FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:II

%24

%24

<>

P Assessment Builder UI App X

WP NWP Assessment Player UI Appli x

A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=Dee163b88-e027-44f4-a52e-6d3f9baff01e#/question/2

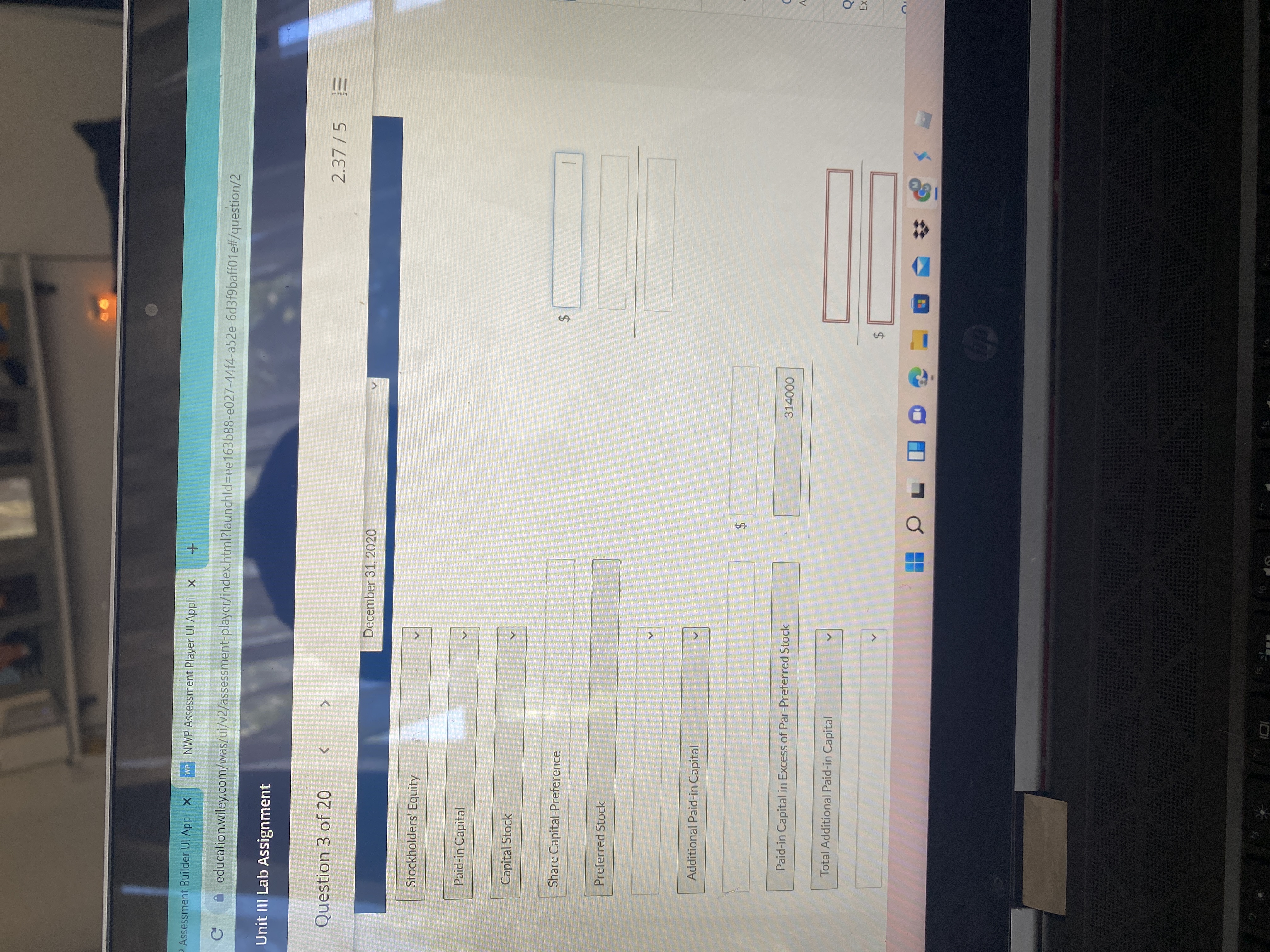

Unit III Lab Assignment

Question 3 of 20

2.37 /5

December 31, 2020

Stockholders' Equity

Paid-in Capital

Capital Stock

Share Capital-Preference

Preferred Stock

Additional Paid-in Capital

Paid-in Capital in Excess of Par-Preferred Stock

314000

A

Total Additional Paid-in Capital

24

8,

Transcribed Image Text:ment Builder UI Appl X

WP NWP Assessment Player UI Appli X

education.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dee163b88-e027-44f4-a52e-6d3f9baff01e#/questi

