Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

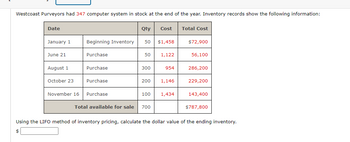

Transcribed Image Text:Westcoast Purveyors had 347 computer system in stock at the end of the year. Inventory records show the following information:

Date

January 1

June 21

August 1

October 23

November 16

Beginning Inventory

Purchase

Purchase

Purchase

Purchase

Total available for sale

Qty Cost

50 $1,458

50

300

200

100

700

1,122

954

1,146

1,434

Total Cost

$72,900

56,100

286,200

229,200

143,400

$787,800

Using the LIFO method of inventory pricing, calculate the dollar value of the ending inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Westcoast Purveyors had 351 computer system in stock at the end of the year. Inventory records show the following information: Date Qty Cost Total Cost January 1 Beginning Inventory 50 $1,398 $69,900 June 21 Purchase 50 1,182 59,100 August 1 Purchase 300 894 268,200 October 23 Purchase 200 1,146 229,200 November 16 Purchase 100 1,434 143,400 Total available for sale 700 $769,800 Using the LIFO method of inventory pricing, calculate the dollar value of the ending inventory.arrow_forwardA company's inventory records report the following in November of the current year: Date November 1 Beginning inventory November 2 Purchase November 8 Sales November 12 Purchase Multiple Choice O O 6 units @ $55 = $330 Using the LIFO perpetual inventory method, what was the amount recorded in the cost of goods sold account for the 12 units sold? $554 Activities $398 $642 Units Acquired at Cost 5 units @ $50 = $250 10 units @ $52 = $520 Units Sold at Retail 12 units @ $84arrow_forwardWestcoast Purveyors had 316 computer system in stock at the end of the year. Inventory records show the following information: Date Qty Cost Total Cost January 1 Beginning Inventory 50 $1,468 $73,400 June 21 Purchase 50 1,192 59,600 August 1 Purchase 300 884 265,200 October 23 Purchase 200 1,216 243,200 November 16 Purchase 100 1,424 142,400 Total available for sale 700 $775,800 Using the LIFO method of inventory pricing, calculate the dollar value of the ending inventory. Step 1 The last-in, first-out (LIFO) method assumes that the items purchased last are sold or removed from inventory first. The items in inventory at the end of the year are matched with the cost of items of the same type that were purchased earliest. Therefore, items included in the ending inventory are considered to be those from the beginning inventory plus those acquired first from purchases. This method involves taking physical inventory at the end of the year or accounting period and…arrow_forward

- Southern Industries had 419 dining sets in stock at the end of the year. Inventory records show the following information: Date Qty Cost Total Cost January 1 Beginning Inventory 50 $1,290 $64,500 April 13 Purchase 200 1,326 265,200 May 2 Purchase 200 1,278 255,600 September 7 Purchase 250 1,242 310,500 November 18 Purchase 400 1,266 506,400 Total available for sale 1,100 $1,402,200 Using the average cost method of inventory pricing, calculate the dollar value of the ending inventory. (Round your answer to the nearest cent.)arrow_forwardThe following inventory transactions took place for Cullumber Corporation for the month of May: Date May 1 May 5 May 10 May 15 May 20 May 22 May 24 May 25 beginning inventory purchase purchase sale sale Event purchase purchase sale Quantity 4,000 3,000 3,000 4,000 4,000 1,500 4,500 4,000 Cost/ Selling Price $3.20 3.40 3.50 6.20 6.20 3.70 3.70 6.20 Calculate the ending inventory balance for Cullumber Corporation, assuming the company uses a perpetual inven moving- average cost formula. (Round unit costs to 2 decimal places, e.g. 52.75 and final answer to O decimal places. e.g The following inventory transactions took place for Cullumber Corporation for the month of May: Date May 1 May 5 May 10 May 15 May 20 May 22 May 24 May 25 beginning inventory purchase purchase sale sale Event purchase purchase sale Quantity 4,000 3,000 3,000 4,000 4,000 1,500 4,500 C 4,000 Cost/ Selling Price $3.20 3.40 3.50 6.20 6.20 3.70 3.70 6.20 Calculate the ending inventory balance for Cullumber Corporation,…arrow_forwardFisher Corporation uses the perpetual FIFO inventory method and has the following information regarding its inventory: Date Inventory Events Amount June 1 Beginning balance 60 units at $6 $360 June 3 Purchased 510 units at $10.00 5,100 June 25 Purchased 370 units at $12.00 4,440 If the company sold 350 units of inventory for $12 each what would be the effect of the sale? Record the effect on the following accounts: Assets Liabilities Stockholders' Equity Revenues and Expenses (Income Statement) Net Income Cash - Decrease $4200; Inventory - Decrease $3500 Cash - Decrease $4200; Inventory - Increase $4200 Cash - Decrease $4200; Inventory - No Change Cash - Increase $4200; Inventory - Decrease $3260 Cash - Increase $4200; Inventory - Increase $3500 Cash - Increase $4200; Inventory - No Change Cash - No Change; Inventory - Decrease $3260 Cash - No Change; Inventory - Increase $3260 Cash - No Change; Inventory - No Changearrow_forward

