FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

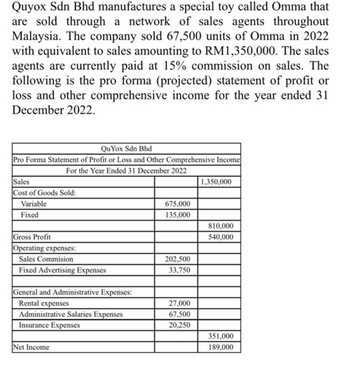

Transcribed Image Text:Quyox Sdn Bhd manufactures a special toy called Omma that

are sold through a network of sales agents throughout

Malaysia. The company sold 67,500 units of Omma in 2022

with equivalent to sales amounting to RM1,350,000. The sales

agents are currently paid at 15% commission on sales. The

following is the pro forma (projected) statement of profit or

loss and other comprehensive income for the year ended 31

December 2022.

Qu Yox Sdn Bhd

Pro Forma Statement of Profit or Loss and Other Comprehensive Income

For the Year Ended 31 December 2022

Sales

Cost of Goods Sold:

Variable

Fixed

Gross Profit

Operating expenses:

Sales Commision

Fixed Advertising Expenses

General and Administrative Expenses:

Rental expenses

Administrative Salaries Expenses

Insurance Expenses

Net Income

675,000

135,000

202,500

33,750

27,000

67,500

20,250

1,350,000

810,000

540,000

351,000

189,000

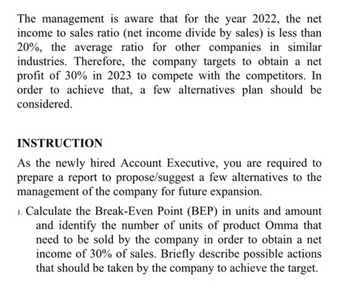

Transcribed Image Text:The management is aware that for the year 2022, the net

income to sales ratio (net income divide by sales) is less than

20%, the average ratio for other companies in similar

industries. Therefore, the company targets to obtain a net

profit of 30% in 2023 to compete with the competitors. In

order to achieve that, a few alternatives plan should be

considered.

INSTRUCTION

As the newly hired Account Executive, you are required to

prepare a report to propose/suggest a few alternatives to the

management of the company for future expansion.

1. Calculate the Break-Even Point (BEP) in units and amount

and identify the number of units of product Omma that

need to be sold by the company in order to obtain a net

income of 30% of sales. Briefly describe possible actions

that should be taken by the company to achieve the target.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2021, year- end trial balance contained the following income statement items: Account Title Sales revenue Debits Credits $13,100,000 56,000 Interest revenue Loss on sale of investments Cost of goods sold Selling expenses General and administrative expenses $ 106,000 6,260,000 626,000 1,580,000 46,000 1,260, e00 906, 000 Interest expense Research and development expense Income tax expense Required: Calculate the company's operating income for the year. Total operating revenue Less operating expenses Operating incomearrow_forwardThe following information is for Sheridan Inc. for the year 2022: Manufacturing costs Number of gloves manufactured Beginning inventory (a) Sales in 2022 were 308,400 pairs of gloves for $22 per pair. Your answer is incorrect. $3,007,000 310,000 pairs 0 pairs Cost of goods sold What is the cost of goods sold for 2022? (Round cost per unit to 2 decimal places, eg. 15.25 and final answer to 0 decimal places, e.g. 125.)arrow_forwardElgin Battery Manufacturers had sales of $840,000 in 2021 and their cost of goods sold is 562,800 Selling and administrative expenses were 75,600 Depreciation expense was $19,000 and interest expense for the year was $12,000. The firm's tax rate is 35 percent. What is the dollar amount of taxes paid in 2021? Multiple Choice $172.974 $59.710 $198,400 $63,910arrow_forward

- Collected these information from Bell Telecom Company (Egypt) producing 3 products"E" ,"F", and "G" for the year 2022:First: Sales:- Estimated sales "E" 11,000,000 EGP "F" 8,400,000 EGP "G" 7,380,000 EGP- Sales price/unit 440 EGP 420 EGP 410 EGPSecond: Production and Inventory (finished goods):- Total estimated sales units for product (E) will allocate for first quarter, second quarter,third quarter, and fourth quarter by equally.- For calculating of ending inventory of Finished Goods (F.G.) of product (E), 1/4 of salesunits of the next quarter are used except the fourth quarter 4/4 of sales units of the samequarter.- Ending inventory of Finished Goods (F.G.) for first quarter = 1250 units for product (E).- Beginning inventory of Finished Goods (F.G.) for first quarter = 2300 units for product (E).- Ending inventory of Finished Goods (F.G.) for product (F) and (G) 1/4 of sales units.- Inventory 31/12/2021 for product (F) and (G) are 1600 and 1100 units, respectivelyThird: Raw materials…arrow_forwardSunland Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 21% of sales. The income statement for the year ending December 31, 2022, is as follows. SUNLAND BEAUTY CORPORATIONIncome StatementFor the Year Ended December 31, 2022 Sales $71,200,000 Cost of goods sold Variable $30,616,000 Fixed 8,560,000 39,176,000 Gross profit $32,024,000 Selling and marketing expenses Commissions $14,952,000 Fixed costs 10,660,400 25,612,400 Operating income $6,411,600 The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 7% and incur additional fixed costs of $9,968,000. Calculate the company’s break-even point in sales dollars for the year 2022 if it hires its own sales force to replace the network of agents. Break-even…arrow_forwardABC Co. is selling its products to customers A, B and C. The following information is given for the year 2018-19. Customer A Customer B Customer C Sales in Lakhs (?) 15.90 20.0 15.0 Number of deliveries (including rush deliveries) 100 40 50 Number of orders 120 50 60 1.2 Average number of hours per delivery (for verification of goods | before loading for delivery) 1 1.30 Number of rush deliveries 2 1 2 Sales commission (% to sales) 4 5 Normal delivery cost is ? 1,250 per delivery. Order processing cost is ? 1,84,000. Verification cost of goods before loading is ? 5,32,500. Rush delivery cost is 180% of normal delivery cost. Variable cost is 75 percent of sales. (i) Present a customer wise profitability statement.arrow_forward

