Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

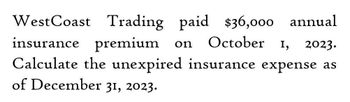

Calculate the unexpired insurance expense. (financial accounting)

Transcribed Image Text:West Coast Trading paid $36,000 annual

insurance premium on October 1,

I, 2023.

Calculate the unexpired insurance expense as

of December 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An examination of Insurance Policies of Standard Company is presented below: Policy Date of Purchase Life of Policy Cost September 1, 2019 4years P25,920 May 1, 2020 2years 18,960 July 31, 2020 1year 9,720 Prepaid Insurance was debited for the cost of each policy at the time of its purchase. Expired insurance was correctly recorded at the end of 2019. What is the balance of Prepaid Insurance at the end of 2020?arrow_forwardOn October 1, 2021, FDN Company paid an insurance premium covering the period from October 1, 2021 to October 1, 2022 in the amount of P190,000. The accounting period ends on December 31, 2021. How much is the Prepaid Insurance Expense reported on the Statement of Financial Position as of December 31. 2021?arrow_forwardA company makes the payment of a one-year insurance premium of $4,584 on March 1, 2019. c. Calculate the amount of prepaid insurance that should be reported on the December 31, 2019, balance sheet with respect to this policy.arrow_forward

- On January 1, 2021, Umbrella Insurance Company has collected $24,000 for multiple two-year insurance premiums and recorded the funds in Unearned Revenue. Umbrella records insurance revenue on a monthly basis. How much will be in the Unearned Revenue account on November 30, 2021?arrow_forwardOn August 15, 2022, Pharoah Company signs a $248000, 7%, twelve-month note payable. Which of the following entries correctly records the accrued interest on December 31, 2022? Dr Interest Expense $5786.67 Cr Interest Payable $5786.67 Dr Interest Expense $10850.00 Cr Interest Payable $10850.00 Dr Interest Expense $17360.00 Cr Interest Payable $17360.00 Dr Interest Expense $6510.00 Cr Interest Payable $6510.00arrow_forwardGeneral/financial Accountingarrow_forward

- Midshipmen Company borrows $11,500 from Falcon Company on July 1, 2021. Midshipmen repays the amount borrowed and pays interest of 12% (1%/month) on June 30, 2022. Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the 2021 year-end adjusted balances of Interest Receivable and Interest Revenue (assuming the balance of Interest Receivable at the beginning of the year is $0).arrow_forwardThe premium on a three-year insurance policy expiring on December 31, 2022 was paid in total on January 1, 2020. The original payment was initially debited to a prepaid asset account. The appropriate adjusting entry had been recorded on December 31, 2020. The balance in prepaid asset account on December 31, 2020 should be a. The same as it would have been if the original payment had been debited initially to an expense account. b. Zero c. Higher that if the original payment had been debited initially to an expense account. d. The same as the original payment.arrow_forwardConstellation Corp. reported the following liability balances on December 31, 2021: 10% note payable issued on October 1, 2020, maturing October 1, 2022... 12% note payable issued on March 1, 2020, on March 1, 2022.... .P 2,000,000 4,000,000 The 2021 financial statements were issued on March 31, 2022. Under the loan agreement, the entity has the right on December 31, 2021 to roll over the 10% note payable for at least 12 months after December 31, 2021. On March 1, 2022, entire P 4,000,000 balance of the 12% note payable was refinanced through issuance of a long-term obligation payable lump-sum. What amount of the notes payable should be classified as current on December 31, 2021?arrow_forward

- Prepaid Insurance amounting to P35,000 was recorded by FDNACCT Co. on April 1, 2021 for a year of fire insurance premium. How much should remain as prepaid insurance on December 31, 2021?arrow_forwardBerlin Company paid or collected during 2020 the following items: Insurance premiums paid P462,000; Interest collected 927,000; Salaries paid 4,056,000. The following balances have been excerpted from Berlin's statements of financial position for the year ended 12/31/2019 and 12/31/2020 respectively. Prepaid insurance P 45,000 P 36,000; Interest receivable 87,000 111,000; Salaries payable 318,000 369,000. Requirement: Based on the above information, determine the insurance expense on the income statement for 2020. Choices; P381,000 P543,000 P453,000 P471,000arrow_forwardRefer to the following list of liability balances at December 31, 2019. Accounts Payable Employee Health Insurance Payable Employee Income Tax Payable Estimated Warranty Payable (Due 2020) Long-Term Notes Payable (Due 2022) FICA OASDI Taxes Payable Sales Tax Payable Mortgage Payable (Due 2023) Bonds Payable (Due 2024) OA. $40,000 B. $105,000 C. $49,000 te to O D. $96,000 $20,000 850 1,100 1,300 40,000 1,260 570 9,000 56,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College