FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hi,

I need help solving for the remaining cells (highlighted in red).

Thank you.

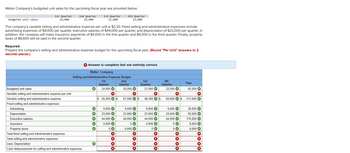

Transcribed Image Text:Weller Company's budgeted unit sales for the upcoming fiscal year are provided below:

1st Quarter

24,000

2nd Quarter

25,000

3rd Quarter

21,000

4th Quarter

22,000

Budgeted unit sales

The company's variable selling and administrative expense per unit is $2.30. Fixed selling and administrative expenses include

advertising expenses of $9,000 per quarter, executive salaries of $44,000 per quarter, and depreciation of $23,000 per quarter. In

addition, the company will make insurance payments of $4,000 in the first quarter and $4,000 in the third quarter. Finally, property

taxes of $8,600 will be paid in the second quarter.

Required:

Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2

decimal places.)

Budgeted unit sales

Variable selling and administrative expense per unit

Variable selling and administrative expense

Fixed selling and administrative expenses:

Advertising

Depreciation

Executive salaries

Insurance

X Answer is complete but not entirely correct.

Weller Company

Selling and Administrative Expense Budget

1st

2nd

Quarter

25,000✔

Quarter

24,000✔

Property taxes

Total fixed selling and administrative expenses

Total selling and administrative expenses

Less: Depreciation

Cash disbursements for selling and administrative expenses

♥

✓

✓

✓

✓

3

3*3

X

$55,200 $ 57,500✔ $

››› ››****

9,000✔

23,000✔

44,000✔

4,000✔

0✓

****<3333

9,000

23,000✔

44,000

0✔

8,600✔

3rd

Quarter

21,000✔

48,300 $

****0003

9,000✔

23,000✔

44,000✔

4,000✔

0✔

4th

Quarter

22,000✔

*********

X

50,600 $ $ 211,600

9,000✔

23,000✔

44,000✔

0✔

Year

0✔

92,000✔

X

*********

36,000✔

92,000✔

176,000✔

8,000✔

8,600✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- can you please show me how to calculate this without using excel? Thanksarrow_forwardWill you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardHi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forward

- PLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forwardAssignment: In the space at the right, type the best formula (or function) needed to perform the following computations. The first one has been done for youarrow_forwardPlease help on parts 4 and 5. Please also show work on how to do.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education