FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

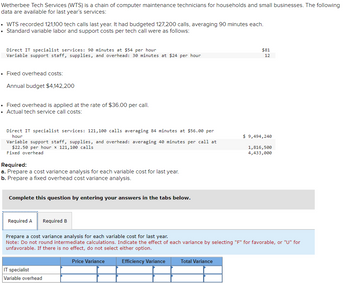

Transcribed Image Text:Wetherbee Tech Services (WTS) is a chain of computer maintenance technicians for households and small businesses. The following

data are available for last year's services:

• WTS recorded 121,100 tech calls last year. It had budgeted 127,200 calls, averaging 90 minutes each.

• Standard variable labor and support costs per tech call were as follows:

Direct IT specialist services: 90 minutes at $54 per hour

Variable support staff, supplies, and overhead: 30 minutes at $24 per hour

• Fixed overhead costs:

Annual budget $4,142,200

Fixed overhead is applied at the rate of $36.00 per call.

• Actual tech service call costs:

Direct IT specialist services: 121,100 calls averaging 84 minutes at $56.00 per

hour

Variable support staff, supplies, and overhead: averaging 40 minutes per call at

$22.50 per hour x 121,100 calls

Fixed overhead

Required:

a. Prepare a cost variance analysis for each variable cost for last year.

b. Prepare a fixed overhead cost variance analysis.

Complete this question by entering your answers in the tabs below.

Required A Required B

IT specialist

Variable overhead

$81

12

Prepare a cost variance analysis for each variable cost for last year.

Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for

unfavorable. If there is no effect, do not select either option.

Price Variance

Efficiency Variance

Total Variance

$ 9,494,240

1,816,500

4,433,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Clone Computers assembles and packages personal computer systems from brand-name components. Its Home Office PC System is assembled from components costing $1400 per system and sells for $2000. Labour costs for assembly are $100 per system. This product line's share of overhead costs is $10,000 per month. a. How many Home Office systems must be sold each month to break even on this product line? b. What will be the profit or loss for a month in which 15 Home Office systems are sold?arrow_forwardRequired: Prepare a flexible budget performance report that shows both revenue and spending variances and activity varlances for September. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Gourmand Cooking School Flexible Budget Performance Report es For the Month Ended September 30 Flexible Planning Budget Actual Results Budget Courses 3. Students 42 Revenue $4 32,400 Expenses: Instructor wages 9,080 8,540 Classroom supplies Utilitios 1,530 Campus rent 4,200 Insurance 1,890 Administrative expenses 3,790 Total expense 29,030 Net operating income 3,370arrow_forwardGive me answer within 45 min please I will give you upvote immediately its very urgent ...thankyou...arrow_forward

- The Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reports-the number of courses and the total number of students. For example, the school might run two courses in a month and have a total of 63 students enrolled in those two courses. Data concerning the company's cost formulas appear below: Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Fixed Cost per Cost per Cost per Month Student Course $ 2,910 $ 1,240 $ 4,500 $ 2,100 $ 3,500 Revenue Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses $ 80 Actual $ 53,170 $ 10,920 $ 17,490 $ 41 For example, administrative expenses should be $3,500 per month plus $41 per course plus $5 per student. The company's sales should average $890 per student. $ 1,970 $ 4,500 $ 2,240 $ 3,405 $ 280 The company planned to run four courses with a total of 63 students;…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.30g $4,300 +$1.50q $5,300 + $0.40g $1,400 + $0.30q $18,200+ $2.70q $8,400 $2,600 $13,800 + $0.60q The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Required: Actual Cost Incurred in March $ 66,780 $ 9,780 $ 7,370 2,870 $ 29,000 $ 8,800 $ 2,600 $ 15,550 1. Prepare the Production…arrow_forwardHarmon Recycling Services (HRS), a not-for-profit organization, has two drop-off centers, Westside and Eastside. Data for the expected operation in the next quarter follow. Clients Revenues Eastside 25,000 $360,000 8,100 Westside 6,250 $ 240,000 2,700 $ 99,000 $ 108,000 Staff hours Staff costs General operating costs Required: a. Compute the predetermined overhead rate used to apply general operating costs to the two centers assuming HRS uses the number of clients to allocate general operating costs. b. Based on the rates computed in requirement (a), what is the expected surplus (revenues less costs) for each center? Required A Required B Complete this question by entering your answers in the tabs below. Predetermined overhead rate Total 31,250 $ 600,000 10,800 $ 207,000 $360,000 Compute the predetermined overhead rate used to apply general operating costs to the two centers assuming HRS uses the number of clients to allocate general operating costs. Note: Round your answer to 2…arrow_forward

