FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:what is stockholders equity x b My Questions I bartleby

M nbox (1.661)

oard

Learn

l.com/webapps/ubsh-lti-integration-BBLEARN/app/content/launchHandler?course id-_132178 18lcontent

pus

Powered by Bb

eCampus

ePortfolios Community Content Collection

ents

> HW Assignment 3

E Menu

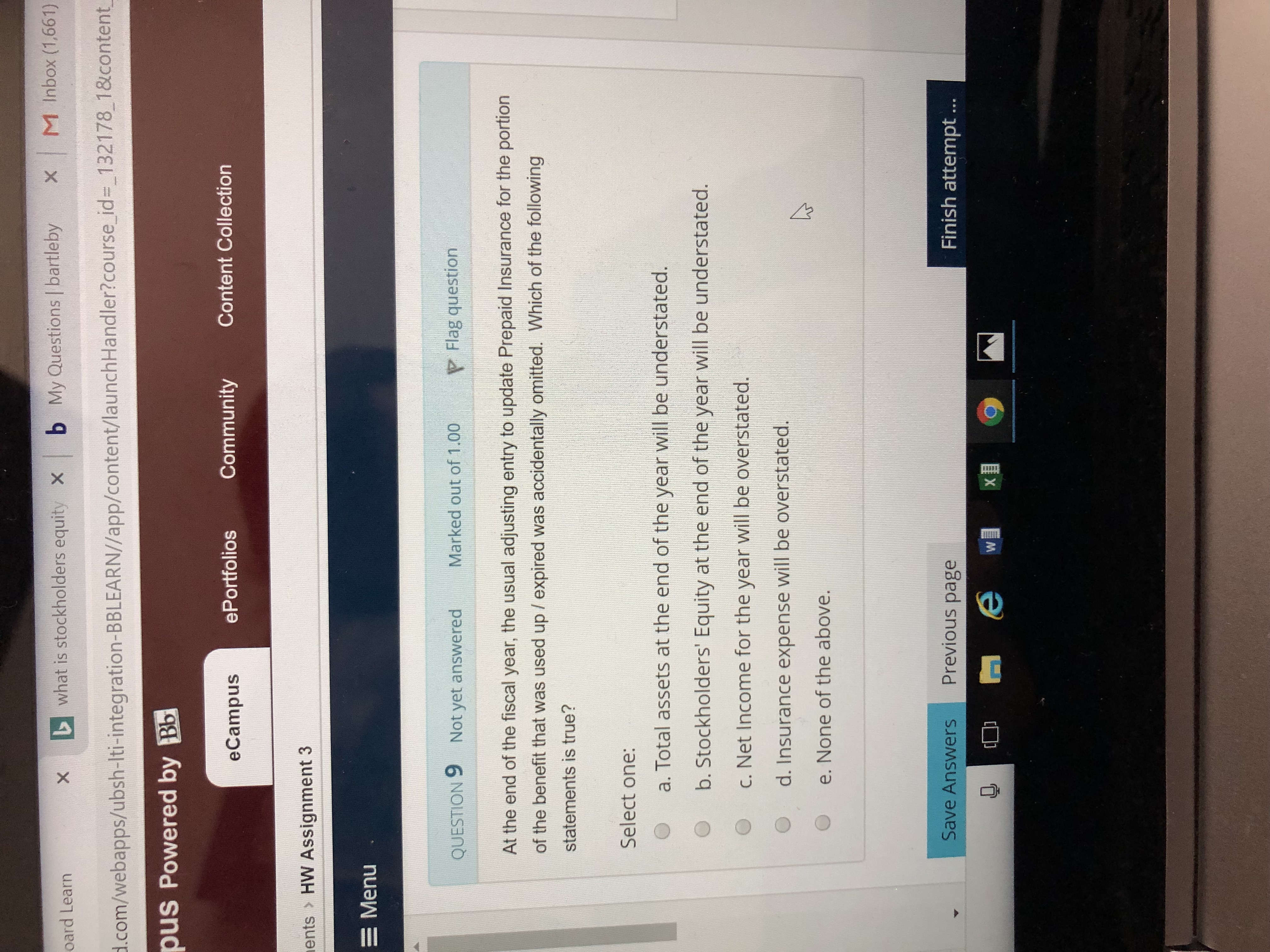

QUESTION 9

Not yet answered

Marked out of 1.00

P Flag question

At the end of the fiscal year, the usual adjusting entry to update Prepaid Insurance for the portion

of the benefit that was used up / expired was accidentally omitted. Which of the following

statements is true?

Select one:

O

a. Total assets at the end of the year will be understated.

b. Stockholders' Equity at the end of the year will be understated.

O C. Net Income for the year will be overstated.

O d. Insurance expense will be overstated.

O e. None of the above.

