surely happen over time? a) The quantity supplied will fall, quantity demanded will rise and quantity sold will fall. b) The quantity supplied will fall, quantity demanded will rise and quantity sold will rise. c) The quantity supplied will fall, quantity demanded will fall and quantity sold will rise. d) The quantity supplied will rise, quantity demanded will fall and quantity sold will rise.arrow_forwardUSD.13 An increase in a price ceiling will change the amount of a good sold in a market: Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a if the price ceiling is effective. b regardless of whether or not the ceiling is effective. c if the price ceiling is ineffective. d if demand is inelastic.arrow_forward

- Price Quantity demanded Quantity supplied 3 150 60 4 100 100 5 70 130 6 50 150 please answer questions below: If the price of chocolate is $5, describe the situation in the market and explain how the price adjust. Chocolate sellers know that Valentine’s Day is next weekend, and they expect the price to be higher, so they withhold 60 chocolates from the market this weekend. What will be the price this weekend?arrow_forwardPlease helparrow_forwarddo fastarrow_forward

- Please no written by hand and no emage Refer to Table 3.1 (attached). If the price per pizza is $15, there is a(n) Urban Economics Table 3.1-1.jpg Download Urban Economics Table 3.1-1.jpg Group of answer choices market equilibrium excess demand of 900 units excess demand of 400 units an excess supply of 600arrow_forwardPure Chase Rice Concert Tickets Price $25.00 20.00 15.00 10.00 200 400 500 600 700 Refer to Figure: Chase Rice Concert Tickets. If the price is $10 Othere is a shortage of 200 tickets. there is a shortage of 300 tickets. O there is a surplus of 200 tickets. O there is a surplus of 300 tickets. there is a shortage of 600 tickets. 800 D Quantityarrow_forwardTable 18.1 Price ($) Quantity Demanded Quantity Supplied 300 60 30 400 55 40 500 50 50 600 45 60 700 40 70 800 35 80 .In response, to lobbying by the skate board association, the government places a price floor at the price of $700 on skate boards. What will this have on the market for skate boards? Explain your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education