- During the year, Wright Company sells 330 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. DateTransactionNumber of UnitsUnit CostTotal CostJan. 1Beginning inventory 60 $73 $4,380 May. 5Purchase 205 76 15,580 Nov. 3Purchase 110 81 8,910 375 $28,870 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO.arrow_forwardUse the following information for questions 17-19 Maxwell Inc. uses the periodic inventory system. During its first year of operations, Maxwell made the following purchases, listed in chronological order of acquisition: 40 units at $100 per unit 70 units at $80 per unit 170 units at $60 per unit Sales for the year totaled 270 units. 17. Ending inventory using the average cost method (rounded) is: A. $650 B. $1,000 C. $707 D. $600arrow_forwardThe annual inventory of Bargain Bonanza, Inc. shows the following information for jackets: Date Qty Cost Total Cost January 1 Beginning Inventory 400 $44 $17,600 February 14 Purchase 150 45 6,750 July 13 Purchase 250 52 13,000 September 2 Purchase 400 71 28,400 October 8 Purchase 200 56 11,200 Total available for sale 1,400 $76,950 If 913 jackets were on hand on December 31, find the value (in $) of the ending inventory using the FIFO method of inventory pricing? $arrow_forward

- During the year, TRC Corporation has the following inventory transactions. Date Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Weighted Average Cost Total Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Transaction Sales revenue Gross profit For the entire year, the company sells 450 units of inventory for $70 each. 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 2 decimal places and all other answers to the nearest whole number.) Number of Units 60 140 210 120 530 Cost of Goods Available for Sale # of units 60 140 210 120 530 Average Cost per unit Cost of Goods Available for Sale $ $ Unit Cost 3,120 $ 52 54 57 58 7,560 11,970 6.960 29,610 Total Cost $ 3,120 7,560 11,970 6,960 $29,610 Cost of Goods Sold - Weighted Average Cost of units Sold Average Cost of Cost per Unit Goods Sold Ending Inventory - Weighted Average Cost # of units in Ending Inventory…arrow_forwardCase D Tompkins Company reports the following Inventory record for November. Date November 1 November 4 November 7 November 13 November 22 INVENTORY Activity Beginning balance Purchase Sale (@ $53 per unit) Purchase Sale (@ $53 per unit) # of Units 135 320 Cost/Unit $ 18 19 245 525 21 520 Selling, administrative, and depreciation expenses for the month were $15,500. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending Inventory and the cost of goods sold under each of the following methods using periodic Inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its Inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that Inventory had a market replacement value of $17.70 per unit, what would Tompkins report on the balance sheet for Inventory? Complete this question by…arrow_forwardLIFO During the year, TRC Corporation has the following inventory transactions. Unit Cost $ 52 54 57 58 Date Transaction Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Total Beginning Inventory Purchases: 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. Apr 07 Jul 16 Oct 06 For the entire year, the company sells 450 units of inventory for $70 each. Sales revenue Gross profit Cost of Goods Available for Sale Cost of Goods Available for Sale $ # of units 0 Number of Units 60 140 210 120 530 Cost per unit 69 $ 0 0 0 0 0 Total Cost $ 3,120 7,560 11,970 6,960 $29,610 # of units Cost of Goods Sold Cost per unit Cost of Goods Sold Ending Inventory # of units Cost Ending per unit Inventoryarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education