FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

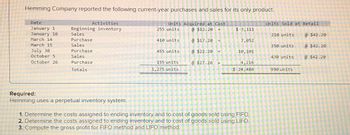

Transcribed Image Text:Hemming Company reported the following current-year purchases and sales for its only product.

Activities

Beginning inventory

Sales

Units Acquired at Cost

@$12.20 =

Purchase

@$17.20 =

Sales

Purchase

@ $22.20 =

Sales

Purchase

Totals

Date

January 1

January 10

March 14

March 15

July 30

October 5

October 26

Required:

Hemming uses a perpetual inventory system.

255 units

410 units

455 units

155 units

1,275 units

@ $27.20

$ 3,111

7,052

10,101

4,216

$ 24,480

1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO.

3. Compute the gross profit for FIFO method and LIFO method.

Units Sold at Retail

210 units

350 units

430 units

990 units

@ $42.20

@ $42.20

@ $42.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Company uses a perpetual inventory system and reports the following for the month of June. Date Explanation Units Unit Cost Total Cost June 1 Inventory 130 $5 $650 12 Purchase 370 6 2.220 23 Purchase 200 1,400 30 Inventory 250 (a1) Calculate the weighted average cost per unit, using a perpetual inventory system. Assume a sale of 400 units occurred on June 15 for a selling price of $8 and a sale of 50 units on June 27 for $9. (Round Intermediate calculations to O decimal places, eg. 152 and final answers to 3 decimal places, eg 5.125 June 1 June 12 June 15 $ June 23 S June 27 $ (a2) Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory system. Assume a sale of 400 units occurred on June 15 for a selling price of $8 and a sale of 50 units on June 27 for $9. (Round answers to O decimal places, es 125) FIFO Cost of the ending inventory $ Cost of goods sold LIFO $ Moving Averagearrow_forwardBridgeport Inc. uses a perpetual inventory system. Its records show the following for the month of May. Date May May May May 1 Inventory Purchase 15 18 Unit Explanation Units Cost 24 Sale Purchase Total -29 26 (42 ) 40 53 $10 11 12 Total Cost $290 286 480 $1,056arrow_forwardCullumber Company uses a perpetual inventory system and reports the following for the month of June. Date June 1 12 23 30 (a1) Explanation Units June 1 Inventory Purchase Purchase June 12 Inventory June 15 June 23 June 27 $ $ $ $ $ 130 Calculate the weighted-average cost per unit, using a perpetual inventory system. Assume a sale of 400 units occurred on June 15 for a selling price of $7 and a sale of 50 units on June 27 for $8. (Round intermediate calculations to O decimal places, e.g. 152 and final answers to 3 decimal places, e.g. 5.125.) eTextbook and Media Save for Later 370- 200 250 Unit Cost $5 6 7 Total Cost $650 2,220 1,400 Attempts: 0 of 10 used Submit Answerarrow_forward

- During the year, TRC Corporation has the following inventory transactions. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 60 $52 $3,120 April 7 Purchase 140 54 7,560 July 16 Purchase 210 57 11,970 October 6 Purchase 120 58 6,960 530 $29,610 For the entire year, the company sells 450 units of inventory for $70 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold.1-c & d. Using FIFO, calculate sales revenue and gross profit.2-a & b. Using LIFO, calculate ending inventory and cost of goods sold.2-c & d. Using LIFO, calculate sales revenue and gross profit.3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold.3-c & d. Using weighted-average cost, calculate sales revenue and gross profit.4. Determine which method will result in higher profitability when inventory costs are rising.arrow_forward[The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Problem 5-1A (Static) Part 2 Ending inventory units Units Acquired at Cost @ $50 per unit @ $55 per unit 100 units 400 units 2. Compute the number of units in ending inventory. 120 units 200 units 820 units FO F9arrow_forwardThe Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2023. Beginning Feb. 10 Aug. 21 640 units @ $75/unit 350 units @ $72/unit 230 units @ $85/unit Stilton Company has two credit sales during the period. The units have a selling price of $135 per unit. Sales Mar. 15 430 units Sept. 10 335 units Stilton Company uses a perpetual inventory system. Required: 1. Calculate the dollar value of cost of goods sold and ending inventory using: (Do not round intermediate calculations. Round "Average cost per unit" to 2 decimal places. Round the final answers to 2 decimal places.) Ending Inventory Cost of Goods Sold a FIFO b. Moving weighted averagearrow_forward

- Flingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forwardUrmilabenarrow_forwardA-1arrow_forward

- Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Acquired at Cost 100 units @ $50 per unit 400 units @ $55 per unit Activities Units Sold at Retail Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. (Round weighted average cost per unit to 2 decimal places.) Gross Margin FIFO LIFO Avg. Cost Spec. ID Sales…arrow_forwardWarnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50 per unit 400 units@ $55 per unit Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. es Complete this question by einering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to…arrow_forwardMontoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 700 units @ $50 per unit February 10 Purchase 300 units @ $46 per unit March 13 Purchase 100 units @ $40 per unit March 15 Sales 780 units @ $70 per unit August 21 Purchase 110 units @ $55 per unit September 5 Purchase 570 units @ $52 per unit September 10 Sales 680 units @ $70 per unit Totals 1,780 units 1,460 units Required:1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (For specific identification, units sold consist of 700 units from beginning inventory, 200 from the February…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education