Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

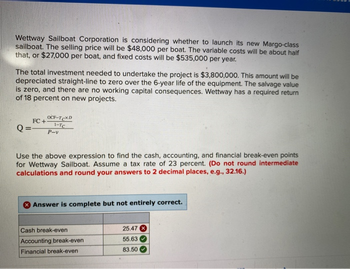

Transcribed Image Text:Wettway Sailboat Corporation is considering whether to launch its new Margo-class

sailboat. The selling price will be $48,000 per boat. The variable costs will be about half

that, or $27,000 per boat, and fixed costs will be $535,000 per year.

The total investment needed to undertake the project is $3,800,000. This amount will be

depreciated straight-line to zero over the 6-year life of the equipment. The salvage value

is zero, and there are no working capital consequences. Wettway has a required return

of 18 percent on new projects.

FC+

OCF-TCXD

1-TC

Q== P-v

Use the above expression to find the cash, accounting, and financial break-even points

for Wettway Sailboat. Assume a tax rate of 23 percent. (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

Cash break-even

Accounting break-even

Financial break-even

25.47

55.63

83.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Lakeside Winery is considering expanding its winemaking operations. The expansion will require new equipment costing $697,000 that would be depreciated on a straight-line basis to zero over the 5-year life of the project. The equipment will have a market value of $192,000 at the end of the project. The project requires $62,000 initially for net working capital, which will be recovered at the end of the project. The operating cash flow will be $187, 600 a year. What is the net present value of this project if the relevant discount rate is 14 percent and the tax rate is 25 percent? USE A CALCULATOR IF POSSIBLE AND SHOW EVERY STEP.arrow_forwardWe are evaluating a project that costs $820,000, has a life of 7 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 159,000 units per year. Price per unit is $43, variable cost per unit is $28, and fixed costs are $833,120 per year. The tax rate is 25 percent, and we require a return of 14 percent on this project. 1a. Calculate the accounting break-even point. Break-even point 1b. What is the degree of operating leverage at the accounting break-even point? DOL 2a. Calculate the base-case cash flow. Cash flowarrow_forwardNikularrow_forward

- You are considering a proposal to produce and market a new sluffing machine. The most likely outcomes for the project are as follows: Expected sales: 115,000 units per year Unit price: $220 Variable cost: $132 Fixed cost: $4,890,000 The project will last for 10 years and requires an initial investment of $16.70 million, which will be depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 30%, and the required rate of return is 12%. However, you recognize that some of these estimates are subject to error. In one scenario a sharp rise in the dollar could cause sales to fall 30% below expectations for the life of the project and, if that happens, the unit price would probably be only $210. The good news is that fixed costs could be as low as $3,260,000, and variable costs would decline in proportion to sales. a. What is project NPV if all variables are as expected? Note: Do not round intermediate calculations. Enter your answer in thousands not in…arrow_forwardUrsus, Incorporated, is considering a project that would have a five-year life and would require a $2,400,000 investment in equipment. At the end of five years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Sales $ 3,500,000 Variable expenses 2,100,000 Contribution margin 1,400,000 Fixed expenses: Fixed out-of-pocket cash expenses $ 600,000 Depreciation 480,000 1,080,000 Net operating income $ 320,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 14%. Required: a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b. Compute the project's internal rate of…arrow_forwardOutdoor Sports is considering adding a putt-putt golf course to its facility. The course would cost $168,000, would be depreciated on a straight-line basis over its 4-year life, and would have a zero salvage value. The sales would be $90,300 a year, with variable costs of $27,450 and fixed costs of $12,050. In addition, the firm anticipates an additional $15,700 in revenue from its existing facilities if the putt putt course is added. The project will require $2,650 of net working capital, which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 11 percent and a tax rate of 21 percent?arrow_forward

- Kolby’s Korndogs is looking at a new sausage system with an installed cost of $680,000. The asset qualifies for 100 percent bonus depreciation and can be scrapped for $90,000 at the end of the project’s 5-year life. The sausage system will save the firm $193,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $45,000. If the tax rate is 25 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardMike's landscaping is considering a new 4-year project. The necessary fixed assets will cost $157,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $98,000, variable costs of $27,400, and fixed costs of $12,000. The project will also require net working capital of $2,600 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project?arrow_forwardChadron Sports is considering adding a miniature golf course to its facility. The course would cost $138,000, would be depreciated on a straight-line basis over its five-year life, and would have a zero salvage value. The estimated income from the golfing fees would be $72,000 a year with $24,000 of that amount being variable cost. The fixed cost would be $11,600. In addition, the firm anticipates an additional $14,000 in revenue from its existing facilities if the golf course is added. The project will require $7,000 of net working capital, which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 12 percent and a tax rate of 34 percent? O $14,438.78 $12,708.48 O $11,757.49 O $10,631.16 O $14,900.41arrow_forward

- Culver Industries is considering the purchase of new equipment costing $1,500,000 to replace existing equipment that will be sold for $100,000. The new equipment is expected to have a $210,000 salvage value at the end of its 5-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 25,000 units annually at a sales price of $44 per unit. Those units will have a variable cost of $22 per unit. The company will also incur an additional $80,000 in annual fixed costs.Click here to view the factor table.(a) Calculate the net present value of the proposed equipment purchase. Assume that Culver uses a 10% discount rate. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971. Enter negative amount using a negative sign preceding the number e.g. -59,992 or parentheses e.g. (59,992).) Net present value $enter the net present value in dollars…arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $171,000 and be depreciated on a 3- year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $108,000, variable costs of $27,650, and fixed costs of $12,250. The project will also require net working capital of $2,850 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project? Multiple Choice $19,125 $28.518 $17,031 $14,520 $15,840arrow_forwardHoffman company is considering a project that would have a five-year life and require a $3,200,000 investment in equipment. At the end of the five years, the project would terminate and the equipment would have no salvage value. The project would provide the following expected forecasts: Sales $ 5,000,000 Variable expenses $3,000,000 Fixed expenses (including depreciation) $1,600,000 The company’s tax rate is 20% and the WACC is 12% REQUIRED Compute the project’s NPV, IRR, payback period, discounted payback period, and profitability indexarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education