FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:CengageNOWv2 | Online teaching and learning resource from Cengage Learning

agenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator3D&inprogress-false

eBook

E Calculator

E Print Item

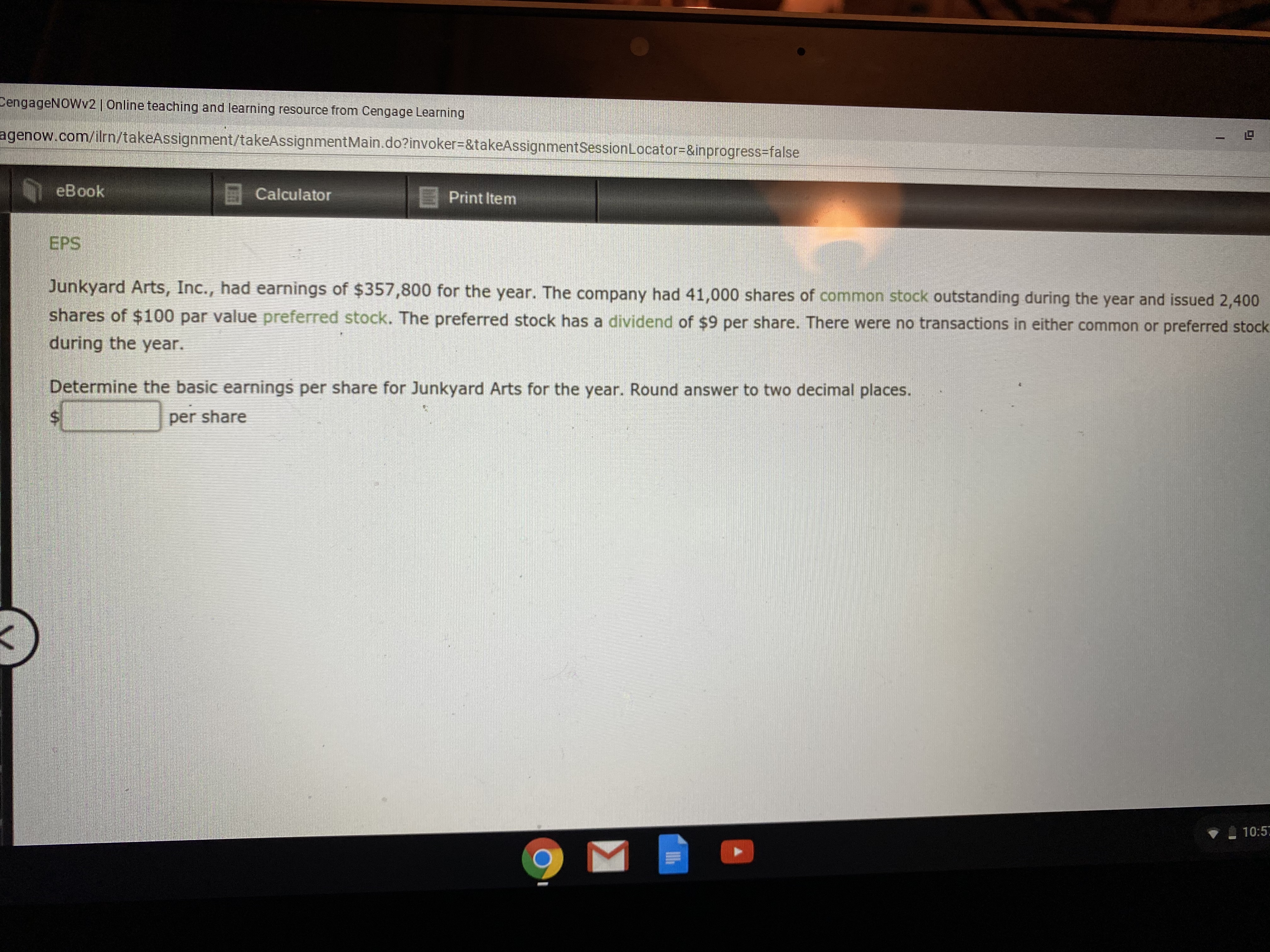

EPS

Junkyard Arts, Inc., had earnings of $357,800 for the year. The company had 41,000 shares of common stock outstanding during the year and issued 2,400

shares of $100 par value preferred stock. The preferred stock has a dividend of $9 per share. There were no transactions in either common or preferred stock

during the year.

Determine the basic earnings per share for Junkyard Arts for the year. Round answer to two decimal places.

per share

10:5

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Provide answerarrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) Paid-In Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (24,000 shares, at cost) The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 45,000 shares of common stock for $720,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 15,000…arrow_forwardgeneral journal entriesarrow_forward

- Do not give image formatarrow_forwardPlease do not give solution in image format thankuarrow_forwardEntries for Selected Corporate Transactions Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Morrow Enterprises Inc., with balances on January 1, 20Y5, are as follows: Common Stock, $10 stated value (800,000 shares authorized, 540,000 shares issued) $5,400,000 Paid-In Capital in Excess of Stated Value-Common Stock 1,050,000 Retained Earnings 12,260,000 Treasury Stock (54,000 shares, at cost) 756,000 The following selected transactions occurred during the year: Jan. 22. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $68,040. Apr. 10. Issued 105,000 shares of common stock for $1,890,000. June 6. Sold all of the treasury stock for $918,000. July 5. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. Aug. 15. Issued the certificates for the…arrow_forward

- TB MC Qu. 10-134 (Algo) Clothing Emporium was organized on January... Basu Emporium was organized on January 1, 2024. The firm was authorized to issue 140,000 shares of $8 par value common stock. During 2024, Basu Emporium had the following transactions relating to stockholders' equity: 1. Issued 42,000 shares of common stock at $10 per share 2. Issued 28,000 shares of common stock at $11 per share 3. Reported a net income of $140,000 4. Paid dividends of $70,000 What is total paid-in capital at the end of 2024? Multiple Choice $728,000 $658,000 $798,000 $868,000arrow_forwardPlease don't give image format and no chatgpt answerarrow_forwardpregunta anexa question in imagearrow_forward

- Entries for Selected Corporate Transactions Morrow Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Morrow Enterprises Inc., with balances on January 1, 2015, are as follows: Common Stock, $10 stated value (300,000 shares authorized, 200,000 shares issued) $2,000,000 Paid-In Capital in Excess of Stated Value- Common Stock 400,000 Retained Earnings 4,540,000 Treasury Stock (20,000 shares, at a cost of $14 per share ) 280,000 The following selected transactions occurred during the year: Jan. 22. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $25,200. Apr. 10. Issued 40,000 shares of common stock for $16 per share. June 6. Sold all of the treasury stock for $340,000. July 5. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. Aug. 15, Issued the certificates for the…arrow_forwardSubject: accountingarrow_forwardengageNOWv2 Online teaching and learning resource from Cengage Learning genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator%3D&inprogress3false Entries for issuing no-par stock Final Question Jounal Chart of Accounts Instructions Instructions On February 12, Quality Carpet Inc., a carpet wholesaler, issued for cash 730,000 shares of no-par common stock (with a stated value of $1.70) at $4.70, and on August X. 3, it issued for cash 24,700 shares of preferred stock, $45 par at $61. Required: A. Journalize the entries for February 12 and August 3, assuming that the common stock is to be credited with the stated value. Refer to the Chart of Accounts for exact wording of account titles. B. What is the total amount invested (total paid-in capital) by all stockholders as of August 3? 10:48arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education