FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

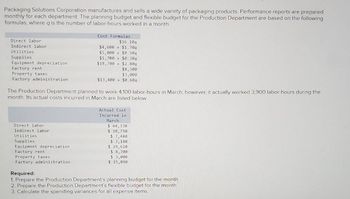

Transcribed Image Text:Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared

monthly for each department. The planning budget and flexible budget for the Production Department are based on the following

formulas, where q is the number of labor-hours worked in a month:

Direct labor

Indirect labor

Utilities

Supplies

Equipment depreciation.

Factory rent

Property taxes

Factory administration

Cost Formulas

$16.10q

$4,600+ $1.70q

$5,000+ $0.509

$1,700+ $0.30q

$18,700+ $2.80q

$8,300

Direct labor

Indirect labor

Utilities

Supplies

Equipment depreciation

Factory rent

Property taxes

Factory administration

$3,000

$13,400+ $0.60q

The Production Department planned to work 4,100 labor-hours in March; however, it actually worked 3,900 labor-hours during the

month. Its actual costs incurred in March are listed below:

Actual Cost

Incurred in

March

$ 64,330

$ 10,750

$ 7,440

$ 3,140

$ 29,620

$ 8,700

$3,000

$ 15,090

Required:

1. Prepare the Production Department's planning budget for the month.

2. Prepare the Production Department's flexible budget for the month.

3. Calculate the spending variances for all expense items.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunland Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Sunland is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead, Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (1) One mobile safe (2) Mobile Safes One walk-in safe 200 300 450 800 Walk-in Safes 435.2 50 The total estimated manufacturing overhead was $272,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) 200 350 1.700 per unit per unitarrow_forward.arrow_forwardPLEASE HELP MEarrow_forward

- Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 14,000 hours for production: Variable overhead cost: Indirect factory labor $44,800 Power and light 10,360 Indirect materials 21,000 Total variable overhead cost $ 76,160 Fixed overhead cost: Supervisory salaries $54,380 Depreciation of plant and equipment 14,310 Insurance and property taxes 26,710 Total fixed overhead cost 95,400 Total factory overhead cost $171,560 Tannin has available 18,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 13,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Actual variable factory overhead cost: Indirect factory labor $40,560…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardCrane Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Crane is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line Mobile Safes 200 300 450 800 Walk-in Safes 50 200 350 1,700arrow_forward

- Cabinare Inc. Is one of the largest manufacturers of office furniture in the United States. In Grand Rapids Michigan and assembles filing cabinets in a assembly Department. Assume following nformation for the assembly departments: Direct labor per filing cabinets 30 min Supervisor salaries $132,000 per month Depreciation $24,000 per month Direct labor rate $21 per hr. Prepare a flexible budget for 13,000,16,000,and 20,000 filing cabinets for the month ending February 28 in assembly departments similar to exhibit 5 Round your final answer to the whole dollar, if required.arrow_forwardPatrick Inc. makes industrial solvents. Budgeted direct labor hours for the first 3 months of the coming year are: January 13,140 February 12,300 March 15,075 The variable overhead rate is $0.70 per direct labor hour. Fixed overhead is budgeted at $2,910 per month. Required: Prepare an overhead budget for the months of January, February, and March, as well as the total for the first quarter. Do not include a multiplication symbol as part of your answer. Round total variable overhead and total overhead to the nearest dollar. Patrick Inc. Overhead Budget For the Coming First Quarter Overhead: January February March Total Total direct labor hrs fill in the blank 1 fill in the blank 2 fill in the blank 3 fill in the blank 4 Variable overhead rate $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 $fill in the blank 8 Total variable overhead $fill in the blank 9 $fill in the blank 10 $fill in the blank 11 $fill in the blank 12 Add: Fixed overhead…arrow_forwardThe following data relates to Coachman Company's budgeted amounts for next year. Budgeted Data: Department 1 Department 2 Overhead costs $ 300,000 $ 400,000 Direct labor hours 60,000 DLH 80,000 DLH Machine hours 1,000 MH 2,000 MH What is the company's plantwide overhead rate if machine hours are the allocation base? (Round your answer to two decimal places.) Multiple Choice $100.00 per MH $150.00 per MH $233.33 per MH $4.90 per MH $5.00 per MH Please dont provide answer in image format thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education