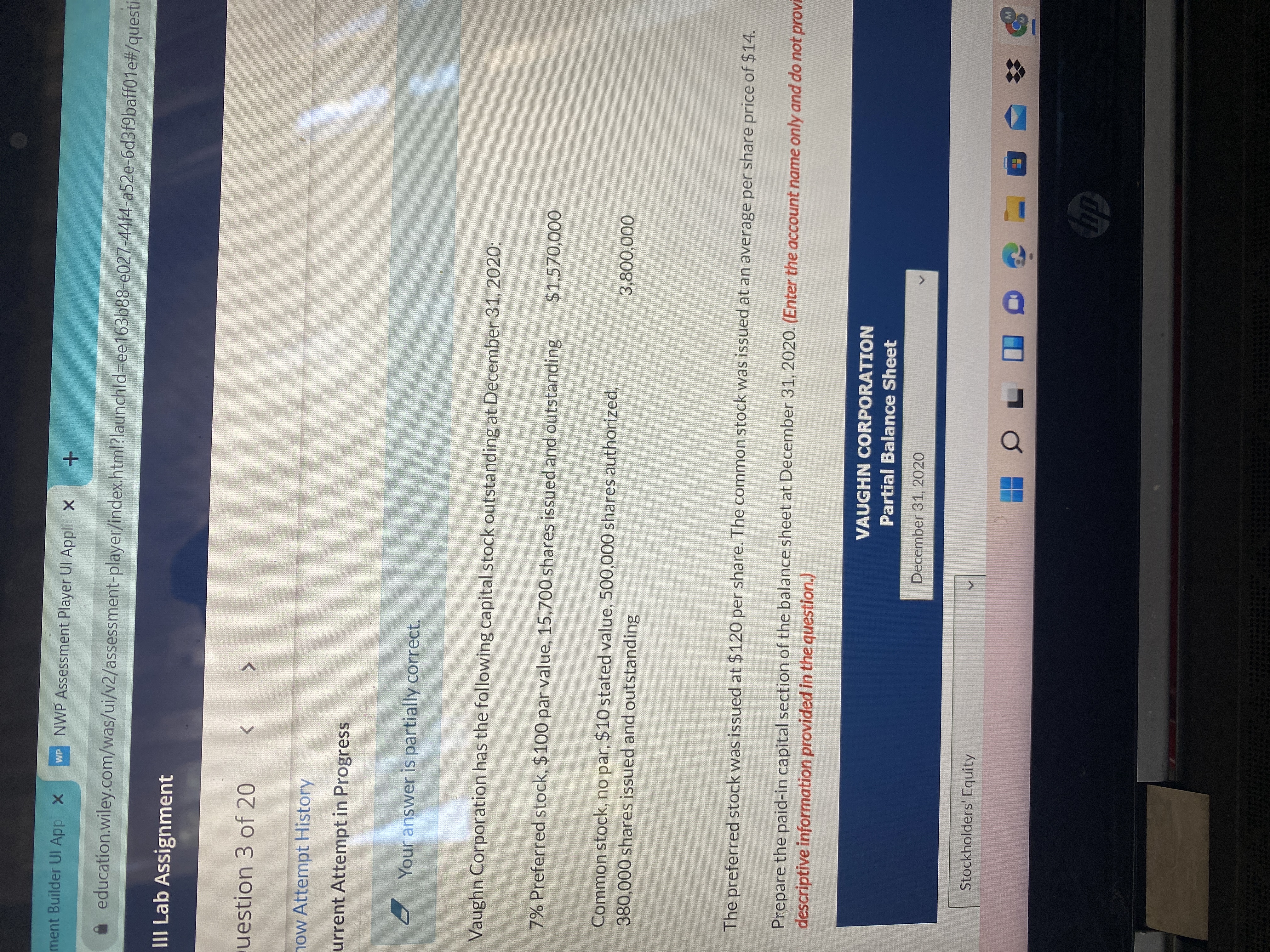

III Lab Assignment

uestion 3 of 20

now Attempt History

urrent Attempt in Progress

Your answer is partially correct.

