ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

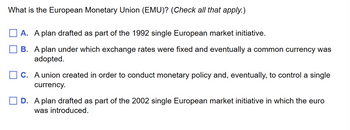

Transcribed Image Text:What is the European Monetary Union (EMU)? (Check all that apply.)

A. A plan drafted as part of the 1992 single European market initiative.

B. A plan under which exchange rates were fixed and eventually a common currency was

adopted.

C. A union created in order to conduct monetary policy and, eventually, to control a single

currency.

D. A plan drafted as part of the 2002 single European market initiative in which the euro

was introduced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In the paper by Degrauwe, The Governance of a Fragile Eurozone by Paul De Grauwe, he argues that the fundamental problem in the Euro-zone today is that countries cannot borrow in their own currencies. Explain what he means by this and what the consequences of this are for Euro-zone countries currently in crisis. DeGrauwe argues that countries in the Eurozone monetary union can face both liquidity and solvency crises – problems that could not occur in a country that issues its own currency, like the UK. Explain. Refer to his comparison of Spain to the UK.arrow_forwardAnswer last two questionsarrow_forward33. Of the following, the one that appears in the current account of the balance of payments is Question 33 options: a) income earned by U.S. subsidiaries of Barclay's Bank of London. b) an Italian investor's purchase of IBM stock. c) a loan by a Swiss bank to an American corporation. d) a purchase of a British Treasury bond by the Fed.arrow_forward

- Question: "In a scenario where a country operates under a floating exchange rate system, what would likely be the effect of a significant increase in its central bank's interest rates on the country's current account balance? Assume other global economic conditions remain constant." a) The current account balance will improve due to increased foreign investment. b) The current account balance will deteriorate due to increased imports and decreased exports. c) The current account balance will improve due to decreased imports and increased exports. d) The change in interest rates will have no effect on the current account balance.arrow_forwardexplain comprehensively what are the benefits faced in using LCS (Local Currency Settlement) ? and what is the role of the LCS in the monetary stability of a country?arrow_forwardA. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forward

- A. B. C. Practice Question 1: The Danish krone is currently pegged to the euro. Using the IS-LM-FX model for Home (Denmark) and Foreign (Eurozone), illustrate how each of the following scenarios affect Denmark: The Eurozone reduces its money supply. Denmark cuts government spending to reduce its budget deficit. The Eurozone countries increase their taxes.arrow_forwardUse the table below to answer the next two questions. You will need to fill in the blanks. Currency South African Rand Singapore Dollar Swiss Franc Euro Danish Krone Foreign Currency to 1$ = U.S. Dollars $0.14 1.30 0.72 $1.01 $0.19 Which of the following below ranks the currencies from most valuable to least valuable? Rand, Singapore Dollar; Franc; Euro; Krone; U.S. Dollar Rand; Krone; Singapore Dollar; U.S. Dollar; Franc; Euro Krone: Dand: Euro: US Dollar: Singapore Dollar Francarrow_forwardParagraph H H Euros per Dollar Quantity of Dollars Styles 1 Title 1. Headline: Fed raises interest rates; attracts foreign investors. Supply of dollars (increase / decrease / stay the same) Demand for dollars (increase / decrease / stay the same) Euros per Dollar (increase / decrease / stay the same) Quantity of Dollars (increase / decrease / stay the same) Select- Editing Create PDF C and Share link Sh A Consider the foreign exchange market for dollars as discussed in Chapter 14, section 3.2 of your text and depicted above. How would the news headlines below affect the market for foreign exchange? Highlight or change the color of your response. 2 Display Settingsarrow_forward

- am. 145.arrow_forwardSuppose country A’s goods becomes more popular with foreign consumers, and country B’s less so. How would this affect each country, assuming that they (a) have their own independent currency and (b) share a common currency? Use the Aggregate Demand and Aggregate Supply framework to explain your answer, and comment briefly on the desirability of currency union.arrow_forwardQ3-20 In the economic and monetary union in Europe (EMU), the member countries Select one: a. tie their currencies to the US dollar. b. use a common currency (the euro). c. tie their currencies to the SDR. d. have completely flexible exchange rates with each other.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education