Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

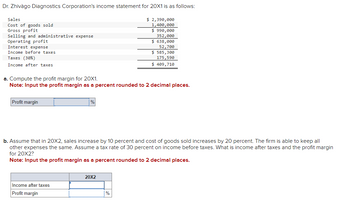

Transcribed Image Text:Dr. Zhivago Diagnostics Corporation's income statement for 20X1 is as follows:

$ 2,390,000

1,400,000

Sales

Cost of goods sold

Gross profit

Selling and administrative expense

Operating profit

Interest expense

Income before taxes.

Taxes (30%)

Income after taxes

a. Compute the profit margin for 20X1.

Note: Input the profit margin as a percent rounded to 2 decimal places.

Profit margin

$ 990,000

352,000

$ 638,000

52,700

$585,300

175,590

$ 409,710

b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all

other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin

for 20X2?

Note: Input the profit margin as a percent rounded to 2 decimal places.

Income after taxes

Profit margin

20X2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please help me with show all calculation thankuarrow_forwardIf a company has sales revenue of $631000, net sales of $500000, and cost of goods sold of $385000, the gross profit rate is 77%. 61%. 39%. 23%.arrow_forwardRequired:a) Compute the times-interest earned and give the interpretation.b) Compute the fixed charge coverage and give the interpretation.arrow_forward

- Use the following to answer questions 34 – 39 ST reports the following income statement results: $700,000 221,575 Sales Operating expense Net income 48,800 Sales returns & allowances 25,000 Gross profit 282,825 Interest expense 250 34. $ Calculate Net sales: 35. Calculate Cost of Goods Sold Calculate operating 36. income 37. $ Calculate Income before Income tax (IBT) %. Calculate the gross profit 38. margin (one decimal place) %. Calculate the net profit margin (one 39. decimal place)arrow_forwardOriole Corporation reported net sales of $166,000, cost of goods sold of $99,600, operating expenses of $36,200, other expenses of $13,600, net income of $16,600. Calculate the following values: (Round answers to 0 decimal places, e.g. 15%.) 1. 2. Profit margin Gross profit rate % %arrow_forwardProvide Answer with calculationarrow_forward

- A company has the following income statement. What is its net operating profit after taxes (NOPAT)? Round it to a whole dollar. Sales $ 1,200 Costs 600 Depreciation 170 EBIT $ ? Interest expense 50 EBT $ ? Taxes (20%) ? Net income $ ?arrow_forwardJester Corporation's most recent income statement appears below: Sales (all on account) Cost of goods sold Gross margin Selling and administrative expense Net operating income Interest expense Net income before taxes Income taxes (30%) Net income Multiple Choice O The beginning balance of total assets was $190,000 and the ending balance was $187,200. The return on total assets is closest to: O 23.9% Income Statement 22.3% 16.7% 31.8% $ 250,000 145,000 105,000 45,000 60,000 15,000 45,000 13,500 $ 31,500arrow_forwardCalculate the gross and net profits (in $) and the two profit margins (as %s) for the given company. (Round profit margins to the nearest tenth of a percent.) Company Net Sales Cost ofGoods Sold GrossProfit OperatingExpenses Net Profit Gross ProfitMargin (%) Net ProfitMargin (%) an optometry store $327,735 $201,655 $ $83,921 $ % %arrow_forward

- Sales Cost of goods sold Gross profit Fixed charges (other than interest) Income before interest and taxes Interest Income before taxes Taxes (35%) Income after taxes. LANCASTER CORPORATION a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times interest earned Fixed charge coverage times b. What would be the fixed-charge-coverage ratio? Note: Round your answer to 2 decimal places. times $ 259,000 209,000 $ 50,000 24,500 $ 25,500 19,000 $ 6,500 2,275 $ 4,225arrow_forwardThe following information was taken from the financial statements of Sunland Company: 2021 2020 Gross profit on sales $678,600 $760,000 Income before income taxes 205,400 225,000 Net income 260,000 225,000 Net income as a percentage of net sales 10% 9% Please show steps to finding answer Compute the cost of goods sold in dollars and as a percentage of net sales for each year. (Round percentages to 1 decimal place, e.g. 15.2%) 2021 2020 Cost of goods sold in dollars $enter a dollar amount $enter a dollar amount Cost of goods sold as a percentage of net sales nter percentages rounded to 1 decimal place % nter percentages rounded to 1 decimal place %arrow_forwardThe company reports the following income statement results: Gross profit $500,000 Interest expense 15,000 Sales discounts 8,000 Net Sales Operating expense Effective tax rate $ $ $ 990,000 365,000 18% Calculate Sales. Calculate Income before Income tax (IBT). Calculate net income. % Calculate the gross profit margin (one decimal place) % Calculate the profit margin (two decimal places)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education