Vaughn Corporation has the following capital stock outstanding at December 31, 2020:

7% Preferred stock, $100 par value, 15,700 shares issued and outstanding

000'

Common stock, no par, $10 stated value, 500,000 shares authorized,

380,000 shares issued and outstanding

000'008

The preferred stock was issued at $120 per share. The common stock was issued at an average per share price of $14.

Prepare the paid-in capital section of the balance sheet at December 31, 2020. (Enter the account name only and do not provi

descriptive information provided in the question.)

VAUGHN CORPORATION

Partial Balance Sheet

December 31, 2020

Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Google Calendar - Tuesday, April X M ACC-650 TOPIC 5 Assignment X WP Question 9 of 11 - ACC-650 TOP X ui/v2/assessment-player/index.html?launchld=78f9d393-a0ac-40c8-aeb3-468fb86f3881#/question/8 : BILL'S APPTS ELSA'S APPTS AMBER'S APPT'S : LENTON'S APPT'S : CHUCK'S APPT'S : GABBY'S APPT'S MAKE PAYMENTS ShareFile Question 9 of 11 × Your answer is incorrect. 3.75/9 : Return to the original data. Monk Builders has just signed a contract with the state government to replace the windows in low- income housing units throughout the state. Monk needs 80,000 windows to complete the job and has offered to buy them from Wilson at a price of $120.00 per window. Monk will pick up the windows at Wilson's plant, so Wilson will not incur the $2 per window shipping charge. In addition, Wilson will not need to pay a distributor's commission, since the windows will not be sold through a distributor. Calculate the contribution from special order, contribution lost from regular sales and the net…arrow_forward1th ed X V VitalSource: Thank You for Your X VitalSource Bookshelf: Intermedi. X Exercises elf.vitalsource.com/reader/books/9781264387403/epubcfi/6/32[%3Bvnd.vst.idref%3Dchapter01]!/4/2/80/36/70/2/1:13[ci Me Graw HI New Tab connect Cash flows during the first year of operations for the Harman-Kardon Consulting Company were as follows: Cash collected from customers, $340,000; Cash paid for rent, $40,000; Cash paid to employees for services rendered during the year, $120,000; Cash paid for utilities, $50,000. In addition, you determine that customers owed the company $60,000 at the end of the year, and no bad debts were anticipated. Also, the company owed the gas and electric company $2,000 at year-end, and the rent payment was for a two-year period. Calculate accrual net income for the year. Jul 17, 2023, 10:38 PMarrow_forwardestions - Blackboa x NWP Assessment Player UI App x A education.wiley.com/was/ui/v2/assessment-player/index.html?launchid 5750652f-a595-413e-b7d3-15080082c239/question/22 ter 6 Questions 0/1 E Question 23 of 25 You have the following information for Sheridan Inc. for the month ended June 30, 2022. Sheridan uses a periodic inventory system. Unit Cost or Date Description Quantity Selling Price June Beginning inventory 40 $34 June 4. Purchase 135 37 June 10 Sale 110 64 June 11 Sale return 15 64 June 18 Purchase 55 40 June 18 Purchase return 10 40 June 25 Sale 65 70 June 28 Purchase 35 44arrow_forward

- P MindTap HW 1 - Spring 2021 - Fi X * MindTap - Cengage Learning b I tried to do the question myself, X 8 https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld=590512258542108435051542&elSBN=9780357114582&snapshotld=22.. Chelsea v CENGAGE MINDTAP Q Search this course A My Home HW 1 Courses eBook eBook Patterson Brothers recently reported an EBITDA of $12.5 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge O Catalog and Study Tools for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest dollar, if necessary. A-Z Partner Offers $ 3900000 x EE Rental Options dOffice Hide Feedback College Success Tips Incorrect Career Success Tips Post Submission Feedback Solution EBITDA $12,500,000 (Given) You are eligible for a FREE 7- day trial of Cengage Unlimited or…arrow_forwardChapter 6 Homework ctors CPO bofa X - Chapter 6 Homework education.wiley.com/was/ui/v2/assessment-player/index.html?launchid=dfb96462-e0c8-4eb4-bc8f-5f439b0e2a06#/question/0 wiley connect NWP Assessment Player Ul Ap x workjam (ulta) school b bartleby Question 1 of 11 Average unit cost $ Calculate average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) eTextbook and Media List of Accounts + The cost of the ending inventory $ MYOCC In its first month of operations, Sheridan Company made three purchases of merchandise in the following sequence: (1) 500 units at $4, (2) 600 units at $5, and (3) 700 units at $7. eTextbook and Media List of Accounts zoom quizlet google docs google slides Compute the cost of the ending inventory under the average-cost method, assuming there are 400 units on hand at the end of the period. (Round answer to O decimal places, e.g. 125.) B instagram twitter -/1 = : F. ☐ Updat youtubearrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forward

