FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

not use ai please

Transcribed Image Text:K

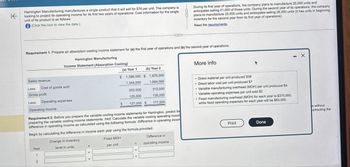

Hamington Manufacturing manufactures a single product that it will sell for $76 per unit. The company is

looking to project its operating income for its first two years of operations. Cost information for the single

unit of its product is as follows:

(Click the icon to view the data.)

During its first year of operations, the company plans to manufacture 25,000 units and

anticipates selling 21,000 of those units. During the second year of its operations, the company

plans to manufacture 25,000 units and anticipates selling 26,000 units (it has units in beginning

inventory for the second year from its first year of operations).

Read the requirements.

Requirement 1. Prepare an absorption costing income statement for (a) the first year of operations and (b) the second year of operations.

Sales revenue

Hamington Manufacturing

Income Statement (Absorption Costing)

(a) Year 1

(b) Year 2

$ 1,596,000 $ 1,976,000

1,344,000

1,664,000

252,000

312,000

125,000

135,000

127,000 $

177,000

Less: Cost of goods sold

Gross profit

Less: Operating expenses

Operating income

Requirement 2. Before you prepare the variable costing income statements for Hamington, predict the

preparing the variable costing income statements. Hint: Calculate the variable costing operating incom

difference in operating income as calculated using the following formula: Difference in operating incom

Begin by calculating the difference in income each year using the formula provided.

Year

Change in inventory

level in units

Fixed MOH

per unit

Difference in

operating income

More info

.

Direct material per unit produced $38

Direct labor cost per unit produced $7

Variable manufacturing overhead (MOH) per unit produced $4

Variable operating expenses per unit sold $2

Fixed manufacturing overhead (MOH) for each year is $375,000,

while fixed operating expenses for each year will be $83,000.

Print

Done

- X

ar without

ubtracting the

1

2

x

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardhelp please, the answers I put are not correctarrow_forwardWhat is an XBRL tag?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education