FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Required information

[The following information applies to the questions displayed below.]

During the year, TRC Corporation has the following inventory transactions.

Number

Unit

Date

Transaction

of Units

Cost

Total Cost

Jan. 1

Beginning inventory

Purchase

46

$38

$ 1,748

Apr. 7

Jul. 16

126

40

5,040

8,428

4,664

Purchase

196

43

Oct. 6

Purchase

106

44

474

$19,880

For the entire year, the company sells 425 units of inventory for $56 each.

Required:

1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

< Prev

8 9 10 11

of 16

Next >

O search

a

42](https://content.bartleby.com/qna-images/question/85339296-ebf0-4a38-b530-52b64ac97ca0/a97980c6-ef84-498c-8c18-146290fbf7c6/o5jw11k_thumbnail.jpeg)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

During the year, TRC Corporation has the following inventory transactions.

Number

Unit

Date

Transaction

of Units

Cost

Total Cost

Jan. 1

Beginning inventory

Purchase

46

$38

$ 1,748

Apr. 7

Jul. 16

126

40

5,040

8,428

4,664

Purchase

196

43

Oct. 6

Purchase

106

44

474

$19,880

For the entire year, the company sells 425 units of inventory for $56 each.

Required:

1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

< Prev

8 9 10 11

of 16

Next >

O search

a

42

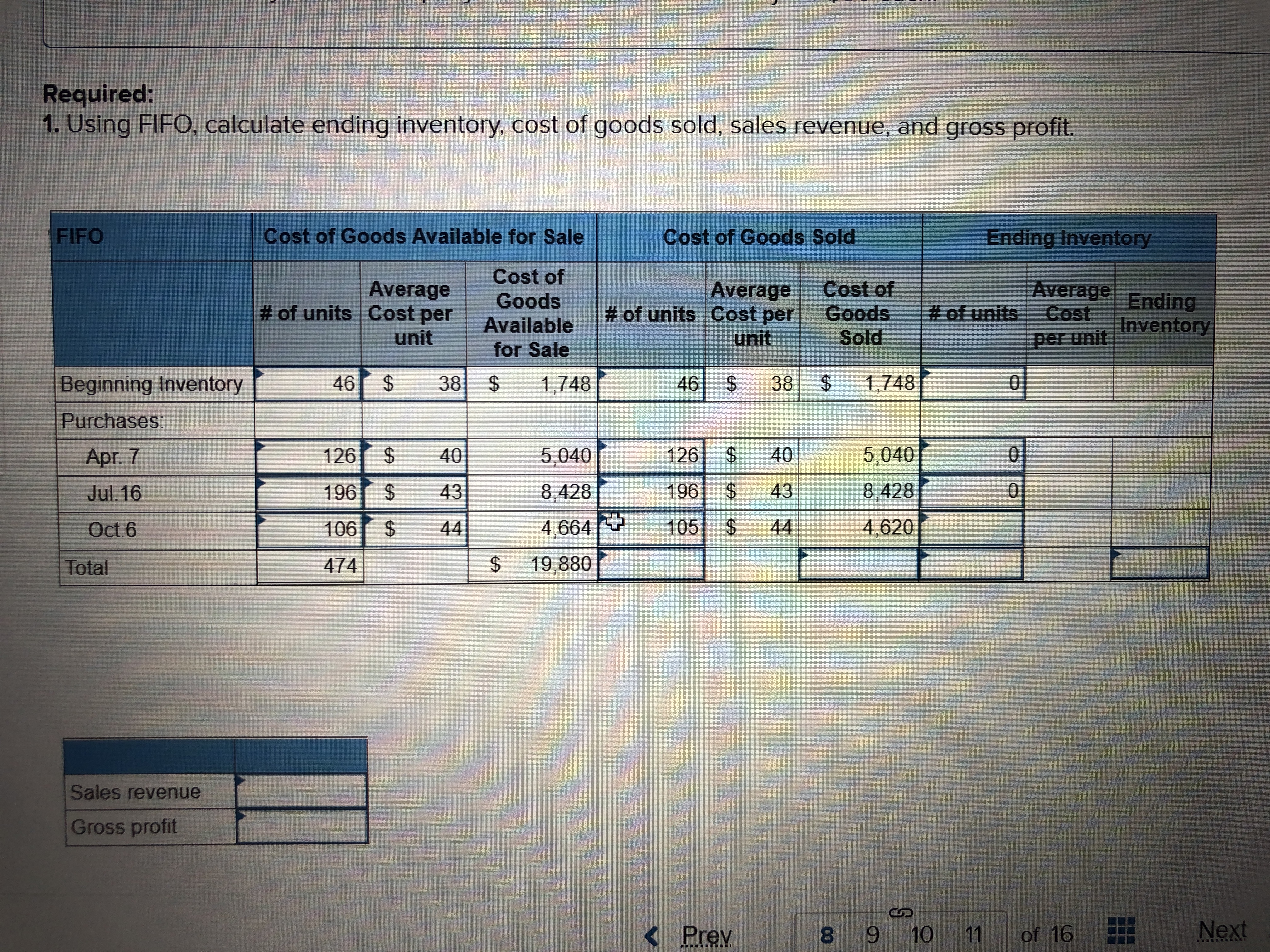

Transcribed Image Text:Required:

1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.

FIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of

Average

# of units Cost per

Average

# of units Cost per

unit

Cost of

Goods

Sold

Average

Cost

per unit

Goods

Ending

Inventory

# of units

Available

unit

for Sale

Beginning Inventory

46

38

24

1,748

46 $

38 $

1,748

Purchases:

Apr. 7

126

40

5,040

126

40

5,040

Jul. 16

196

43

8,428

196 $ 43

8,428

Oct.6

106 $

44

4,664T 105 $

44

4,620

Total

474

24

19,880

Sales revenue

Gross profit

< Prev

8 9 10 11

of 16

Next

.. R

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 9arrow_forwardThe following units of a particular item were available for sale during the calendar year: Jan. 1 Apr. 19 Inventory Sale 4,000 units at $50 2,500 units June 30 Purchase 4,500 units at $54 Sept. 2 Sale 5,000 units Purchase 2,000 units at $56 Nov. 15 The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5. Date Purchases Quantity Purchases Unit Cost Purchases Total Cost Quantity Weighted Average Cost Flow Method Cost of Goods Sold Cost of Goods Sold Unit Cost Cost of Goods Sold Total Cost Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 ☐ ☐ ☐ ☐ ☐ ☐ Dec. 31 Balancesarrow_forwardAt the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $15.20 per unit: Transactions Units Inventory, January 1 Purchase, January 12. 560 Amount $1,792 540 Purchase, January 26 140 2,808 1,008 Sale Sale (420) (200) Required: 1a. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LIFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 2a. Between FIFO and…arrow_forward

- ces Montoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities January 1 Beginning inventory February 10 Purchase March 13 Purchase March 15 Sales August 21 Purchase September 5 Purchase September 10 Sales Totals Units Acquired at Cost Units Sold at Retail 685 units @$45.00 per unit 570 units @ $42.00 per unit 285 units @ $27.00 per unit 1,140 units @ $75.00 per unit 185 units 585 units @ $50.00 per unit @ $46.00 per unit 2,310 units 770 units @ $75.00 per unit 1,910 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of goods available for sale Number of units available for sale 2. Compute the number of units in ending inventory. Ending inventory units unitsarrow_forwardNittany Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Unit Units Cost Inventory, December 31, prior year. 1,860 $ 3 For the current year: Purchase, March 21 5,180 5 Purchase, August 1 Inventory, December 31, current year 2,980 4,030 6 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. Note: Round "Average cost per unit" to 2 decimal places and final answers to nearest whole dollar amount. Ending inventory Cost of goods sold FIFO LIFO Average Costarrow_forwardThe following information applies to the questions displayed below; Hemming Company reported the following current-year purchases and sales for its only product. Date Activities January 1 Beginning inventory January 10 Sales March 14 Purchase March 15 Sales- July 30 Purchase October S October 26 Sales Purchase Totals 275 units 450 units 475 units Units Acquired at Cost $13.00- $18.00 $23.00- Units Sold at Retail $3,575 230 units $43.00 8,100 10,925 408 units 455 units $43.00 $43.00 175 units 1,375 units @$28.90 4,900 $ 27,500 1,885 units Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. (c) Compute the gross profit for each method. a) Periodic FIFO Beginning inventory Purchases March 14 July 30 October 28 Total b) Periodio LIFO Beginning inventory Purchases: Cost of Goods Available for Sale Cost of Goods Sold…arrow_forward

- Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Assessment Tool iFrame Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase, January 30 b. Purchase, May 1 c. Sale ($5 each) d. Sale ($5 each) Units 400 Unit Cost $ 3.00 300 460 3.40 4.00 (160) (700) Required: a. Compute the amount of goods available for sale. b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in, first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two- fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1. Complete this…arrow_forwardRequired information [The following information applies to the questions displayed below.] A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 310 units. Ending inventory at January 31 totals 130 units. Units Unit Cost $ 2.60 Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 280 60 2.80 100 2.94 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. Perpetual FIFO: Cost of Goods Sold Goods purchased Inventory Balance # of units Date Cost per unit Cost per Cost of Goods unit Cost per Inventory Balance # of units # of units Sold unit sold January 1 January 9 Total January 9 Ianuani 2Earrow_forward21. Williams Co. uses a periodic inventory system. The following are inventory transactions for the month of March: 3/1 Beginning Inventory 5,000 units at $2 3/7 Purchase 2,500 units at $3 3/16 Purchase 2,500 units at $4 3/26 Sales at $8 per unit 7,500 units Williams uses the weighted average method to determine the value of its inventory. What amount should Williams report as cost of goods sold on the income statement for the month of January?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education