ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

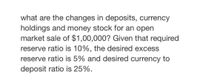

Transcribed Image Text:what are the changes in deposits, currency

holdings and money stock for an open

market sale of $1,00,000? Given that required

reserve ratio is 10%, the desired excess

reserve ratio is 5% and desired currency to

deposit ratio is 25%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Federal Reserve purchases $12 million in U.S. Treasury bonds from a bond dealer, and the dealer's bank credits the dealer's account. The required reserve ratio is 15 percent, and the bank typically lends any excess reserves immediately. Assuming that no currency leakage occurs, calculate how much will the bank be able to lend to its customers following the Fed's purchase. Smillion. (Enter your response rounded to two decimal places.)arrow_forwardThe following data represents money from a small Island economy near Fuji. Cash in the hands of the public = $402 Public credit limit on all credit cards= 136 Demand deposits and all other checkable deposits= 693 Money market mutual funds = 618 Travelers check = 8 Large time deposits = 512 Small time deposits= 971 Public stock market holdings = 1,069 Savings-type account = 256 What is the value of M1 for this economy using data above? What is the value of M2 for this economy using data above?arrow_forwardWhen you take a vacation and keep cash with you in case you might need it, money is serving as a: Store of value Medium of exchange Unit of account Standard of deferred paymentsarrow_forward

- No written by hand solutionarrow_forwardAfter suffering two years of staggering hyperinflation, the African nation of Zimbabwe officially abandoned its currency, the Zimbabwean dollar, in April 2009 and made the U.S. dollar its official currency. Why would anyone in Zimbabwe be willing to accept U.S. dollars in exchange for goods and services?arrow_forwardNo written by hand solutionarrow_forward

- Compare the use of open market operations, discounting, and changes in reserve requirements to control the money supplyarrow_forward2. Consider the following data (all values are in billions of dollars): (b) Currency Transactional deposits Bank reserves June 1930 June 1931 June 1932 $ 3.681 3.995 4.959 21.612 19.888 15.490 3.227 3.307 2.829 (a) Calculate the values for each period for the currency-deposit ratio, the ratio of total reserves to deposits, the monetary base, M1, and the money multiplier. Can you explain why the currency-deposit ratio and the ratio of total reserves to deposits moved as they did between 1930 and 1932(Great depression era)?arrow_forward8:30 1 19) Which of the following is a function that money serves? A) medium of exchange B) unit of value C) store of account D) All of the above are correct.arrow_forward

- If the actual reserve ratio is 16%, what is the money multiplier? Include up to two decimal places, if needed.arrow_forwardwhat is the excess reserve amount if the total reserve is $48 billion dollars and the required ratio is 0.07?arrow_forwardMatch the function of money with the definitionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education