- Wetherbee Tech Services (WTS) is a chain of computer maintenance technicians for households and small businesses. The following data are available for last year's services: • WTS recorded 120,600 tech calls last year. It had budgeted 126,200 calls, averaging 90 minutes each. • Standard variable labor and support costs per tech call were as follows: . Direct IT specialist services: 90 minutes at $54 per hour Variable support staff, supplies, and overhead: 30 minutes at $24 per hour Fixed overhead costs: Annual budget $4,141,200 Fixed overhead is applied at the rate of $36.00 per call. Actual tech service call costs: Direct IT specialist services: 120,600 calls averaging 84 minutes at $56.00 per hour Variable support staff, supplies, and overhead: averaging 40 minutes per call at $22.50 per hour x 120,600 calls Fixed overhead Required: a. Prepare a cost variance analysis for each variable cost for last year. b. Prepare a fixed overhead cost variance analysis. Complete this question by…arrow_forwardThe Gourmand Cooking School runs short cooking courses at its small campus. Management has identified two cost drivers it uses in its budgeting and performance reports-the number of courses and the total number of students. For example, the school might run two courses in a month and have a total of 61 students enrolled in those two courses. Data concerning the company's cost formulas appear below. Instructor wages Classroom supplies Utilities Campus rent Insurance Administrative expenses Cost per Fixed Cost per Month Cost per Course Student 2,940 $ 290 1,210 $ 50 4,700 2,200 3,700 $ 46 $ For example, administrative expenses should be $3,700 per month plus 546 per course plus $4 per student. The company's sales should average $880 per student. The company planned to run four courses with a total of 61 students; however, it actually ran four courses with a total of only 55 students. The actual operating results for September appear below. Revenue Actual 50,780 Instructor wages $ 11,040…arrow_forwardA local picnic table manufacturer has budgeted these overhead costs: Purchasing $80,000 Handling Materials 34,540 Machine Setups 63,000 Inspections 25,000 Utilities 25,500 They are considering adapting ABC costing and have estimated the cost drivers for each pool as shown: Cost Driver Activity Orders Material Moves B00 1,340 Machine Setups 14,000 Number of Inspections 5,000 Square Feet 190,000 Recent success has yielded an order for 900 tables. Assume direct labor costs per hour of $25. Activity Order, Units Direct Materials Machine Hours Direct Labor Hours Number of Purchase Orders Number of Material Moves Number of Machine Setups Number of Inspections Direct Materials Direct Labor Number of Material Moves 900 Number of Machine Setups Number of Inspections Number of Square Feet Occupied Total Order Cast 112,700 15,300 5,300 Number of Square Feet Occupied Determine how much the job would cast given the following activities: Do not round Intermediate computations and round final answers…arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation. Factory rent Property taxes Factory administration Cost Formulas $16.10q $4,600+ $1.70q $5,000+ $0.509 $1,700+ $0.30q $18,700+ $2.80q $8,300 Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration $3,000 $13,400+ $0.60q The Production Department planned to work 4,100 labor-hours in March; however, it actually worked 3,900 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March $ 64,330 $ 10,750 $ 7,440 $ 3,140 $ 29,620 $ 8,700 $3,000 $ 15,090 Required: 1. Prepare the Production…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration. Cost Formulas $16.10q $4,100 +$1.60q $5,400 + $0.40q $1,400 +$0.10q $18,600 + $2.50q $8,100 $2,700 $13,600 +$0.90q The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Actual Cost Incurred in March $ 69,160 $ 10,320 $ 7,550 Indirect labor Utilities Supplies Factory rent $ 2,050 Equipment depreciation $ 29,100 $ 8,500 $ 2,700 $ 16,790 Property taxes Factory administration Required: 1. Prepare the Production…arrow_forwardSubject: Acountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education