ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

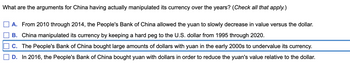

Transcribed Image Text:What are the arguments for China having actually manipulated its currency over the years? (Check all that apply.)

A. From 2010 through 2014, the People's Bank of China allowed the yuan to slowly decrease in value versus the dollar.

B. China manipulated its currency by keeping a hard peg to the U.S. dollar from 1995 through 2020.

C. The People's Bank of China bought large amounts of dollars with yuan in the early 2000s to undervalue its currency.

D. In 2016, the People's Bank of China bought yuan with dollars in order to reduce the yuan's value relative to the dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using information from problems 3 and 4, suppose that the central bank of Mexico has 200 bln dollars of foreign reserves just before the financial crisis began. If the central bank wants to keep the exchange rate at the level described in problem 4, it can do so for _____ weeks before it runs out of reserves (provided supply and demand curves do not change). Question 3 and 4 attached for your information:)arrow_forwardAt the international Bretton-Woods Conference that designed the International Monetary Fund, participating countries' representatives agreed to peg the value of their currencies to: O U.S. dollar Euro O A basket of U.S. dollar, U.K. pound, French franc and German mark SDRarrow_forwardPlease dont copy paste from chegg pleasearrow_forward

- Q3-11 If a country ties its currency to a specific foreign currency and allows its holdings of that currency to govern the country's money supply, this arrangement is known as a Select one: a. currency board. b. floating exchange rate. c. monetary union. d. Special Drawing Right.arrow_forward2. On February 1st, the Federal Reserve announced it would raise interest rates by 25 bps. On February 2nd, the European Central Bank announced that it would raise interest rates by 50 basis points. Puzzlingly, the Euro then proceeded to depreciate relative to the dollar on February 2nd and 3rd despite this growing interest rate differential between Europe and the US. a. Compare what changed between the December 2022 and February 2023 European Central Bank Monetary Policy Decisions and statement in the first two paragraphs in such statement. Note that you can do this manually by reading the statements and comparing them. You may also use a word processor to automatically highlight any changes between the versions of the documents. b. Also, compare what changed between the December 2022 and February 2023 Federal Reserve FOMC statements. c. From your analysis what were the unexpected shocks or surprises to the interest rate differential contained in the February statements?arrow_forwardIs this correct? thanksarrow_forward

- Indicate which of the functions of money (a medium of exchange, a unit of account, and a store of value) each of the following performs in the U.S. economy. Check all that apply. Plastic credit card Picasso painting Mexican peso Demand deposit Plastic credit card Picasso painting Mexican peso Medium of Exchange Unit of Account Given your answers to the previous task, indicate whether each of the following is considered money in the U.S. economy. Money Yes No Demand deposit 0 0 0 0 Store of Value 0 0 0 0arrow_forwardSuppose that at the initial equilibrium we know that the price level in the Eurozone is PE = 90.91, the dollar-euro expected exchange rate is E = 1.1, and that the interest rate in the Eurozone is 3%. $/e For the US variables take the same value as the ones specified in the beginning of the problem. Assume now that the Federal Reserve unexpectedly and permanently increases the nominal money supply from M* = 100 to M* = 105. Assume that the European Central Bank remains passive, making no changes to its monetary policy. Based on this information answer the following questions: 1. Find the new short-run equilibrium (interest rate, exchange rate, real money balances). Note that the shock is permanent, so expectations of the exchange rate should change. 2 2. Find the long-run equilibrium (interest rate, exchange rate, prices, real money balances). Is the exchange rate overshooting in the short run? Why? 3. Plot the dynamics of the variables of interest with respect to time. Denote T the…arrow_forwardA U.S. company wants to buy its televisions from a Chinese company. The Chinese company sells its TVs for 1,200 yuan each. The current exchange rate between the U.S. dollar and the Chinese yuan is $1 = 6 yuan. How many U.S. dollars will the U.S. company have to convert into yuan to pay for each television? A. $1,200 B. $7,200 C. $200 D. $100arrow_forward

- A. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forwardSuppose that Argentina's central bank wants to depreciate the Argentine Peso against the U.S. Dollar. It could accomplish this by pesos and U.S. Dollars. selling; selling O selling; purchasing O purchasing; purchasing O purchasing; sellingarrow_forwardUse the following information to answer Questions 78 to 80: The Czech Republic, whose own currency is the koruna (Kë) and whose foreign currency is the euro (€), begins to intervene in the exchange market in order to stimulate its exports to the EU. Kč J€ Se {left} {right} De Qe To stimulate its exports the Czech central bank could O neither sell euros O buy eurosarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education