- Sisyphus Inc. records total sales of $657,500 in the current period, with a cost of goods sold of $389,000 . Sisyphus expects 4% of sales to be returned. How much in net sales will Sisyphus recognize for the current period? Group of answer choices $373,400 $268,500 $631,200 $657,500 $257,760 The Sisyphus Inc’s (SSY) Company’s annual statement of cash flows reported the following (in millions): Net cash from financing activities $63,864 Net cash from investing activities -62,512 Cash at the beginning of the year 13,152 Cash at the end of the year 18,948 What did SSY report for “Net cash from operating activities” during the year? Group of answer choices $71,220 million cash inflow None of the above $4,444 million cash outflow $4,444 million cash inflow $71,220 million cash outflowarrow_forwardPlanet Ltd produces fridges and freezers, which are sold to retailers. The financial statements for the last three years are as follows: Income statements for the year ending 31st December 2021 2022 £000 £000 Revenue 336,250 427,038 Cost of sales (126,675) (190,012) Gross profit 209,575 237,025 Administration expenses (73,290) (95,795) Distribution expenses (14,678) (8,720) Operating profit 121,407 121,931 Interest (8,750) (11,250) Profit before tax 118,142 166,326 Tax (22,531) (22,136) Profit for the year 90,126 88,545 Statements of financial position as at 31st December 2021 2022 £000 £000 Non-current assets Property, plant and equipment 286,250 327,650 Current assets Inventories 37,000 28,000 Trade receivables 42,000 43,500 Cash 19,632 24,570 98,632 96,070 Total assets 384,882…arrow_forwardCollected these information from Bell Telecom Company (Egypt) producing 3 products"E" ,"F", and "G" for the year 2022:First: Sales:- Estimated sales "E" 11,000,000 EGP "F" 8,400,000 EGP "G" 7,380,000 EGP- Sales price/unit 440 EGP 420 EGP 410 EGPSecond: Production and Inventory (finished goods):- Total estimated sales units for product (E) will allocate for first quarter, second quarter,third quarter, and fourth quarter by equally.- For calculating of ending inventory of Finished Goods (F.G.) of product (E), 1/4 of salesunits of the next quarter are used except the fourth quarter 4/4 of sales units of the samequarter.- Ending inventory of Finished Goods (F.G.) for first quarter = 1250 units for product (E).- Beginning inventory of Finished Goods (F.G.) for first quarter = 2300 units for product (E).- Ending inventory of Finished Goods (F.G.) for product (F) and (G) 1/4 of sales units.- Inventory 31/12/2021 for product (F) and (G) are 1600 and 1100 units, respectivelyThird: Raw materials…arrow_forward

- The CVP income statement for Blossom Machine Company for 2021 appears below. BLOSSOMMACHINE COMPANY Income Statement For the Year Ended December 31, 2021 Sales (42,000 units) $1,050,000 Variable expenses Contribution margin Fixed expenses Net income (loss) (b) Answer the following independent questions. (c) What was the company's break-even sales dollars in 2021? 735,000 Your answer is correct. eTextbook and Media 315,000 360,000 ($45,000) Break-even point in sales dollars $ Additional units Your answer is correct. How many additional units would the company have had to sell in 2022 to earn a net income of $45,000? eTextbook and Medial Number of units sold 1,200,000 12,000 Attempts: 3 of 5 used If the company reduces variable costs by $2.50 per unit in 2022 while other costs and unit revenues remain unchanged, how many units will the company have to sell to earn a net income of $45,000? (Round per unit value to 2 decimal places, e.g. 52.75. Final answer to O decimal places, e.g.…arrow_forwardPharoah Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 22% of sales. The income statement for the year ending December 31, 2025, is as follows. PHAROAH BEAUTY CORPORATION Income Statement For the Year Ended December 31, 2025 Sales | Cost of goods sold Variable Fixed Gross profit Selling and marketing expenses Commissions Fixed costs Operating income $30,760,000 8,580,000 $16,918,000 10,070,400 $76,900,000 39,340,000 $37,560,000 26,988,400 $10,571,600 (a) ✓ Your answer is correct. Under the current policy of using a network of sales agents, calculate the Pharoah Beauty Corporation's break-even point in sales dollars for the year 2025. (b) Break-even point $ eTextbook and Media Calculate the company's break-even point in sales dollars for the year 2025 if it hires its own sales force to replace the network of agents. Break-even point $ eTextbook and Media Save for Later Attempts: 1 of 2 used The…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education