- practicearrow_forwardnt Technical College X C 2 Unit 4 Exercises i ? 7 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q... 7.27 points 38°F Clear (8 eBook Print References Mc Graw Hill W S # Microsoft Office Home (a) Break-even point in units (b) Margin of safety E D CA Coors Company expects sales of $340,000 (4,000 units at $85 per unit). The company's total fixed costs are $175,000 and its variable costs are $35 per unit. Compute (a) break-even in units and (b) the margin of safety in dollars. R % 5 Question 7 - Unit 4 Exercises X T G Y 3.500 & K E11 3X3 WES prt sc Help T delete backspace Save & Exit ENG home enter Check my num lock 10/ enc 7 home Aarrow_forwardplem Set: Mod x * CengageNOW2| On x * Cengage Learning B Milestone Two Guidel x G module 5 problem se x+ ow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogres.. еBook Show Me How Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $44,000 in cash and giving a short-term note for $272,000. Legal fees paid were $1,780, delinquent taxes assumed were $14,700, and fees paid to remove an old building from the land were $21,700. Materials salvaged from the demolition of the building were sold for $4,700. A contractor was paid $960,600 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Next Previous 3:20 PM Check My Work 11/28/2021 56 Farrow_forward

- File Edit View History Bookmarks Tools Window Help Appendix 3B: Work Sheet as a TX nework Problems Chapter 3 i 7 59 ints eBook C Print n References Mc Graw Hill 1 08 F1 Question 7 Homework Problems CIX - On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252F April 2 Nozomi invested $36,000 cash and computer equipment worth $35,000 in the company in exchange for its common stock. 167 Computer Equipment 168 Accumulated Depreciation-Computer Equipment. 209 Salaries Payable 307 Common Stock 318 Retained Earnings 319 Dividends @ April 3 The company rented furnished office space by paying $2,200 cash for the first month's (April) rent. April 4 The company purchased $1,800 of office supplies for cash. 2 April 10 The company paid $2,880 cash for a 12-month insurance policy. Coverage begins on April 11.…arrow_forwardJ X ersity X Quiz List - Su22 RELS 308- X Question 24 - Chapter 6 Prc X * Course Hero ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewcom ge... W3Schools Online... Ally Auto Online Se... M Gmail Your report has bee... Best Buy Credit Car... i: Hono Saved oter 6 Problem Set 24 Problem 6-26 Calculating Annuity Present Values [LO1] Beginning three months from now, you want to be able to withdraw $2,400 each quarter from your bank account to cover college expenses over the next three years. If the account pays 46 percent interest per quarter, how much do you need to have in your. bank account today to meet your expense needs over the next three years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value 21 O P F8 F9 F10 5467 & 7 03:06:31 pped Book Hint rences re to search 2 F2 F3 3 WE S D F4 4 C O At FS R F % 5 V F6 T J G 6 F7 525 370 Y B H U N 00. 8 J ( 9 F11 K Marrow_forwardard Collaborate x G wileyplus - Google Sear x Ch10 Homework F21 O #SummerFridays At W x O NWP Assessment Play x A Player i education.wiley.com/was/ui/v2/assessment-player/index.html?launchld-22d696ac-86f1-41c7-99c8-d40d5ddc6467#/question/12 Ch10 Homework F21 - /1 三 Question 13 of 20 View Policies Current Attempt in Progress A factory machine was purchased for $380000 on January 1, 2021.It was estimated that it would have a $70000 salvage value at the end of its 5-year useful life. It was also estimated that the machine would be run 37000 hours in the 5 years. The company ran the machine for 3700 actual hours in 2021. If the company uses the units-of-activity method of depreciation, the amount of depreciation expense for 2021 would be O $70000. O $38000. O $31000. O $62000. eTextbook and Media Attempts: 0 of 2 used Submit Answer Save for Later & 3 4. 7 8 t d farrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education