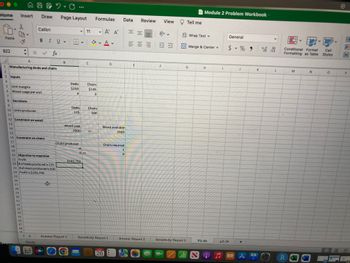

A furniture company manufactures desks and chairs. Each desk uses four units of wood, and each chair uses three units of wood. A desk contributes $250 to profit, and a chair contributes $145. Marketing restrictions require that the number of chairs produced be at least four times the number of desks produced. There are 2000 units of wood available. a. Use Solver to maximize the company’s profit. b. Confirm graphically that the solution in part a maximizes the company’s profit. c. Use SolverTable to see what happens to the decision variables and the total profit when the availability of wood varies from 1000 to 3000 in 100-unit increments. Based on your findings, how much would the company be willing to pay for each extra unit of wood over its current 2000 units?

I got through part a and need help on the last 2 parts. Please use the attached template.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

What are the steps to get the graph in part b?

What are the steps to get the graph in part b?

- Nash Inc. is the only player in the classy snow shovel market. The variety of shovel designs includes camouflage (both green and pink, of course), snowman, beach, and northern lights. Nash purchases basic aluminum snow shovels from a supplier, applies its durable designs, and sells the shovels for $30 each. Last year, the company generated $58,000 in operating income, based on the following details. Sales volume in units Operating expenses DM cost per unit DL cost per unit Variable-MOH per unit Fixed-MOH per unit 10,300 $85,000 $8.00 $3.00 $5.00 $2.00 This year, the company realizes that its operating expenses will increase by $16,000 and its direct labor costs will increase by 20% per unit.arrow_forwardAny help is appreciated!arrow_forwardElroy Racers makes bicycles. It has always purchased its bicycle tires from the M. Wilson Tires at $25 each but is currently considering making the tires in its own factory. The estimated costs per unit of making the tires are as follows: Direct materials $8 Direct labor $5 Variable manufacturing overhead $7 The company’s fixed expenses would increase by $60,000 per year if managers decided to make the tire.(b)What qualitative factors should Elroy Racers consider in making this decision?arrow_forward

- Dellcom Inc. sells two products: a regular and a deluxe version. The owner would like to better understand the impact of the sales mix on the company's sales. The following information is available: Regular Deluxe Sales price per unit Variable cost per unit $38 $61 $15 $34 The company has total fixed costs of $384,615 for the year and they sell 9 Regular products for every 4 Deluxe product. The owner would like to know, given the sales mix, how many units of each product the company must sell per year to break even. The company must sell units of the Regular product. Enter the number of units given the current sales mix. The company must sell units of the Deluxe product. Enter the number of units given the current sales mix.arrow_forwardZebra company manufactures custom-designed skins(covers) for ipods and other portable MP3devices. Variable costs are $10.80 per custom skin, the price is $16, and fixed cost are $66,560. Required: 1. What is the contribution margin for one custom skin? 2. How many custom skins must Zebra company sell to break even? 3. If Zebra company sells 13,000 custom skins, what is the operating income? 4. Calculate the margin of safety in units and in sales revenue if 13,000custom skins are sold.arrow_forwardVice President for Sales and Marketing at Waterways Corporation is planning for production needs to meet sales demand in the coming year. He is also trying to determine how the company's profits might be increased in the coming year. This problem asks you to use cost-volume-profit concepts to help Waterways understand contribution margins of some of its products and decide whether to mass-produce any of them. Waterways markets a simple water control and timer that it mass-produces. Last year, the company sold 635,000 units at an average unit selling price of $5.00. The variable costs were $2,222,500, and the fixed costs were $619,125. (a1) Your answer is correct. What is the product's contribution margin ratio? (Round ratio to O decimal places, e.g. 25%.) Contribution margin ratio 30 % (a2) eTextbook and Media Your answer is correct. What is the company's break-even point in sales units and in sales dollars for this product? Break-even point in units 412750 units Break-even point in…arrow_forward

- Stylish Sitting is a retailer of office chairs located in San Francisco, California. Due to increased market competition, the CFO of Stylish Sitting has grown worried about the firm's upcoming income stream. The CFO asked you to use the company financial information provided below. Sales price $ 76.00 Per-unit variable costs: Invoice cost 40.25 Sales commissions 17.25 Total per-unit variable costs $ 57.50 Total annual fixed costs: Advertising $ 54,300 Rent 76,600 Salaries 224,600 Total annual fixed costs $ 355,500 If 38,500 office chairs were sold, Stylish Sitting's operating income (πB) would be: (Do not round intermediate calculations.)arrow_forwardok Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $520 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 760 canoes for $520 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $520 each. 5. Suppose Sandy Bank wants to earn $69,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $520 each. , t Complete this question by entering your answers in the tabs below. t Required 1 Required 2 Required 3 Required 4 Required 5 Complete the following table. nces Note: Round your "Cost per Unit" answers to 2 decimal places. Number of Canoes Produced and Sold 450 610 700 Total costs Variable Costs…arrow_forwardVice President for Sales and Marketing at Waterways Corporation is planning for production needs to meet sales demand in the coming year. He is also trying to determine how the company's profits might be increased in the coming year. This problem asks you to use cost-volume-profit concepts to help Waterways understand contribution margins of some of its products and decide whether to mass-produce any of them. Waterways markets a simple water control and timer that it mass-produces. Last year, the company sold 735,000 units at an average unit selling price of $3.60. The variable costs were $1,852,200, and the fixed costs were $508,032.arrow_forward

- PLease ASAP. and show calculations!! Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardDwyran Ltd. manufactures a number of different products and has recently employed Ruth Benton as its management accountant. Ruth is currently looking at the various products and processes within Dwyran Ltd. to increase profitability, as a measure to try to avoid redundancies. Ruth has identified 4 areas of that she would like to look at first and she has asked you to provide her with the following information. Dwyran Ltd. manufacture the Newborough which it sells for £40 a unit. The direct material cost is £8 per unit. Other factory costs are £60,000 each month. The bottleneck factor of the production is the assembly of the unit, which is a labour intensive process. There are 20,000 labour hours available in assembly each month. Each unit of the Newborough takes 2 hours to assemble. Calculate the Newborough’s budgeted rate per factory hour and through put ratio for the month.arrow_forwardSandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $540 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 760 canoes for $540 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $540 each. 5. Suppose Sandy Bank wants to earn $76,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $540 each. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 This year Sandy Bank expects to sell 760 canoes for $540 each. Prepare a contribution margin income statement for the company. Note: Round your intermediate calculations to 2 decimal…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education