Save Answers

Previous page

Finish attempt.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- rome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forwardestkentucky.kctcs.edu - Yahc X ube Maps Maps News News Translate M SmartBook 2.0 M SmartBook 2.0 ter 10 Homework i Book Hint Gradebook / ACC 202: Manage X M Question 6 - Chapter 10 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Ask 5 Surf Company can sell all of the two surfboard models it produces, but it has only 476 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $276 for Glide and $452 for Ultra. Print erences W 1 Q (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Required A Complete this question by entering your answers in the tabs below. MyPath - Home Compute the contribution margin per direct labor hour for each product. F1 Contribution margin per direct labor hour…arrow_forwardogle Sheets G american association of peop x w Chapter 5 Homework NWP Assessment Player UI A x - Wiley Course Resources A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=49c81008-809a-4bc8-914e-9ab92d5bfb7f#/question/0 W Desmos Google Keep O Dashboard e Welcome- Liferay 9 MLA Citation Gener ACC201-01 TWSU Wsu O YouTube Goldlink Music 101-06 er 5 Homework Question 1 of 8 > -/6 E View Policies Current Attempt in Progress Presented here are the components in Carla Vista Co's income statement. Determine the missing amounts. Sales Revenue Cost of Goods Sold Gross Profit Oper Year $76.020 2$ (b) $ 32,200 %24 Year $112,800 $70,200 2$ (c) 24 %24 2 Year (a) $74,460 $115,930 3 eTextbook and Media Assistance Used Save for Later Attempts: 0 of 3 used Submit Answer hp F2 F3- F4 F5 F6 4) F7 FA F9 F10 F11 F12 Print Screen Pause Break %23 & 2. 5arrow_forward

- View History Bookmarks Profiles Tab Window Help ZOOM G Netflix waa - help with F WiConnect - Home Content X M Question 8- Chapter 12 & 13 X _mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducati... 3 Assignment Saved Rodriguez Corporation issues 19,000 shares of its common stock for $98,400 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The stock has a $4 par value. 2. The stock has neither par nor stated value. 3. The stock has a $2 stated value. Graw View transaction list View journal entry worksheet No A Transaction General Journal Debit Credit 1 Cash Common stock dividend distributable 2 ? 2 11 -> C 4 G Search or type URL % 5 tv 7 9arrow_forwardestions - Blackboa x NWP Assessment Player UI App x A education.wiley.com/was/ui/v2/assessment-player/index.html?launchid 5750652f-a595-413e-b7d3-15080082c239/question/22 ter 6 Questions 0/1 E Question 23 of 25 You have the following information for Sheridan Inc. for the month ended June 30, 2022. Sheridan uses a periodic inventory system. Unit Cost or Date Description Quantity Selling Price June Beginning inventory 40 $34 June 4. Purchase 135 37 June 10 Sale 110 64 June 11 Sale return 15 64 June 18 Purchase 55 40 June 18 Purchase return 10 40 June 25 Sale 65 70 June 28 Purchase 35 44arrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forward

- WP BAB140 Lab#2 Ch3 W2022 NWP Assessment Player UI Appli x A Player O New Tab G Taccounts. - Google Search + A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=59c96111-f5ca-414f-9f35-58b827278d0d#/question/1 E Apps W MarketWatch: Stock.. e Business News Market News | Seek... O FINVIZ.com - Stock.. 7 CVNA 228.28 A +1. S Stocktwits - The lar. EE Google Translate E Earnings and Econo. AV Short Interest Stock. * U.S. News | Reuters WSJ market volume E Reading list >> BAB140 Lab#2 Ch3 W2022 Question 2 of 4 > 0/ 2.5 Accounts Payable Aug. 5 (c) 18 3,600 Aug. 29 5,900 Aug.31 1,700 Sept. 12 7,200 Sept. 23 5,800 Sept.30 (d) Sales Aug. 10 50,000 Aug. 12 500 15 44,000 Aug. 31 (e) Sept. 12 (f) Sept. 25 400 Sept. 30 98,100arrow_forwardf Qwileyplus log in - Search X w NWP Assessment Player Ul App X + https://education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=158b0479-2179-4251-b96d-ee6bbf0aa5fe#/question/7 13°C Partly sunny X w Chapter 15 Quiz Question 8 of 15 Current Attempt in Progress Crane Company has completed all of its operating budgets. The sales budget for the year shows 52,000 units and total sales of $2,340,000. The total unit cost of producing one unit is $20. Selling and administrative expenses are expected to be $312,000. Interest is estimated to be $10,400. Income taxes are estimated to be $208,000. Prepare a budgeted multiple-step income statement for the year ending December 31, 2022. CRANE COMPANY Budgeted Income Statement HH Search ENG US 4x D વા મી ક + 203 10:10 AM 2022-11-06 Ⓒarrow_forwardCompute the total equity to shown in the 2021 Statement of Changes in Equity and subsequently carried forward to the Statement of Financial Positionarrow_forward

- U Portal Assignments: Corp Fin Reprtnx OQuestlon 21 - E&P Set #4 (Lea X (no subject)- ellse.patipewe@ x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser3D0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... 4 (Leases) 6 Saved Help Save & Exit Submit Check my work Exercise 15-3 (Static) Finance lease; lessee; balance sheet and income statement effects [L015-2] On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 10%, the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the equipment is $3 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use…arrow_forwardEdit View History Bookmarks Profiles Tab Window Help t Fridays - Become a w x sp MyPath - Home Gradebook / ACC 202: Manage X M Question 7 - Chapter 11 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Maps News Translate M SmartBook 2.0 M SmartBook 2.0 Homework i t Perez Company is considering an investment of $28,245 that provides net cash flows of $9,300 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A What is the internal rate of return of this investment? Present value factor Internal rate of return FI Required B @ 2 F2 # 3 APR…arrow_forwardFile Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education