Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

can you explain how to solve this?

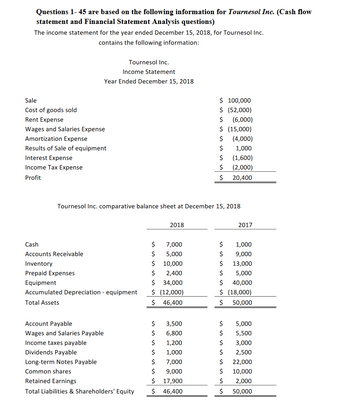

Transcribed Image Text:Questions 1-45 are based on the following information for Tournesol Inc. (Cash flow

statement and Financial Statement Analysis questions)

The income statement for the year ended December 15, 2018, for Tournesol Inc.

contains the following information:

Tournesol Inc.

Income Statement

Year Ended December 15, 2018

Sale

Cost of goods sold

Rent Expense

Wages and Salaries Expense

Amortization Expense

Results of Sale of equipment

Interest Expense

Income Tax Expense

Profit

Cash

Accounts Receivable

Inventory

Prepaid Expenses

Tournesol Inc. comparative balance sheet at December 15, 2018

Equipment

Accumulated Depreciation - equipment

Total Assets

Account Payable

Wages and Salaries Payable

Income taxes payable

Dividends Payable

Long-term Notes Payable

Common shares

Retained Earnings

Total Liabilities & Shareholders' Equity

$

7,000

$ 5,000

$

$

10,000

2,400

34,000

$

$ (12,000)

$ 46,400

$

$

$

2018

$

$

$

$

$

3,500

6,800

1,200

1,000

$ 100,000

$ (52,000)

$ (6,000)

$ (15,000)

$ (4,000)

1,000

(1,600)

(2,000)

20,400

7,000

9,000

17,900

46,400

$

$

$

$

$

$

2017

1,000

9,000

$ 13,000

$ 5,000

$ 40,000

$ (18,000)

$ 50,000

$ 5,000

$

5,500

$

3,000

$

2,500

$

$

$

$

22,000

10,000

2,000

50,000

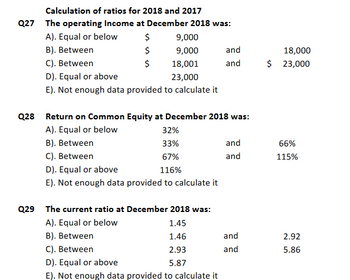

Transcribed Image Text:Calculation of ratios for 2018 and 2017

Q27 The operating Income at December 2018 was:

A). Equal or below

$

B). Between

$

C). Between

$

D). Equal or above

E). Not enough data provided to calculate it

9,000

9,000

18,001

23,000

Q28 Return on Common Equity at December 2018 was:

A). Equal or below

32%

B). Between

33%

C). Between

67%

D). Equal or above

116%

E). Not enough data provided to calculate it

Q29 The current ratio at December 2018 was:

A). Equal or below

B). Between

1.45

1.46

2.93

5.87

and

and

C). Between

D). Equal or above

E). Not enough data provided to calculate it

and

and

and

and

18,000

$ 23,000

66%

115%

2.92

5.86

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did you get the Amortization Expense of 25,000

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did you get the Amortization Expense of 25,000

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following excerpts from Unigen Companys financial information to prepare the operating section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forwardPreparing a Statement of Cash Flows Volusia Company reported the following comparative balance sheets for 2019: Required: Prepare a statement of cash flows for Volusia using the indirect method to compute net cash flow from operating activities.arrow_forward

- Use the following excerpts from Indigo Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $225,000.arrow_forwardUse the following information from Dubuque Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Stern Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from Tungsten Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Fromera Companys financial information to prepare the operating section of the statement of cash flows (direct method) for the year 2018.arrow_forwardUse the following excerpts from Mountain Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Selected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forwardUse the following excerpts from Yardley Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forwardPrepare the income statements and balance sheets for years 2018 and 2019 for Thompson Company using the following information. The balance sheet numbers are at the end of year figures.Item20182019Accounts Payable120.0150.0Accounts Receivable150.0180.0Accumulated Depreciation330.0360.0Cash & Cash Equivalents10.012.0Common Stock150.0200.0Cost of Goods Sold750.0850.0Depreciation25.030.0Interest Expense30.033.0Inventory200.0180.0Long-term Debt150.0150.0Gross Plant & Equipment650.0780.0Retained Earnings208.5225.0Sales1,500.01,700.0SG&A Expenses500.0570.0Notes Payable51.567.0Tax Rate21%21%(2) Answer the following questions:(a) How much did Thompson Company spend in acquiring fixed assets in 2019?(b) How much dividend did Thompson Company pay out during 2019?(c) Using the end of year numbers, did the long-term solvency ratios improve or deteriorate from 2018 to 2019? Answer this question using at least two long-term solvency ratios.(d) Using the end of year numbers, did the asset…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning